Running your business with

LedgerSMB 1.10

DRAFT / WORK IN PROGRESS

Preface

The current development goal for the book is to get the content current and accurate, not necessarily perfect structure and grammar.

You will find many incomplete sections which should be regarded as an outline for the finished book. However, some sections are nearly complete.

Because LedgerSMB is undergoing active infrastructure and API changes in 2023, some portions of this book will not be written until those changes are nearing completion.

Intended audience

The book has been split up into several parts intended for starting entrepreneurs, (potential) users, application integration developers and administrators, it offers something for everybody who works with or considers working with LedgerSMB.

Organization of the book

The first part (‘Overview’) is intended for everybody who tries to get an impression of LedgerSMB, with chapters on technology, features, licensing and a bit of project history.

The second part (‘Getting started’) leads new users and especially new entrepreneurs step by step through the application using a tutorial format. This part also contains additional explanations on good business and accounting processes.

The third part (‘Configuration’) describes system wide configuration settings such as the LedgerSMB configuration file and those required for dependencies like PostgreSQL. Additionally it describes the company specific settings within the application, such as audit control settings and required special accounts. This part is required material for anybody who wants to set up a LedgerSMB instance.

The fourth part (‘Administration’) discusses the different topics regarding application administration such as user management, product definition, taxes and etc. Anybody responsible for maintaining application instances in good health should read this part.

The fifth part (‘Business processes’) discusses LedgerSMB’s best practices. This part is highly advised reading for everybody who is a LedgerSMB user and should be considered required reading for ’business architects’: those in the company who decide about process design and execution.

The sixth part (‘Customization’) discusses how to customize the application. This part is intended for developers of custom extensions (such as company specific integrations), add-ons and plug-ins.

The last part (‘Appendices‘) contain supplemental reference information on various subjects, such as a listing and description of the authorization roles in the application as well as information on migration to or upgrading of LedgerSMB versions.

Comments and questions

The sources of this book are being developed in the ledgersmb-book Github project at

https://github.com/ehuelsmann/ledgersmb-book.

Comments and enhancement ideas can be filed

in the ticket tracker of the project. Additionally, discussion about the content of the book

can be organized on the mail list or chat channels listed at https://ledgersmb.org/topics/support.

Finally, up-to-date versions of this book in both PDF and HTML formats can be found on the book website at https://book.ledgersmb.org.

Acknowledgments

Håvard Sørli for his efforts to help develop the original book outline.

Members of the https://app.element.io/#/room/#ledgersmb:matrix.org chat room.

Part I Overview

Chapter 1 What is LedgerSMB

1.1 Introduction

LedgerSMB is an open source, web based Enterprise Resource Planning system (ERP system). An Enterprise Resource Planning (ERP) is a system which supports business processes of all disciplines throughout the organization, automating as much of those processes as possible. To illustrate this, consider the process of selling goods to a customer in a trade company. Typically, a customer will request a quote, which Sales will provide. When satisfied he or she will convert the quote to an order. Sales will register the order, leading to order-pickers to collect one or more shipments. Upon completion, Finance sends out an invoice and records the customer’s payment. LedgerSMB supports this process by automating the conversion from quotation to order, order to shipment and shipment to invoice, as well as providing pack lists and other production related documents.

LedgerSMB includes a powerful framework which supports building your own extensions and integrations with other applications. Through this philosophy, it aspires to be the (open source) integrated administration system.

The software is being developed by the LedgerSMB project with its homepage at https://ledgersmb.org/. However, the actual project activity can be witnessed at the Github project site hosted at https://github.com/ledgersmb/LedgerSMB and on the mailing lists or chat channel listed at https://ledgersmb.org/topics/support

Its open source nature allows you to download LedgerSMB and use it with any infrastructure you like. So there’s no vendor lock-in: you can always take your data and set up your system with another hardware vendor or set up your own hardware.

1.2 Supported functionality

As most ERP systems LedgerSMB’s functionalities are grouped into modules. Many modules are integrated parts of the base application. New features can be implemented in separate modules at first to allow evaluation of the feature set. When a it has become sufficiently stable, the new module may be integrated in the base application. As of that time, the existing features will be frozen, meaning that the utmost will be done to prevent it from being changed.

These separate modules - which are called add-ons- have to be installed separately. After installation they become seamless parts of LedgerSMB with no visible difference from the base application. An additional benefit of having add-ons is that they can follow different release schedules and separate maturity levels than the main application.

LedgerSMB 1.10 features the following integrated modules:

-

•

General ledger

-

•

Payment and Accounts payable

-

•

Invoicing and Accounts receivable

-

•

Fixed asset accounting

-

•

Time registration and invoicing

-

•

Point of Sale

-

•

Quotation and Order management

-

•

Manufacturing

-

•

Inventory (warehousing) and shipping management

-

•

VAT reporting

-

•

Controlling

-

–

Project accounting

-

–

Department accounting

-

–

-

•

Application administration

There are no known add-ons available at this time.

With this list of modules and add-ons LedgerSMB has been successfully implemented in a wide range of companies of varying types and sizes: shops, manufacturing companies and service oriented businesses up to as big as @@TODO million transactions, growing by 50,000 transactions (spread across AR, AP and GL) per month.

1.3 Feature comparison with alternatives

@@@ TODO

Packages to compare to:

-

•

GNUcash

-

•

OSfinancials

-

•

ERP5

-

•

Odoo

-

•

xTuple

1.4 System requirements

The README file which comes with every LedgerSMB software release should be considered the canonical source for system requirements. In summary, the following technical components are required:

-

•

A web server (known working are Nginx, Apache, lighttpd and Varnish)

-

•

Modern Perl 5, with additional modules

-

•

PostgreSQL 13 or higher

-

•

(optional) LaTeX or XeLaTeX from the TeTeX or TeXLive TeX distributions

More information about system requirements for clients and servers is available at https://ledgersmb.org/content/system-requirements.

System requirements such as required RAM and number of CPUs and their speed largely depend on the expected system activity. However, any modern VPS should provide enough memory and storage to satisfy a reasonable number of users.

1.5 Application architecture

Due to its heritage from SQL Ledger and the on-going process of rewriting the inherited code, the architecture differs between parts of the application: the old parts and the ones which have already been rewritten.

Overall, the application consists of five layers:

-

•

The web browser (as the user interface)

-

•

The web server (as a network traffic handler)

-

•

The Perl (web)server process (as an application - Perl Web Server Gateway Interface (PSGI))

-

•

The database (as an application - PL/SQL)

-

•

The database (as storage)

In version 1.10 the user interface is a Single Page Application using a mixture of new (e.g. Vue 3, webpack 5 and Web Components) and old (e.g. Dojo Toolkit) technology.

The web server is an optional component that’s highly recommended for TLS termination and protecting the back end Perl HTTP server from malicious traffic11 1 This setup is an industry-wide accepted best practice for deploying web applications; web servers like Apache or Nginx have been and continue to be extensively security-reviewed. No other implementations can achieve the same level of scrutiny.. It may also be used for serving static page components such as images, style sheets and JavaScript component as an efficiency measure.

Recent releases add separation between business logic and process state with the latter being stored in the database and managed at the Perl layer. Other than that, it’s the Perl layer’s responsibility to forward web requests to the database and presenting the resulting data in response to the user interface. The original goal to reduce the Perl layer to be a “glue” layer between the web server and the database has been abandoned with the introduction of this additional (business process) layer.

At the “database as an application” layer, PL/SQL functions implement business functionality, such as creating cost of goods sold (COGS) accounting entries.

The “database as storage” layer is responsible for storing data with consistency and integrity; to that extent (and much more than in SL) constraints and triggers have been implemented. An additional role for the storage layer is to enforce data access rules; i.e. to protect data from being accessed by unauthorized users.

The main difference between old and new coding paradigms is at the Perl application layer: older code generates HTML fragments while newer code delivers data through web services. As part of the on-going code restructuring, there’s a major effort to create a Representational State Transfer (REST) web service based APIs. The intent here is to facilitate integration with other applications used by businesses (both in the business itself or as provided by customers and vendors).

1.6 License

LedgerSMB is available under the terms of the GNU Public License version 2, in short: GPLv2 22 2 https://opensource.org/license/gpl-2-0/.

The project attaches the following meaning to this license: The copyright holders grant you the right to copy and redistribute the software. In case you make any modifications to the software you’re obligated to publish the changes if you distribute the software. You are always free to provide third party access to the API from your modified software without being required to disclose your changes.

The project considers the API to include:

-

•

Database tables

-

•

URLs with their input and output

-

•

Webservices of any kind

-

•

Function and object calls

The effect of this interpretation is that changes directly to the code base as well as inheritance of classes defined in the software constitute “making modifications”.

Chapter 2 Reasons to use LedgerSMB

Jack finds several tools which suit his requirements to some extent or another. After evaluation of his options he decides to use LedgerSMB for the following reasons:

-

•

Centralized data storage

-

•

Actively developed

-

•

Development team with security focus

-

•

Access to the application requires only a web browser

-

•

Integrated sales, shipping, invoicing, purchasing and accounting

-

•

Open source solution, so no vendor lock in

-

•

The roadmap appeals to him, because it has web services payrolling on it

-

•

There are multiple vendors offering commercial support, including hosted options

-

•

The developers envision building a platform out of it: creating the building blocks required to build a company on

-

•

Own your own data

-

•

Freedom to change

-

–

Support organization

-

–

Developer (organization)

-

–

Data storage provider

-

–

Application service provider

-

–

2.1 Internal control

Internal control11 1 See also https://en.wikipedia.org/wiki/Internal_control helps organizations to prevent and detect fraud by introducing checks and balances to assess effectiveness and validity of transactions in the organization and thereby in its ERP system and accounting system(s).

2.2 Accounting principles

The accounting guidelines International Accounting Standards (IAS) and International Financial Reporting Standards (IFRS) describe requirements to financial statements (reports) and the underlying accounting process 22 2 See also https://en.wikipedia.org/wiki/International_Financial_Reporting_Standards. Said requirements include qualitative characteristics:

-

1.

Relevance

-

2.

Faithful representation

-

3.

Comparability

-

4.

Verifiability

-

5.

Timeliness

-

6.

Understandability

While some - if not most - of these characteristics relate to the process of accounting, the “Verifiability” item clearly has an impact on the underlaying accounting systems: In order to be verifiable, there must be a clear audit trail to show the origin of the figures. To make sure users leave behind the required audit trail, some actions can’t be performed in LedgerSMB, even though it would seem to be a logical requirement to be able to do so - from the perspective of a non-accountant.

2.3 Impact of tight integration

While both the qualitative characteristics from IFRS and the checks and balances from the internal controls are pose restrictions on the accounting process, sometimes these restrictions require support from the underlying accounting software.

One example is the support for creating reliable audit trails by protecting accounting data from deletion. It’s important to realize the scope of accounting data in this respect: because invoices are being registered in the accounts receivable administration - which is summarized in the general ledger - they are part of the data for which the audit trail needs to be recorded.

Another example is separation of duties (also known as the “four eye principle”), where one accountant enters financial transactions and another is responsible for posting them. This procedure protects the company from an accountant single-handedly faking transactions and possibly masking fraud.

The requirements for good accounting processes and internal control have impact on the work flows supported by LedgerSMB. As a consequence some of the work flows described in part V may seem unwieldy; an example being the lack of functionality to delete or correct incorrect invoices (See Section 38.5 on page 38.5 for more details).

Chapter 3 Introduction to accounting

The purpose of an accounting system is to keep track of the company’s financial status. The following reports are used to present it:

- Balance Sheet

-

Provides a snapshot of the financial position of a company, listing its possessions (assets), debts (liabilities) and residual value (equity).

- Income Statement

-

Also known as the “Profit & Loss Statement”, summarizes the income generated over a specific period and the expenses associated with it, resulting in “Net Result”.

- Cashflow Statement11 1 Not currently implemented in LedgerSMB

-

Summarizes the incoming and outgoing cash flows over a specific period, resulting in “Free Cash Flow”.

- Statement of Owner’s Equity2

-

Summarizes the changes in equity over a specific period.

- Trial Balance

-

An intermediate report used for preparing the Balance Sheet and Income Statement, tallies transactions over the reporting period; used to assert that all accounts in the General Journal are balanced.

The accounting system is composed of these parts:

- Journals

-

Contain the company’s transactions with extensive additional data; they are the first point of entry for transactions, ordered by order of entry.

- Ledgers

-

Contain aggregated data from the journals, ordered by date.

- Chart of Accounts

-

The categories by which financial data are classified.

All accounting data ends up summarized in the GL. Transactions may be entered in a different (sub)ledger before ending up in the GL; e.g. the Sales Ledger. With the advent of computerized accounting, the use of journals is in decline: transactions are classified while directly being entered into ledgers.

In addition to the parts mentioned above the following terms are used throughout this document:

- Assets

-

Money and anything that can be converted into money without reducing the net equity of the business. Assets include money owed, money held, goods available for sale, property, etc.

- Liabilities

-

Debts owned by the business such as bank loans and unpaid bills.

- Equity

-

What would be left for the owner if all the assets were converted to money and all the liabilities paid off.

