6.5 Checking sales tax (VAT) rates

First off, Jack asserts that a sales tax account has been provisioned. He finds it in the Current Liabilities section of his chart of accounts. In his jurisdiction there is only one sales tax rate applicable at any one time, which means this single account will suit his needs just fine. If he had been in a jurisdiction with multiple tax rates applicable, e.g. different rates for different types of goods, he would have been required to create more accounts.

The procedure to create more sales tax accounts is the same as the one used in Section 6.3 on page 6.3, with the notable difference that this time the base account to be used is the sales tax account.

With the accounts in place, the tax rates have to be checked and possibly adjusted.

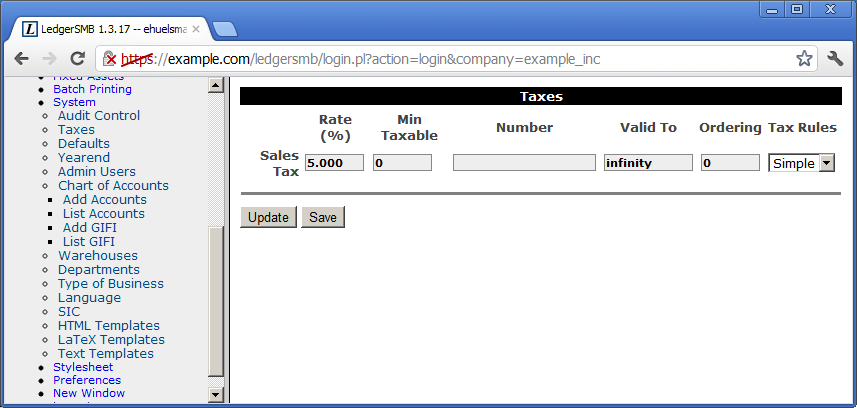

To do so, go to the System ![]() Taxes page as shown in Figure 6.5 on page 6.5.

Taxes page as shown in Figure 6.5 on page 6.5.