- Revenue

-

Income from business activities.

- Expense

-

Money paid to operate the business.

- Cost of Goods

-

Money that was spent to acquire material and services to build a product being sold.

- Operating Expenses

-

Expenses that are consumed to administer the business.

- Accounts Receivable

-

An asset on the books as a claim for a future payment from a customer.

- Accounts Payable

-

A liability on the books for a future payment to a supplier or vendor.

3.1 Double-entry accounting

The basic concept in double-entry accounting is that every transaction is an exchange. For example, when a business sells goods to a customer, it issues an invoice. The exchange is to provide the goods and receive the right for (future) payment. When the customer later pays the invoice, the right for payment is exchanged for cash.

Each exchange is to have the same value on both sides of the exchange, making sure no transaction is incomplete. This is where the requirement comes from that double-entry transactions need to be balanced. It can occur that a customer’s payment is a bit short of the owed amount. Should the company decide not to pursue payment, the transaction would end up being unbalanced. After all the exchange is not equal-value between the providing and receiving sides. Double-entry accounting accommodates this scenario by explicitly recording the unpaid amount as an expense.

Because every transaction is balanced, so is the balance sheet. Through this approach, double-entry accounting provides strong control over correctness of the numbers: as soon as a transaction is unbalanced (i.e. contains an error), the balance sheet becomes unbalanced – a relatively simple check.

3.2 Cash versus accrual basis

Financial statements, such as the Income Statement and Balance Sheet can be prepared using either a cash or accrual basis.

In cash basis accounting, the income is deemed earned when the business physically receives the customer payment, and the expenses are deemed incurred when the business physically pays them. Cash basis accounting does not require the use of purchase orders, invoices, or long term liabilities.

In accrual basis accounting, income is considered earned when a valid asset is received for services or product provided. The asset is the claim on the customer, by way of the invoice, to collect an amount at a later date. This asset is called Accounts Receivable. An expenses is considered earned when a liability is created, by way of a purchase order, to the supplier or vendor. The liability is the commitment to pay the supplier or vendor at a later date. This liability is called Accounts Payable. Accrual basis accounting requires the use of invoices and purchase orders.

There can be a number of problems with cash basis accounting:

-

•

No visibility in the accounting system regarding your cash commitments leading you to think you have more or less money to spend than you actually have.

-

•

No visibility in the accounting system about unpaid customer debts.

-

•

Your taxing jurisdiction may limit businesses that can use cash basis accounting. For example in the United States, if you sell products or services on credit, have gross receipts higher that allowed, or need inventory to account for income.

-

•

Because cash basis accounting isn’t part of any accounting standards, there are varying expectations of what a cash balance or income statement looks like.

3.3 Valuation of inventory

@@@ TODO Need why is this important paragraph?

The cost of inventory, in theory, includes all costs incurred to acquire the goods and make them ready for sale. This theoretical cost may include shipping costs, discounts, insurance, receiving costs, handling costs, storage costs, etc.

In practice, the cost used is often limited to the total invoice price for the goods. This formula may or may not include shipping and handling. Other costs are often ignored if they are immaterial to the overall cost of the inventory, if there is no easy way to allocate the costs to the inventory, or they are relatively constant period to period.

Inventory valuation must consider in the following situations:

-

•

When the valuation of inventory varies from purchase to purchase. The costing method determines the valuation. This situation is automatically handled in LedgerSMB using one of the inventory valuation methods discussed below.

-

•

When the valuation of inventory is less that what was paid for it. The inventory must be written down. This is usually a manual calculation that is the result of damage, obsolescence, or decline in the vendor or suppliers selling price.

-

•

When estimates are required, such as when inventory is stolen, destroyed, or when a physical inventory cannot be performed. In this case, a reasonable and consistent manual method must be used to estimate the value.

There are several general automated inventory valuation methods including the following:

-

•

Specific Identification – Each specific inventory item has its cost tracked individually. This method is usually used for large and expensive items that can be tracked by serial number or identification tag. Typically, the specific identification inventory valuation method results an inventory valuation close to value of using the First in, first out (FIFO) method.

-

•

FIFO– This method is similar to selling the oldest product first merchandising policy. In the FIFO method the lastest costs are included in inventory cost and the older costs are charged back to COGS.

FIFO is the preferred method for maintaining accurate historical costs and is less susceptible to income manipulation by the timing of new purchases. Typically FIFO results in the highest inventory value of these methods.

In LedgerSMB the inventory cost is tracked on a FIFO basis. When a part is purchased, its cost is added to the inventory asset account. When the part is sold, the cost of the item is moved to the cost of goods sold account.

@@@TODO Is this paragraph redundant?

@@@TODO What sold cost is used; oldest, newest, average?

@@@TODO How is the inventory asset account debited? -

•

Last in, first out (LIFO)– Under LIFO the costs of the last goods purchased are charged against revenues as the COGS and the inventory is composed of the costs of the oldest goods acquired.

LIFO is preferred when prices are rising as it typically results in reducing net income and thereby reducing taxes. However, LIFO allows manipulation of income by simply changing the time at which additional purchases are made and does not represent accurate historical costs. Typically LIFO results in the lowest inventory value.

-

•

Weighted Average – Under the weighted average method, the total number of units purchased plus those on-hand at the beginning of the period is divided by the total costs of purchases plus the cost of the beginning inventory.

Part II Getting started

Chapter 4 Overview

This part of the book will run the reader through the LedgerSMB using an example startup company run by Jack: Example Inc, which starts its life as a computer parts store for the business-to-business market.

4.1 Introduction

Jack just completed incorporation of Example Inc and is ready to start doing business. Before starting his operation Jack was looking for tooling to run his operation efficiently. To that extent he’ll be running LedgerSMB using the domain he acquired for his business: https://example.com/.

The other chapters in this part of the book show you what steps Jack has to go through to get LedgerSMB up and running for Example Inc., as well as the steps he has to take to keep LedgerSMB in good health.

Due to its success Example Inc. will grow, posing new challenges to LedgerSMB and we’ll show you how Jack can change the configuration to adapt to his growing business’s needs.

Jack chooses to use a hosted LedgerSMB, so he doesn’t need to concern himself with the technical details of getting the application up and running. Instead he can start by setting up the company database immediately.

In Chapter 5 starting at page 5 and Chapter 6 starting at page 6 Jack goes through the steps of setting up a basic company. The chapters after that may not apply to every business. Chapter 7 starting at page 7, Chapter 8 starting at page 8 and Chapter 9 starting at page 9 apply to businesses dealing with physical goods: buying, selling and shipping. Chapter 38 starting at page 38 discusses how to handle invoicing from LedgerSMB. Chapter 11 starting at page 11, Chapter 12 starting at page 12 and Chapter 13 starting at page 13 discuss how to manage accounts receivable and payable including arrears monitoring.

Not all chapters may be relevant to the reader, e.g. when he or she is starting up or running a services company in which case the chapter “Building up stock” doesn’t apply. Chapters can be skipped based on relevance both to the type of business and its growth phase.

@@@ more chapters??

Chapter 5 Creating a company database

5.1 Using setup.pl

LedgerSMB comes with a tool called setup.pl. It’s the beginning of a web-based 11 1 There’s also a command line based setup tool called ledgersmb-admin; it’s covered as part of the section ‘Administration’ database administration interface to LedgerSMB. This tool can be used to create company databases as well as backups of existing ones.

Please note that while executing the steps described in this section, it may take a while for the next screen to appear after clicking each button: Some buttons involve a large amount of server processing before the next screen can be presented.

5.1.1 Step 1: setup.pl login

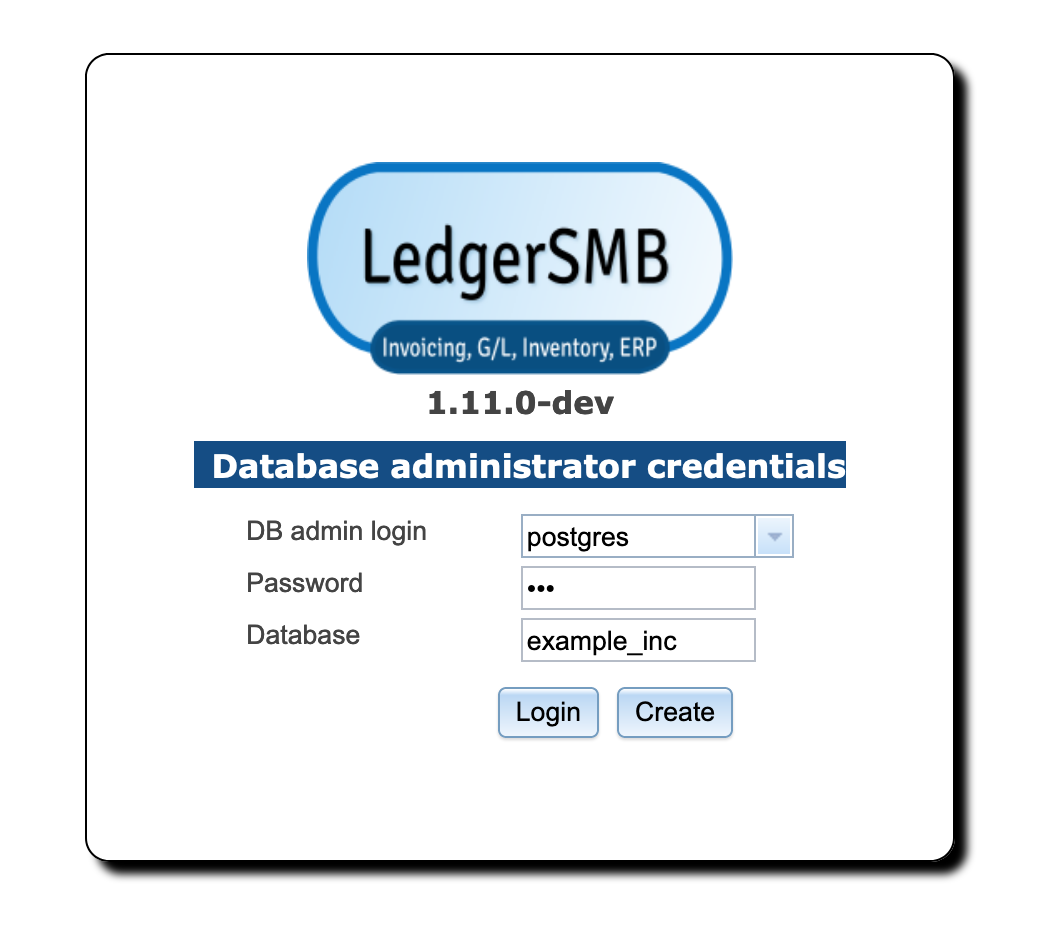

Jack installed LedgerSMB using the default installation instructions, which means the url for his setup.pl is https://example.com/setup.pl. Figure 5.1 on page 5.1 shows the login screen for the tool.

Please note that in version 1.7 and earlier you can’t be logged into the administration tool (setup.pl) and the webapp through the same browser at the same time due to limitations of the implementation.

The login screen shows three fields: (a) a user, (b) a password and (c) a database name.

The user name you use with setup.pl needs to be a PostgreSQL user. The user needs at least the right to create databases and other users; the postgres super user has these rights and more, so it’s generally convenient (but not very secure) to use it.

The password must be the same as that used to log in from the command line using the psql tool or the password you assigned on user creation using the createuser tool 22 2 Most PostgreSQL deployments need configuration changes for this to work, if you’re installing LedgerSMB yourself. See https://ledgersmb.org for installation instructions.. Both psql and createuser are PostgreSQL tools (not LedgerSMB tools).

The third field is the name of the company database to be created. For practical reasons it’s best to use only lower case letters, numbers and the underscore (_).

The “Login” button is used when the company database already exists. The user can then perform some administrative tasks on the existing database.

The “Create” button is used to create a new company.

5.1.2 Step 2: Company creation

When creating a company database, there are a few things that are of importance:

-

•

The name of the company database will be used at login time and hence will be used by all users - a choice of recognizable value is important

-

•

The value entered (and hence the company name) is case-sensitive

-

•

The name can’t be more than 63 characters long

After choosing “example_inc” as his company name, Jack clicks “Create” to create the database and load it with LedgerSMB’s database schema, authorization rules and stored procedures33 3 Parts of the program inside the database.. It may take a while (30 seconds or more) for the next screen to appear44 4 Note that during the creation of the database, logs are kept so that in case of errors these can be reviewed either by the person running the installation or by support personnel. On Linux/Unix systems these are stored, by default, in the “/tmp/ledgersmb/” directory and named “dblog”, “dblog_stderr” and “dblog_stdout”.

5.1.3 Step 3: Selection of a Chart of Accounts

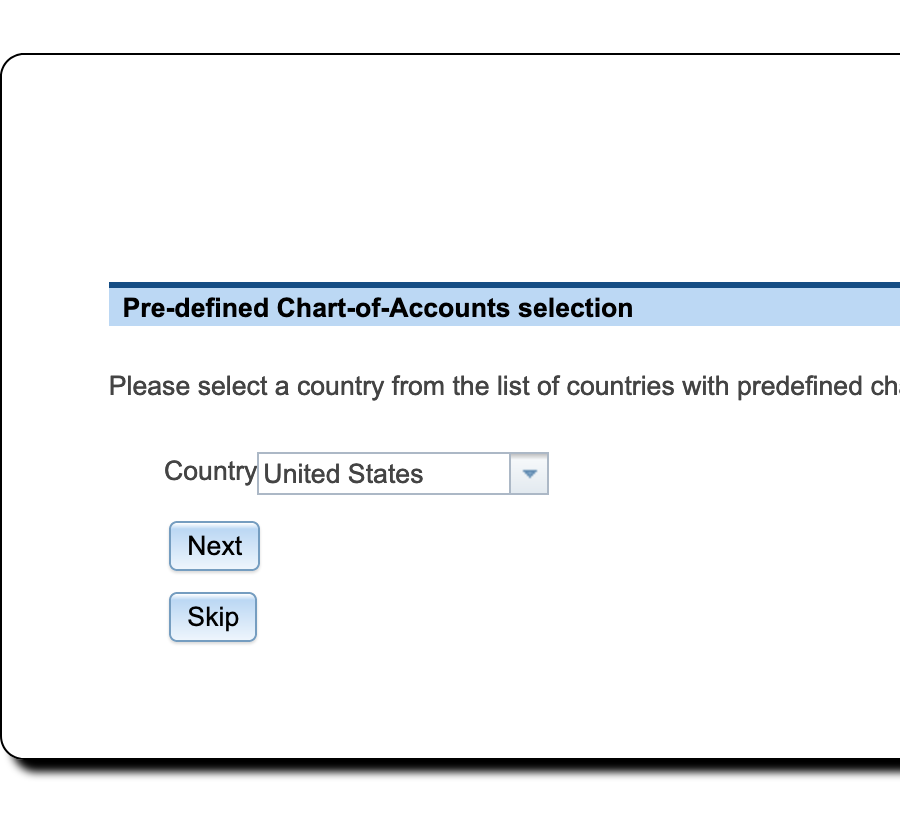

LedgerSMB comes with numerous predefined charts of accounts. These have been grouped per country making the selection of a chart a two-step procedure. setup.pl allows for users wanting to define their own charts by offering a “Skip” button. This button skips the process of loading a chart.

Note that you need to define a chart of accounts before you can meaningfully do anything inside LedgerSMB. If you don’t load a pre-defined one you’ll need to create or upload your own from inside the application once setup has completed.

Figure 5.3 on page 5.3 shows the first screen in the CoA selection procedure. Here you select the country for which you want to use the CoA. Note that charts of accounts are highly country dependent and you may want to consult an accountant if no default chart of accounts is included for your country.

As Jack runs his company in the United States, that’s what he selects.

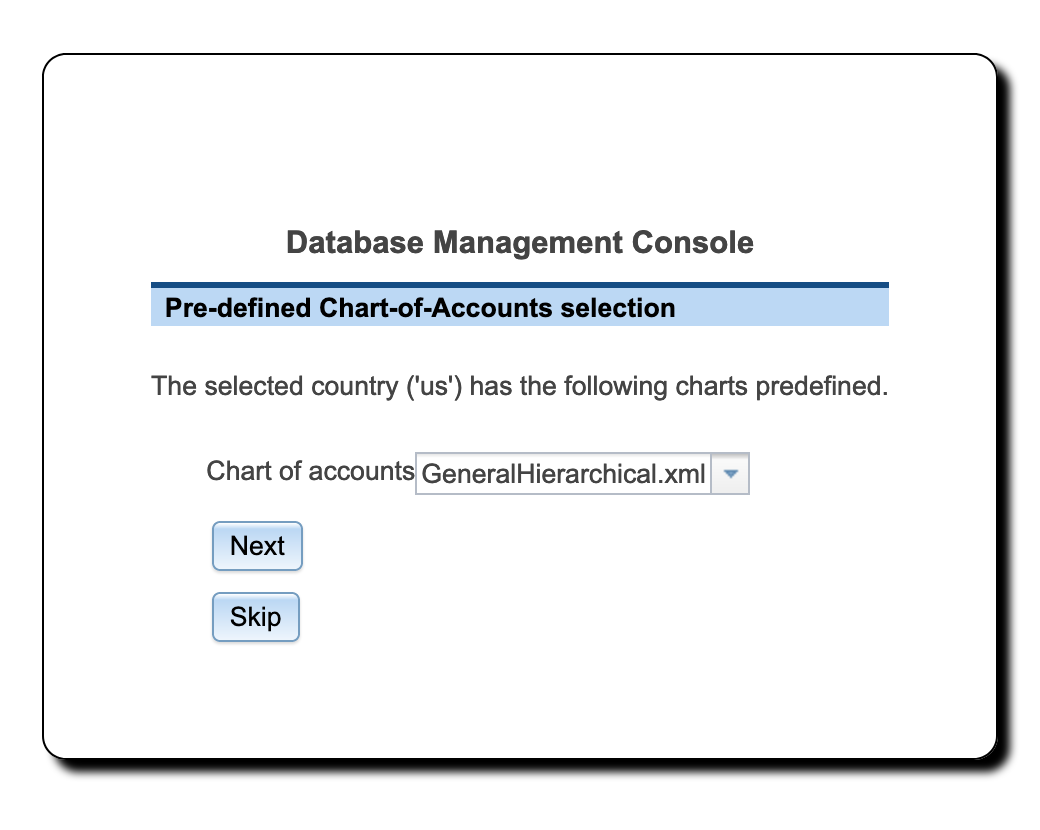

Figure 5.4 on page 5.4 shows the second screen in the chart of accounts selection procedure. The drop down contains a list of all charts of accounts defined for the selected country.

Jack selects the GeneralHierarchical.xml chart of accounts: that will leave him enough room to specialize the setup later if he has to, but for the time being offers a broadly usable setup.

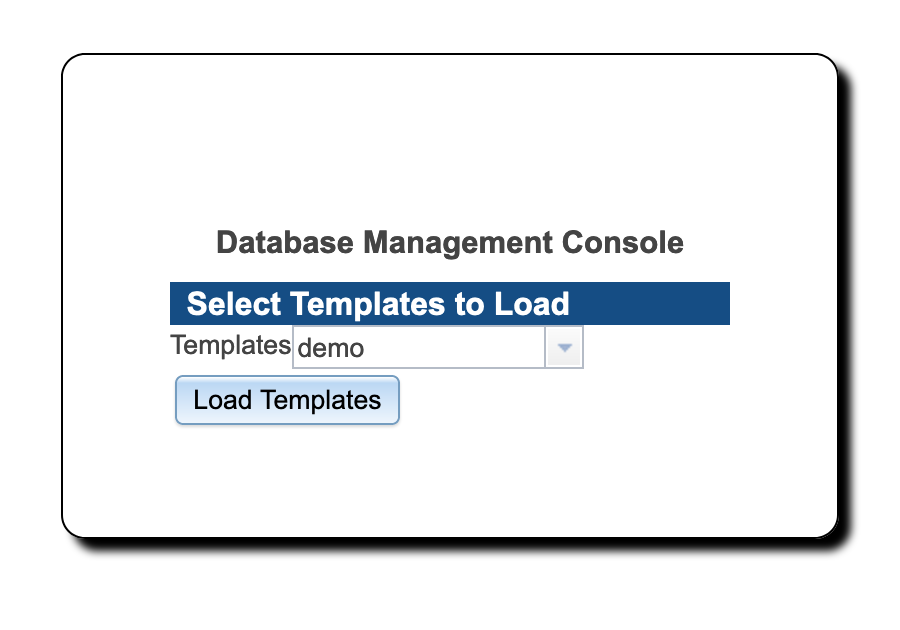

5.1.4 Step 4: Load template

LedgerSMB comes with a set of default reporting templates. These control the formatting of documents like invoices, checks, balance sheet, purchase orders, income statement, etc. Jack is now presented with the screen to load templates. LedgerSMB 1.10 comes with a single choice55 5 Administrators may define extra sets for users to be selected upon company creation; see 48.1:

-

•

demo – Example template set for various output formats including PDF, HTML and Excel

5.1.5 Step 5: Initial user

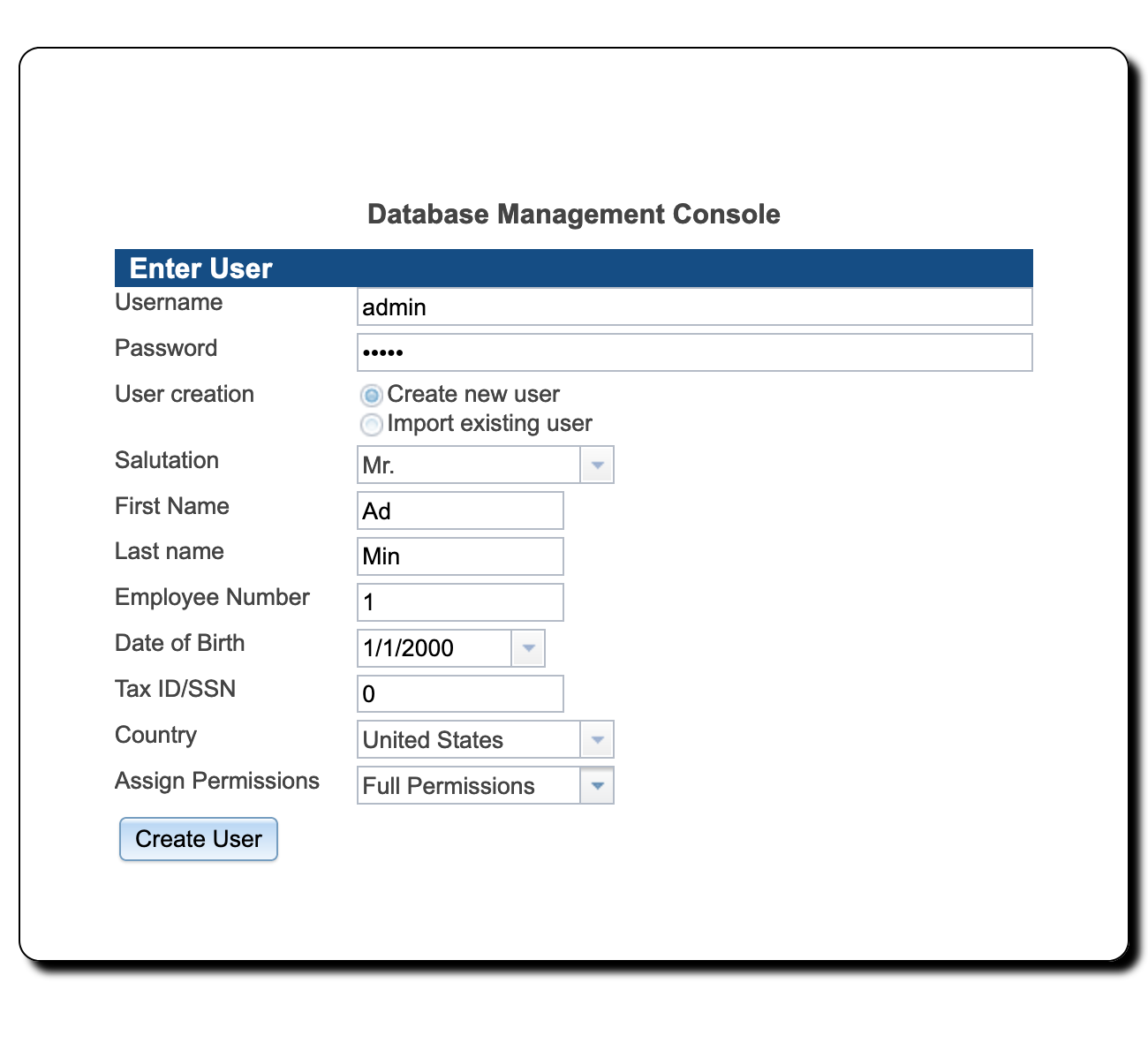

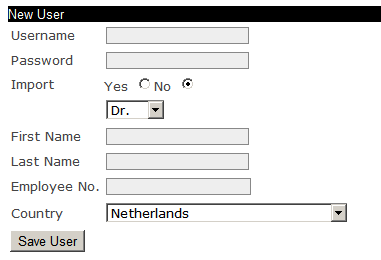

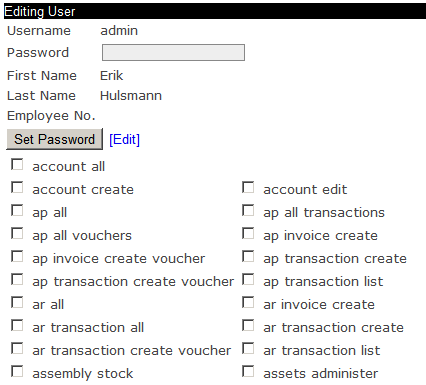

In the previous step, the technical part of the company creation procedure was completed. However, it’s not possible to log in to the company yet. Figure 5.5 on page 5.5 shows the next step in the setup process: the user creation screen. The fields shown have the same meaning as those discussed as part of user management in Section 24.2 on page 24.2.

Jack chooses to create an administrative user called admin who will be authorized to do everything in the application. Later on he will also create a user jack who will be authorized to do everything but changing the configuration and doing application administration. He’ll use the latter user to log in for day to day operations. This will help him prevent changing settings by accident.

Note that none of the fields in this screen are optional. If the name of the user being created isn’t already used with other companies, leave the Import option set to No, otherwise please read the chapter on user creation mentioned above.

Note: The password you enter here is a temporary one which will remain in effect for 24 hours only. Be sure to execute the steps in Section 6.2 on page 6.2 before these 24 hours elapse, because the user will be disabled after that.

Jack proceeds to enter the values as follows:

| Field | Value |

Description |

|---|---|---|

| User Name | admin |

The login user name |

| Password | asdfg |

The password to use for your first login |

| Create New User | Checked | |

| Import Existing User | Unchecked |

Only used when the user exists in another database |

| Salutation | Mr. | |

| First Name | Ad |

Used in combination with Last Name to identify the user |

| Last Name | Min | |

| Employee Number | 1 | |

| Date of Birth | 1/1/2000 |

not used by the application |

| Tax ID/SSN | 0 |

Tax or SSN; not used by the application |

| Country | United States | |

| Assign Permissions | Full Permissions |

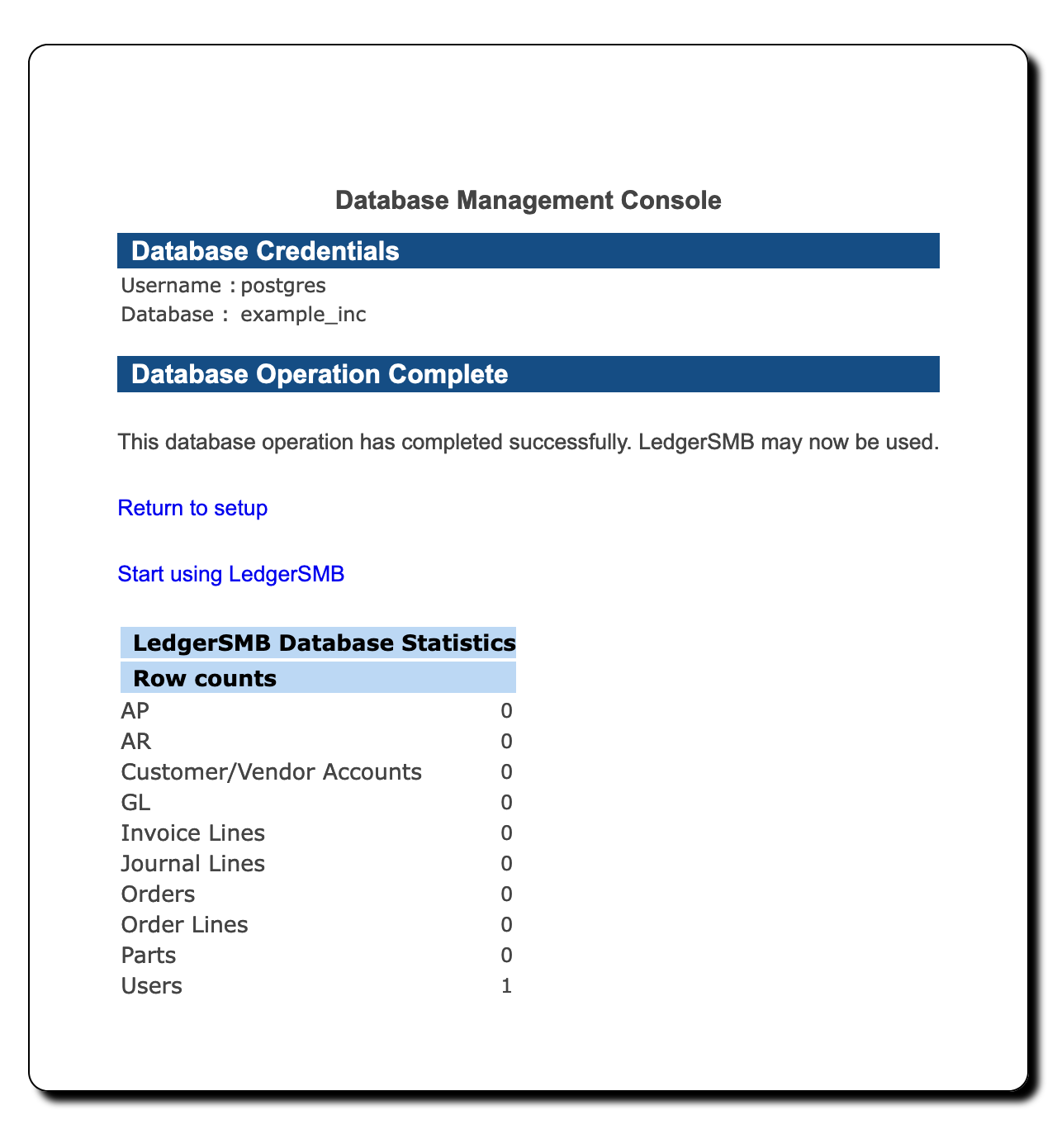

Jack has created his company database and now sees the “Database Management Console” screen as shown in Figure 5.6 on page 5.6.

By selection Start using LedgerSMB in the “Database Operation Complete” section of the screen his story continues in the next chapter “The first login”.

Chapter 6 The first login

6.1 Introduction

After the company database has been created by executing the procedure described in the last chapter it is still an empty shell which needs to be populated. The correct data needs to be entered for things like bank accounts and company contact data to be used on invoices.

These steps have to be completed before LedgerSMB can be used meaningfully: these settings have to be present for many workflows. A major reason is that with LedgerSMB - as most ERP system- financial consequences of events in many workflows are directly reflected in the company’s books. Some accounting related settings have to be completed before LedgerSMB can do so.

This chapter documents the steps to create a basic usable configuration for Example Inc. It assumes that one of the default chart of accounts was selected as shown in Chapter 5 starting at page 5 or that a custom chart of accounts was imported using the instructions in Section 26.2.3 on page 26.2.3. Whatever method was chosen, this chapter assumes that a chart of accounts is available.

6.2 Steps to the first login

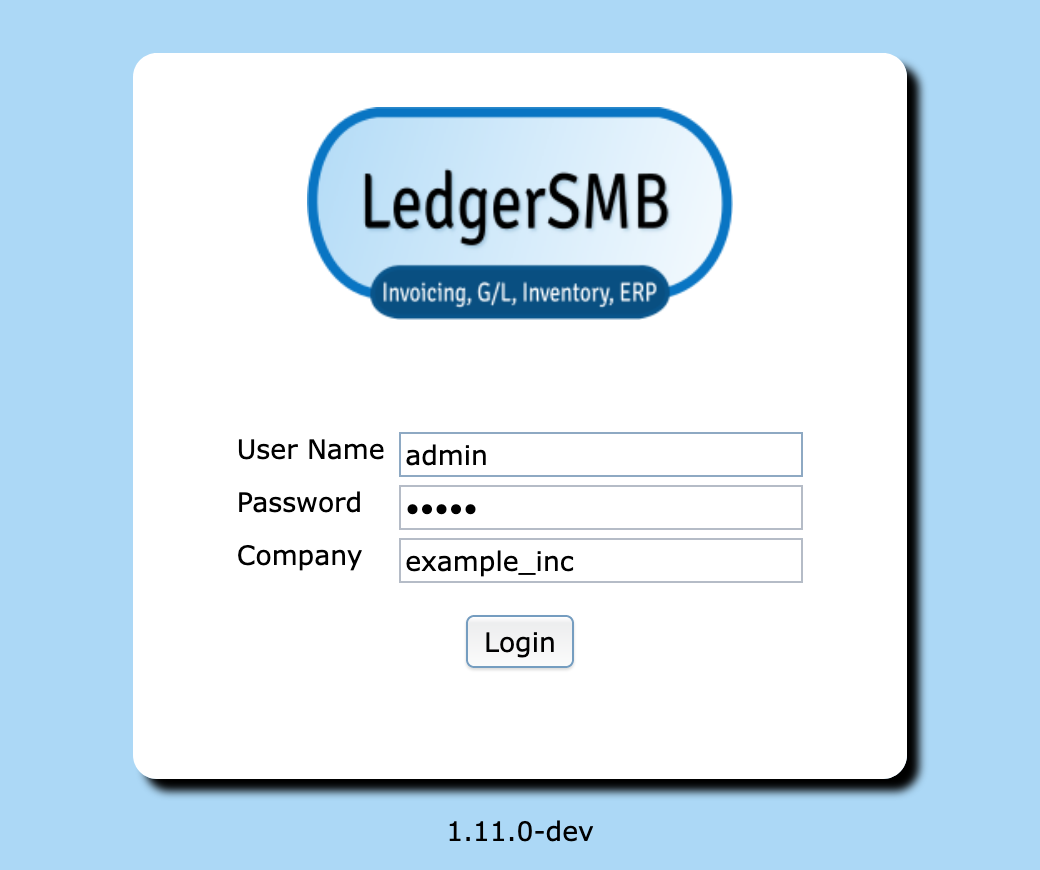

If this screen is not shown then Jack navigates to https://example.com/ledgersmb/login.pl to access the login screen.

6.2.1 Login screen

The login screen shows three fields which Jack proceeds to fill in as follows:

| Field | Value |

Description |

|---|---|---|

| Name | admin |

The login user name |

| Password | asdfg |

The password to use for your first login |

| Company | example_inc |

The name of the company database |

After entering all of the information and tapping the Login button Jack will see an alert letting him know that his password will expire today. Jack clicks OK to dismiss the alert.

6.2.2 Selecting a password

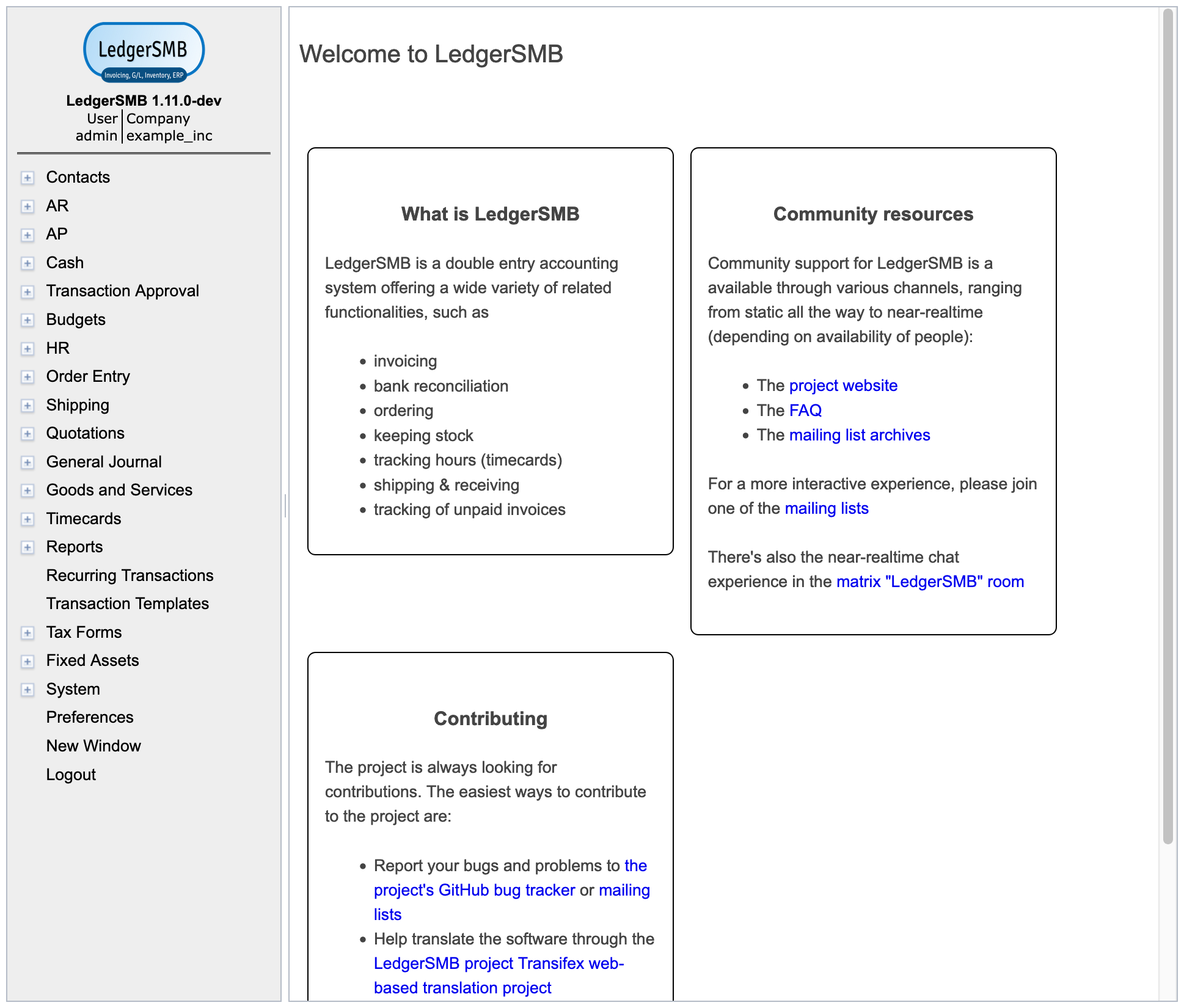

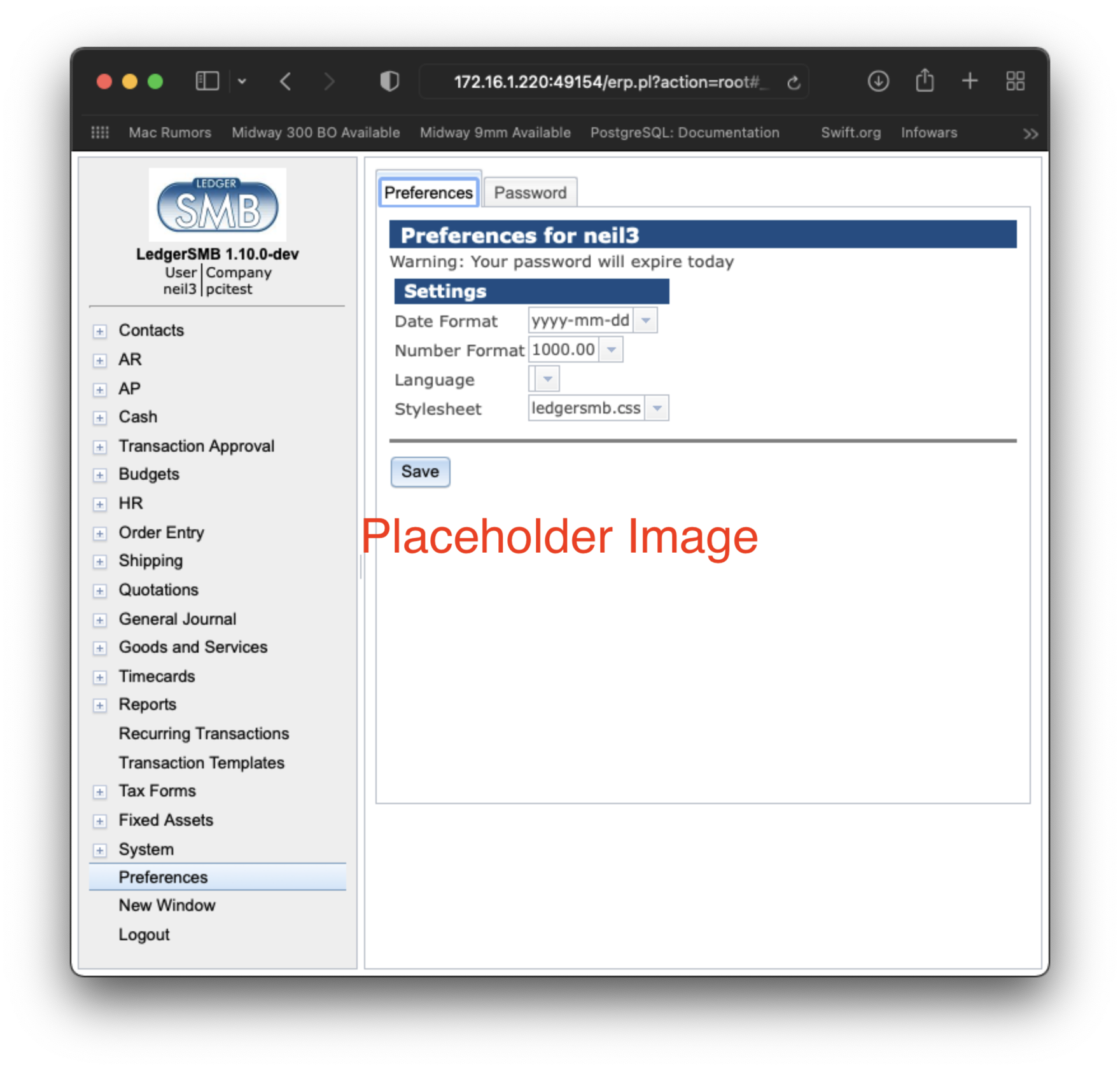

After successful login, the system shows the Welcome to LedgerSMB screen as depicted in Figure 6.2 on page 6.2.

The initial password has a 24-hour validity limit to prevent unused user accounts from posing a security risk.

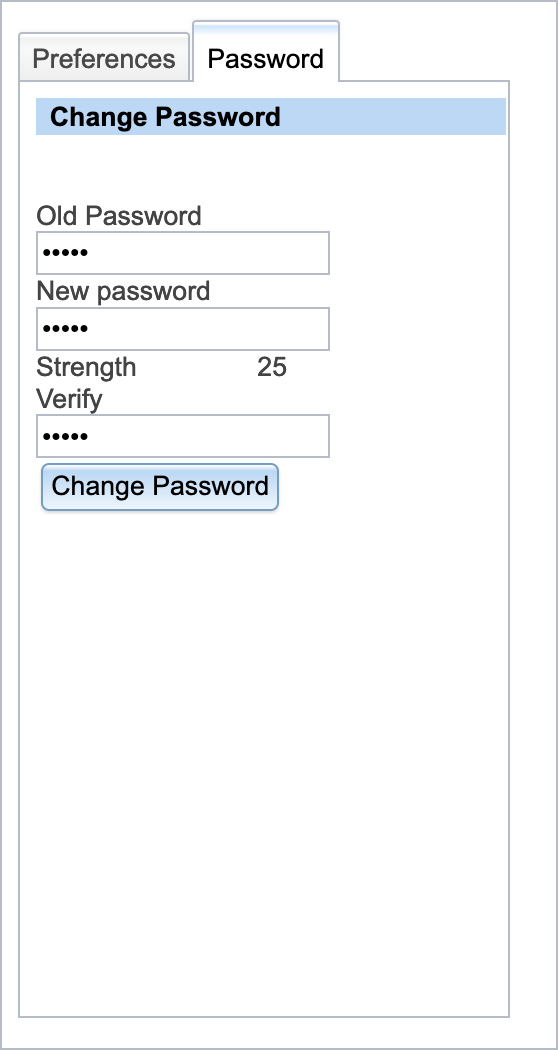

To set a new password Jack navigates to Preferences Password and sees the screen as depicted in Figure 6.3 on page 6.3.

The new password that Jack chooses will be different than any password used before and different than the temporary password set by the administrator. Not clicking the Save button means the password remains unchanged and the 24-hour limit remains in effect.

Jack enters the information in the Change Password screen as follows:

| Field | Value |

Description |

|---|---|---|

| Old Password | asdfg |

The old password set by the administrator using setup.pl |

| New Password | lkjhg |

The new password that Jack wants to use for admin |

| Verify | lkjhg |

Repeats the new password that Jack wants to use for admin |

Jack then clicks the Change Password button.

The new password has a validity of determined by the Password Duration setting from the System Defaults screen. User management is discussed is detail in Chapter 24 starting at page 24.

Login will be denied to users with expired passwords; they can request password resets through user admins.

6.2.3 Setting user preferences

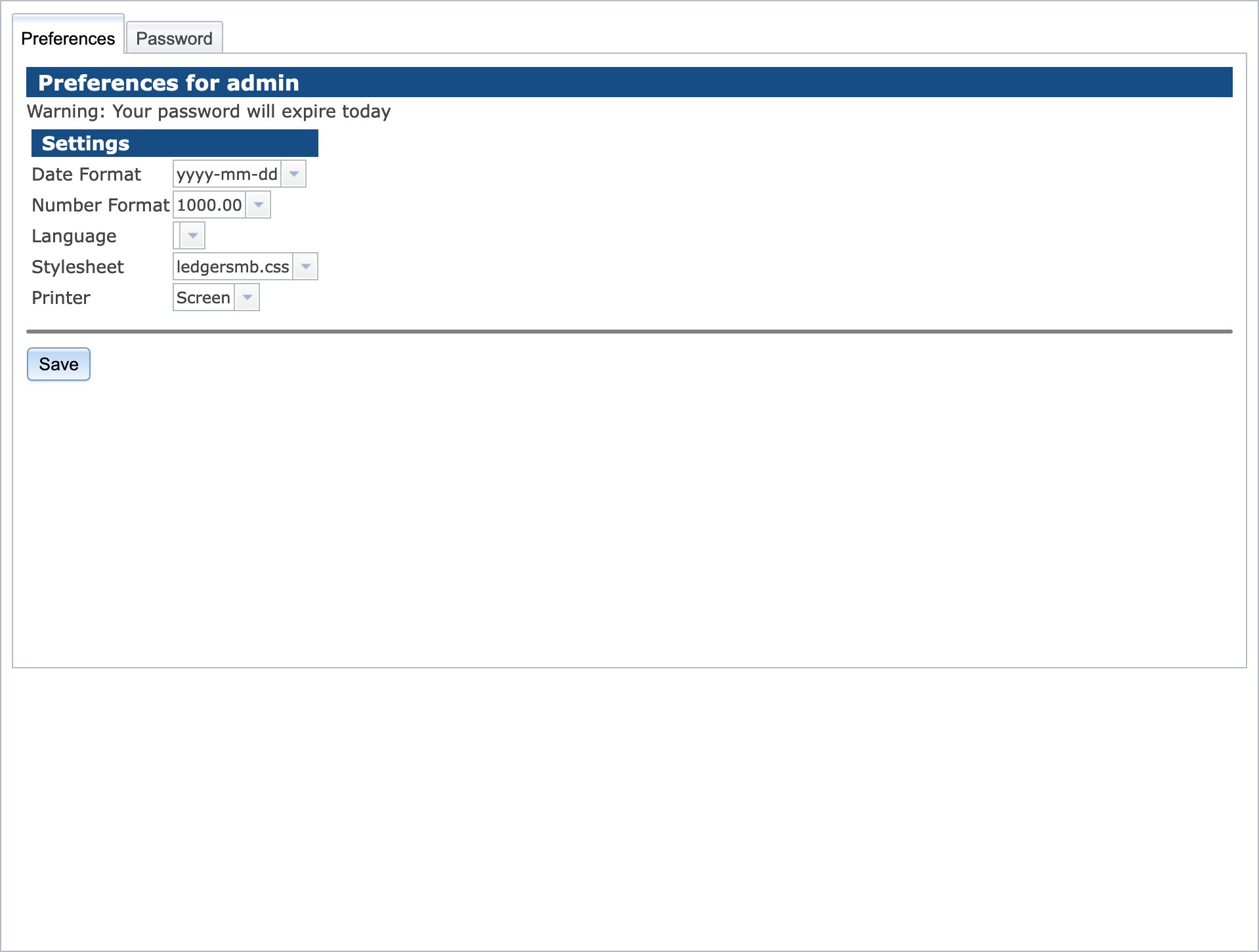

Jack clicks on the tab Preferences and the system shows the Preferences screen as depicted in Figure 24.3 on page 24.3

Jack selects his language, in this case American English and clicks Save.

6.2.4 Setting system defaults

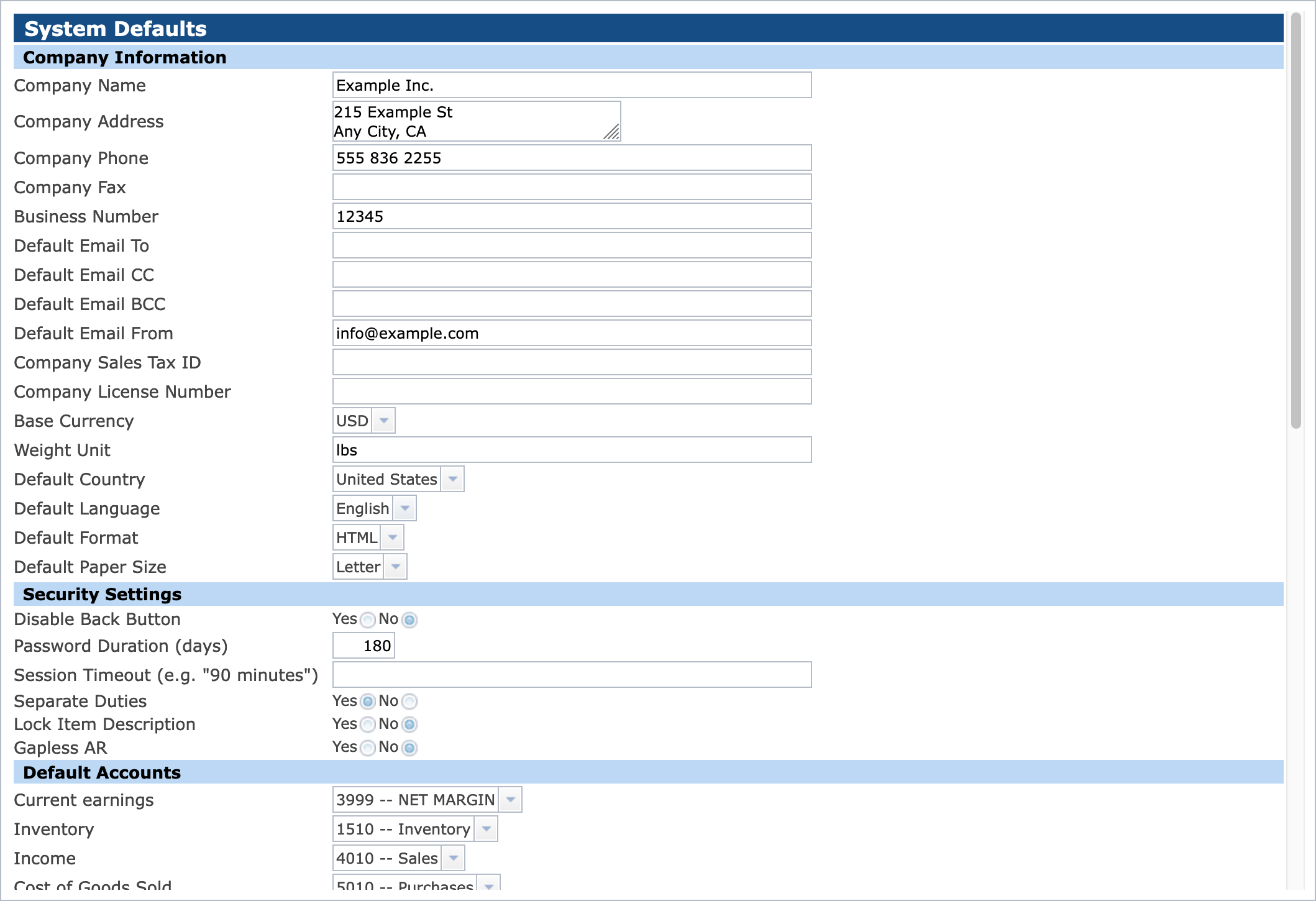

Out of the box, LedgerSMB contains reasonable system defaults, but Jack needs to add some specific company information. In order to do so, Jack navigates to System Defaults and sees the screen depicted in Figure 6.5 on page 6.5.

Jack sets the following defaults:

| Field | Value |

Description |

||

|---|---|---|---|---|

| Company Name | Example Inc. | |||

| Company Address |

|

Note the use of the new line |

||

| Company Phone | 555 836 2255 | |||

| Business Number | 12345 |

e.g. Chamber of commerce number |

||

| Default Email From | info@example.com | |||

| Default Country | United States | |||

| Default Language | English (US) | |||

| Password Duration | 180 |

Days |

Then clicks the Save button at the bottom of the screen.

A more elaborate description of the parameters in this screen is provided in subsection 18.4.3.

6.3 Setting up a bank account or credit card

As part of the start up activities of his company, Jack comes to an agreement with the bank for three products:

-

•

A current account with number “C54769”

-

•

Deposit account with number “D54990”

-

•

Credit card with a number ending with “.7734”

Most accounting systems - LedgerSMB included - use separate GL accounts to represent each bank account. This allows easy reconciliation of the ending balance on the bank account with the balance in the books.

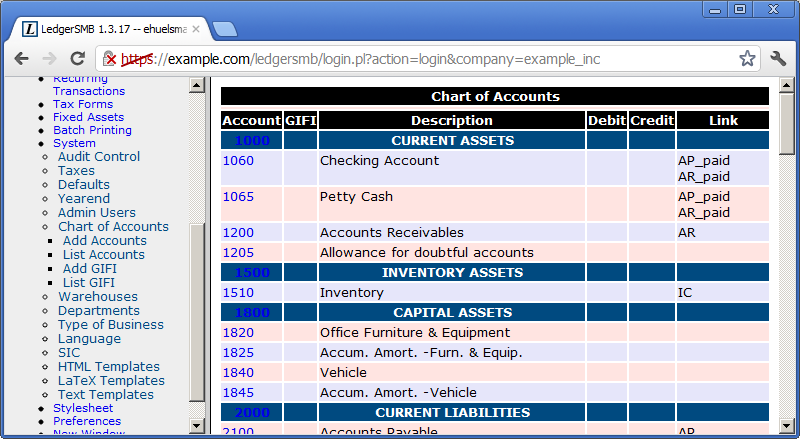

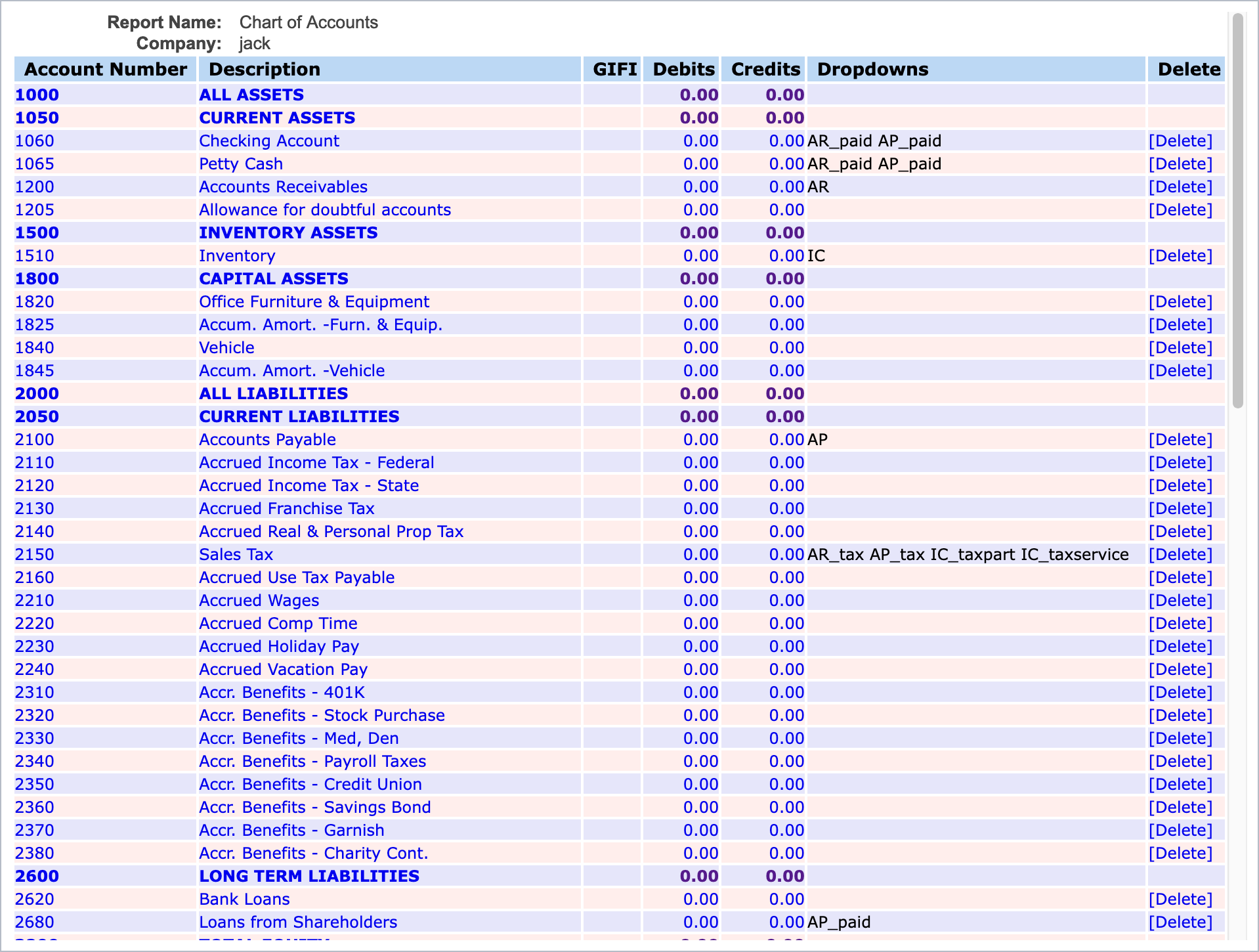

Knowing this, Jack looks up the example bank account from his preconfigured US chart of accounts using the General Journal Chart of Accounts menu as shown in Figure 6.6 on page 6.6.

Jack adds the new bank accounts by doing the following:

-

1.

Click on “1060”

- 2.

-

3.

Change the Description “Checking Account” to “Checking Account C54769”

-

4.

Click “Save”

-

5.

In the same screen change the Account Number to “1061”

-

6.

Change the Description to “Cash Deposit Account D54990”

-

7.

Click “Save as new”

-

8.

In the same screen change the Account Number to “1062””

-

9.

Change the description to “Credit Card xxxx.xxxx.7734”

-

10.

Click “Save as new”

Section 26.2.1 on page 26.2.1 discusses the options in detail - for now using the settings as configured for the sample checking account will do.

6.4 Checking and adjusting the chart of accounts

First and foremost the chart of accounts serves to register income, expenses, assets and liabilities in categories which support financial decision making or regulatory requirements. When checking his chart of accounts, this is the first thing Jack checks for.

Many business events in LedgerSMB trigger the creation of financial transactions. If the configuration required for these transactions to be created isn’t in place, users won’t be able to complete their workflows.

6.4.1 Accounts list

Jack wants to make sure his chart of accounts fits his purposes. To perform these checks Jack goes into the General Journal Chart of Accounts page. For now, he finds the ledger to be in order. Although the single Sales account stands out a bit against the numerous expense accounts, it turns out that there is also a single Purchases account on which all the expenses for parts purchases are going to be booked.

6.5 Checking sales tax rates

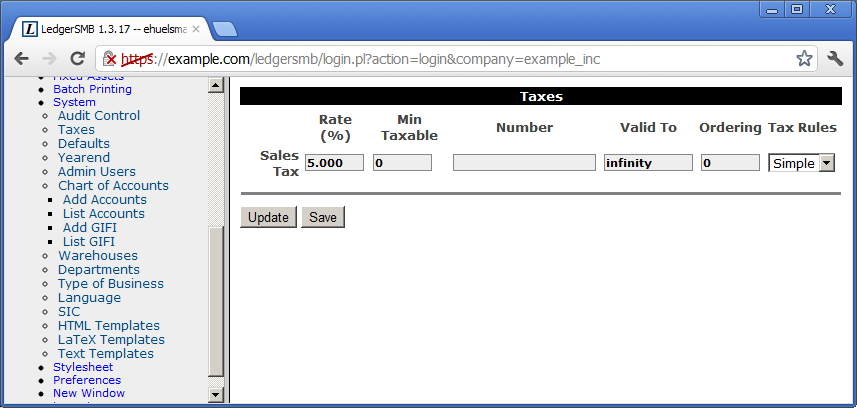

First off, Jack asserts that a sales tax22 2 Sales tax may be called Value Added Tax (VAT) in some jurisdictions. account has been provisioned. He finds it in the Current Liabilities section of his chart of accounts (CoA). In his jurisdiction there is only one sales tax rate applicable at any one time, which means this single account will suit his needs just fine. If he had been in a jurisdiction with multiple tax rates applicable, e.g. different rates for different types of goods, he would have been required to create more accounts.

The procedure to create more sales tax accounts is the same as the one used in Section 6.3 on page 6.3, with the notable difference that this time the base account to be used is the sales tax account.

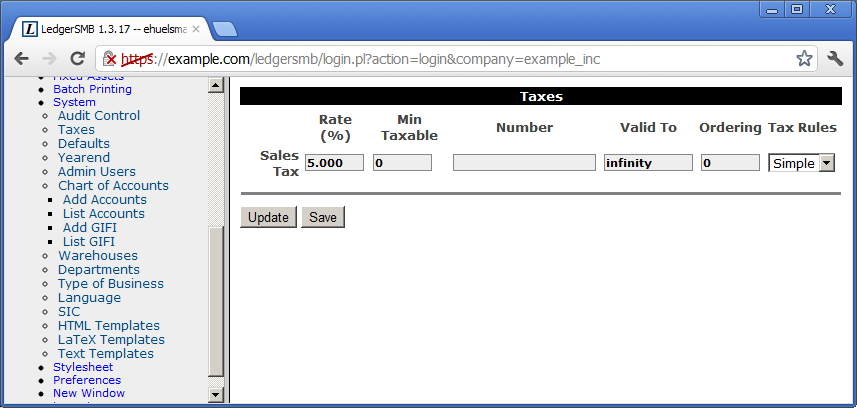

With the accounts in place, the tax rates have to be checked and possibly adjusted. To do so, Jack navigates to the System Taxes page as shown in Figure 6.8 on page 6.8.

Chapter 7 Building up stock

7.1 Overview

In this chapter Jack goes through the process of setting up LedgerSMB for his trade activities in computer parts, which includes deciding which parts he wants to resell. From there on he goes to contact a vendor to request a quotation, convert that to an order and receive goods into inventory and invoices into accounts payable.

To prepare LedgerSMB for his parts sales and purchases, Jack needs to configure Parts. The system records inventory for parts and assemblies. Jack won’t use them for his business. There’s more on assemblies in Section 25.1.3 on page 25.1.3.

Once set up, Jack is ready to execute the ordering process. Even though the process is described here from a purchasing perspective, sales work the same way with the roles reversed (Jack will act as a vendor in the sales process).

To start his purchase, Jack creates a Request for quotation (RFQ) document which he sends one or multiple vendors to let them know he’s interested in their products.

The vendor responds to Jack’s request by issuing a Quotation. From a legal perspective a quotation is a document which promises to deliver the requested goods or services at a certain rate - subject to conditions specifically mentioned. If Jack accepts the quotation and meets the conditions, the vendor is obligated to deliver.

In response to the quotation, Jack will place an order with the vendor to indicate acceptance of the quotation (or he can let the it expire). When he places the order, that legally means he agrees to the terms and conditions in the quotation. If the vendor delivers the goods or services as per the order, Jack has accepted the legal obligation to pay.

The vendor responds to the order by shipping the goods and services as well as sending an invoice. The invoice legally means the vendor considers to have a claim on the assets of Jack’s company. Jack creates a vendor invoice in his system to record the claim on his company by the vendor and the vendor creates a sales invoice in their system to do the same.

As a result of the above it’s considered bad practice to delete or change invoices once created. The accepted process to adjust invoices is to generate a debit invoice (for purchases) or a credit invoice (for sales) to “undo” the effects of the invoice and letting the other party know about it. Then a new invoice can be generated with the appropriate content. However, when the order process is correctly followed from order to invoice chances of sending the wrong invoice are greatly reduced.

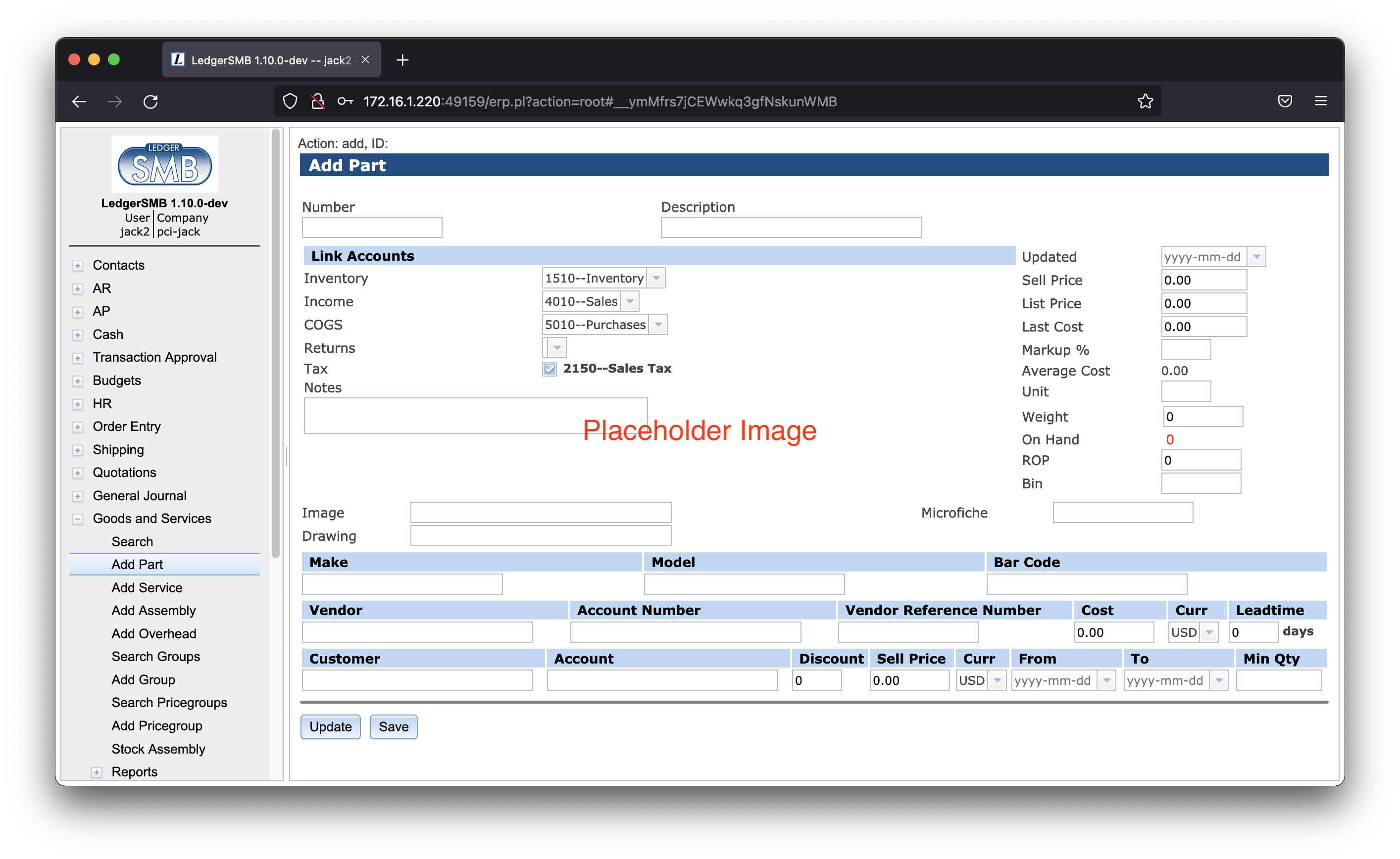

7.2 Defining parts

Jack needs to enter a large number of items he’ll be offering in his new shop. He starts out with the easy ones: the ones which will be sold as single items.

7.2.1 Single items

Jack chooses a 5TB hard drive by Samsung to be entered into the system as the first item. To do so, he goes to the Goods and Services Add part page from the menu as shown in Figure 7.1 on page 7.1.

Based on his reading from Section 25.1.1 on page 25.1.1, Jack decides to enter the hard drive with the following data:

| Field | Value |

| Number | SAM1TB |

| Description | SAMSUNG 980 PRO 1TB PCIe NVMe Gen4 SSD |

| Inventory account | 1510 - Inventory |

| Income account | 4010 - Sales |

| COGS account | 5010 - Purchases |

| Sell price | 175.00 |

After entering the data Jack clicks Save.

He decides not to include make/model information, drawings or images yet and since he hasn’t entered vendors or customers in his system yet, he decides to leave those sections blank as well.

7.2.2 Combining single-item and “multi-item pre-packaged” sales

After having finished setting up the solid state drive, Jack now wants to enter the memory modules he’s going to sell. The problem is that they usually go in pairs, since that’s what the systems consuming them need. However, he expects them to be sold as single items as well and he wants to be able to set a separate price for those occasions.

From his reading of Section 25.1.5 on page 25.1.5, it should be possible to support this scenario with a small work around11 1 It’s planned to directly support this use-case in some version higher than 1.3. From the two solutions available, he chooses option (b): to create a part and an assembly and regularly restock the assembly to 0 (zero) in order to remove the stock from the single item.

7.3 Defining part groups

As Jack continues to enter more parts into the system, he wonders how he’s going to look up the parts efficiently later on. Returning his reading to Section 25.1.1 on page 25.1.1, he understands that ’part groups’ are the solution to that problem.

He decides to create the part groups by navigating to:

Goods and Services Add Group.

For each group in the list below Jack enters the group name and clicks Save after each one:

| Field | Value |

| Group | Storage |

| Group | Monitors |

| Group | Input devices |

| Group | Printers |

After creating these part groups, the “Group” drop down appears on the parts entry screen, allowing him to assign each of his parts to one of these groups.

Since he doesn’t expect to be running more than one or two types of CPUs, he decides not to create a separate group for those and leaves these two parts unassigned.

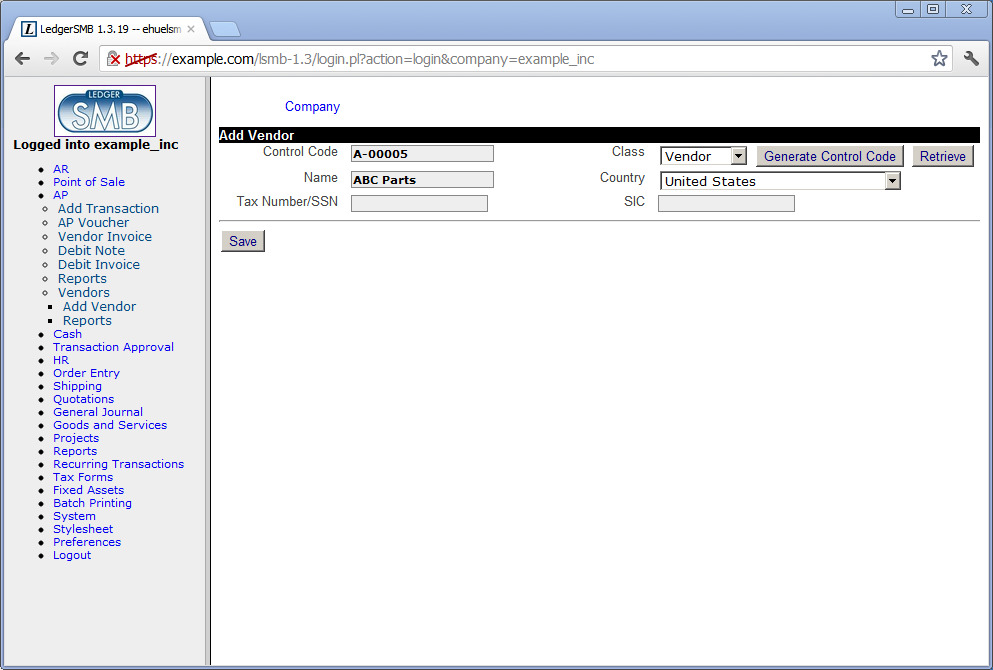

7.4 Defining vendors

Jack selects “ABC Parts” to purchase the inventory he needs to run his company. In order to start buying inventory, ABC Parts needs to be entered as a Vendor to LedgerSMB.

Using the work flow detailed in Section 34.2 on page 34.2 Jack starts to do so by going through the menu Contacts Add Contact Company. He fills out the Company creation form by clicking the Generate control code button and adding the data as shown in Figure 7.2 on page 7.2.

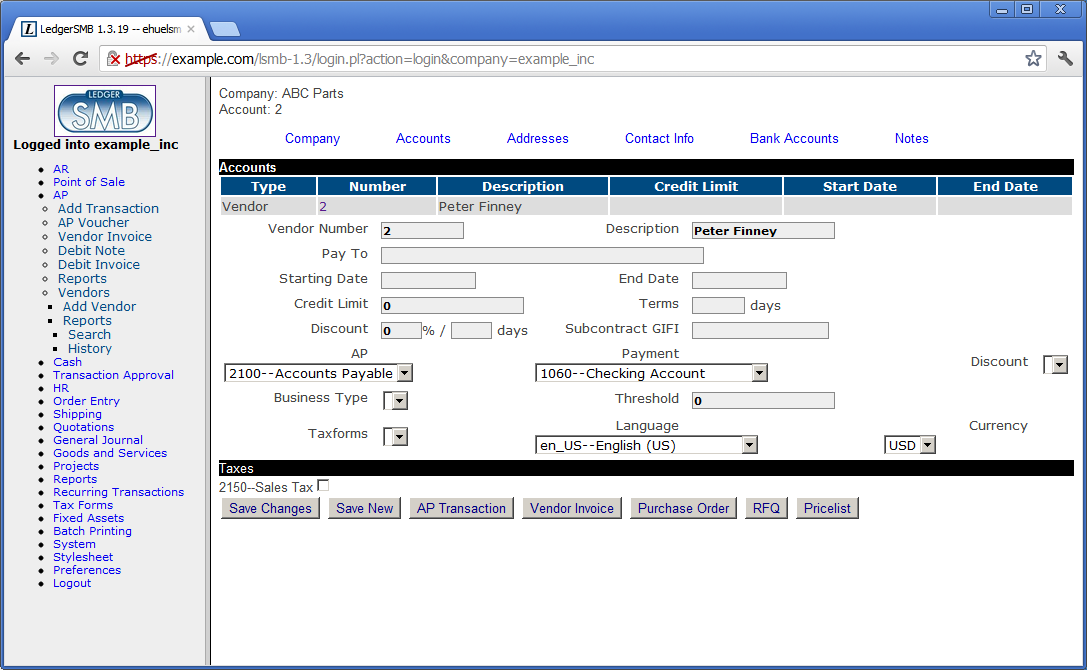

After saving the company data, Jack is presented the account data screen which he fills out as shown in Figure 7.3 on page 7.3.

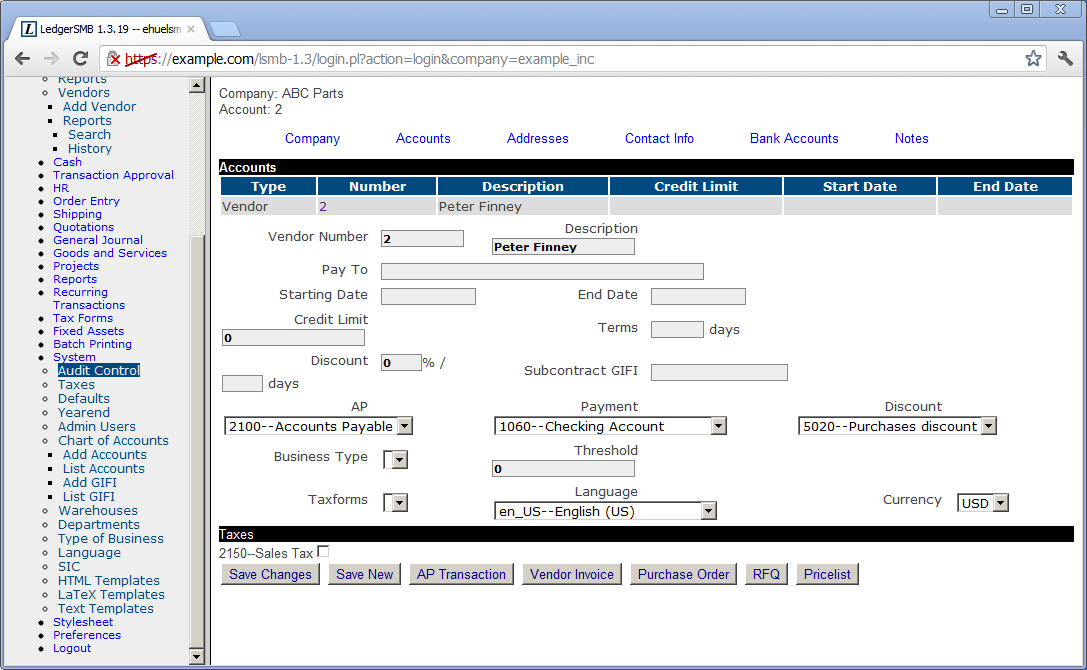

When he’s done filling out and saving the form, he notices the empty “Discount” drop down. Reading more about account configuration check marks in Section 26.2.3 on page 26.2.3 and going back to the checks on his chart of accounts (Section 6.4 on page 6.4), he finds he’s missing the purchase and sales discount accounts. He adds two accounts as follows:

-

4020

Sales discount

-

5020

Purchase discount

Note the top-left corner stating “Company: ABC Parts” and “Account: 2”. The information entered on the “Addresses”, “Contact Info” and “Bank Accounts” tabs will be attached to the account listed, i.e. account number 2 in this case.

7.5 Requesting quotations

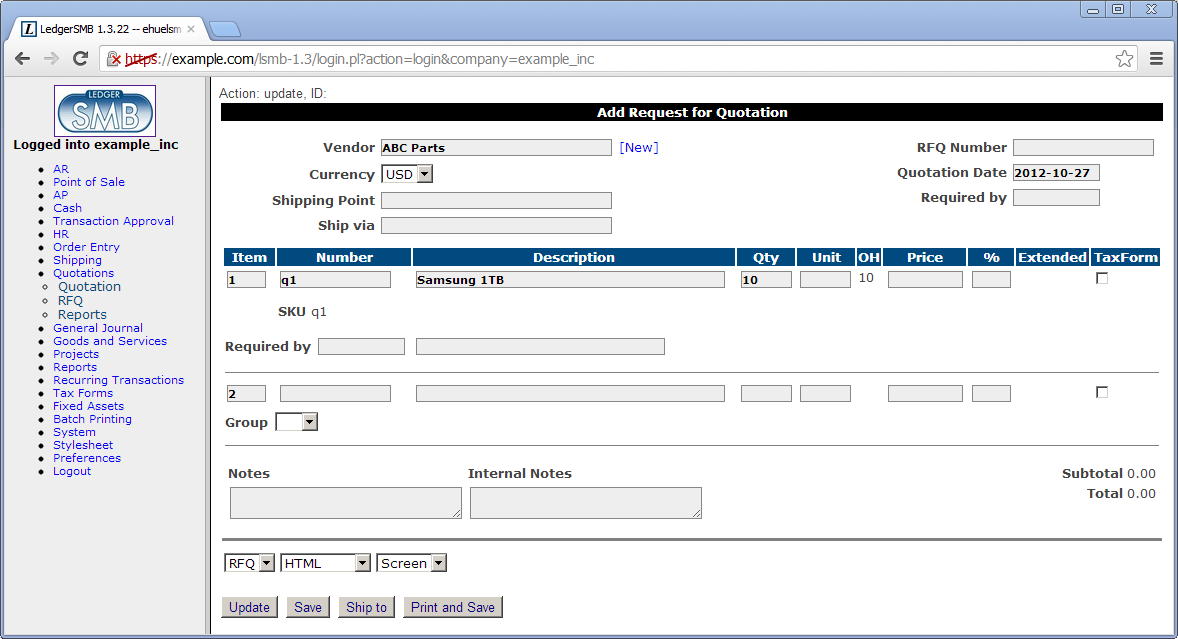

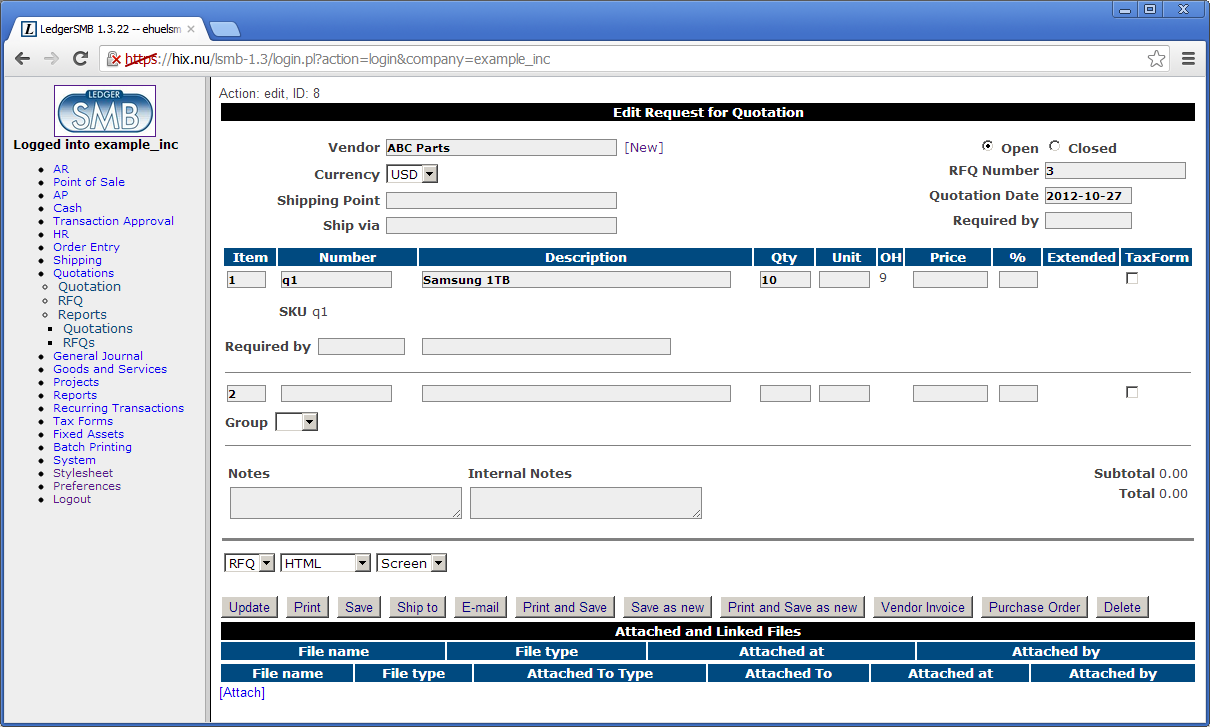

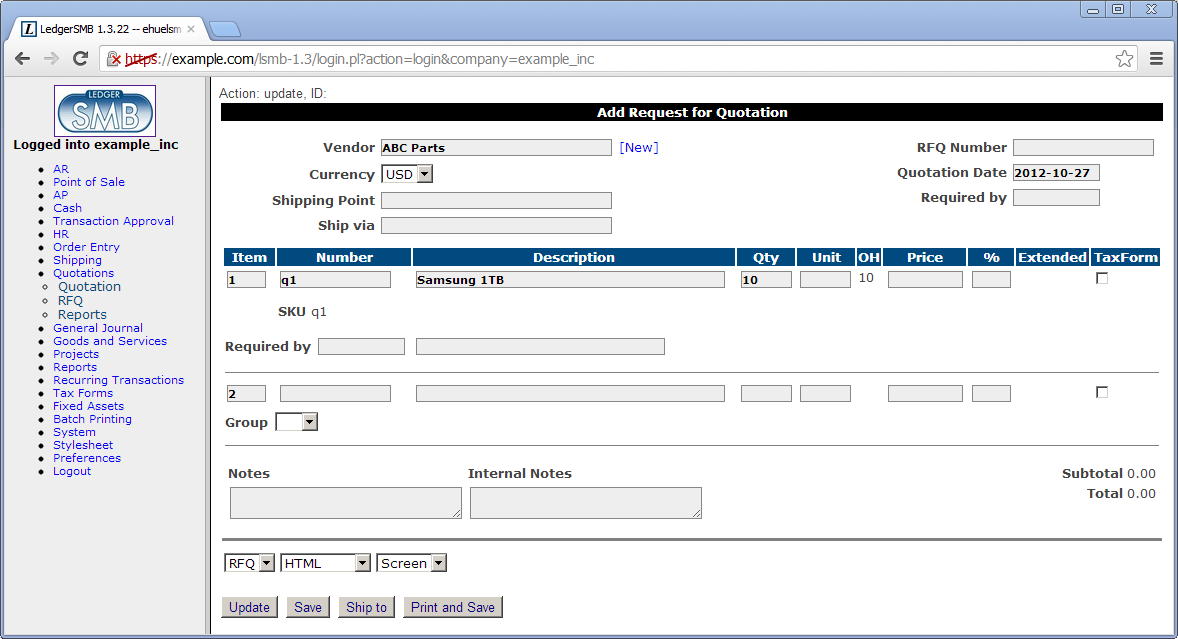

After Jack finishes setting up the parts and vendor information, he decides to use LedgerSMB to draw up a list of items he wants to order from this company. To do so he follows the menu path Quotations RFQ which opens up a screen (shown in Figure 35.1 on page 35.1) for entering a new RFQ.

Remark Note that the RFQ entry screen contains prices; this is misleading at least: the printed output to be sent to the vendor does not. The fact that this screen allows entry of prices could be considered a bug.

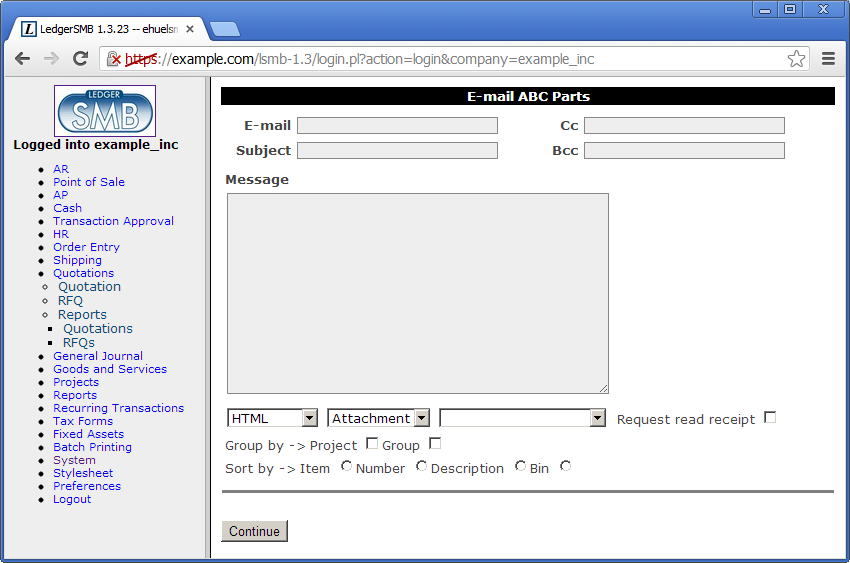

After filling out the form in accordance with the description in Section 35.1 on page 35.1, Jack expedites his RFQ to his vendor through e-mail by clicking the “E-mail” button. He finds himself in the screen shown in Figure 7.6 on page 7.6.

The From field of the e-mail to be sent out will be filled using the “Default From” setting documented in Section 18.4.3 on page 18.4.3. The other address fields can be entered by the user and may be readily populated if the customer account has the right contact info items attached: if there are Email, Cc and/or Bcc contact items set up, those will be used to fill these fields.

At the bottom there are three selection lists. The first allows selection of the format used to send the RFQ. Available options are HTML, CSV, Postscript (PS) and PDF. The last two require Postscript and PDF support to be correctly set up. The last selection list selects the language to be used for the RFQ. If no value is selected the system default language is used.

7.6 Following up on a quotation

Jack’s vendor (ABC Parts) sends him a quotation in response to his RFQ. Jack and his vendor can go back and forth a few times until Jack likes the offer he’s getting, but for the sake of argument let’s assume this is the final quotation.

Since Jack likes the offer, he wants to place an order with his vendor. To do so he looks up the RFQ he sent to the vendor using the menu path Quotations Reports Search. The screen shows additional buttons now that it shows a saved RFQ.

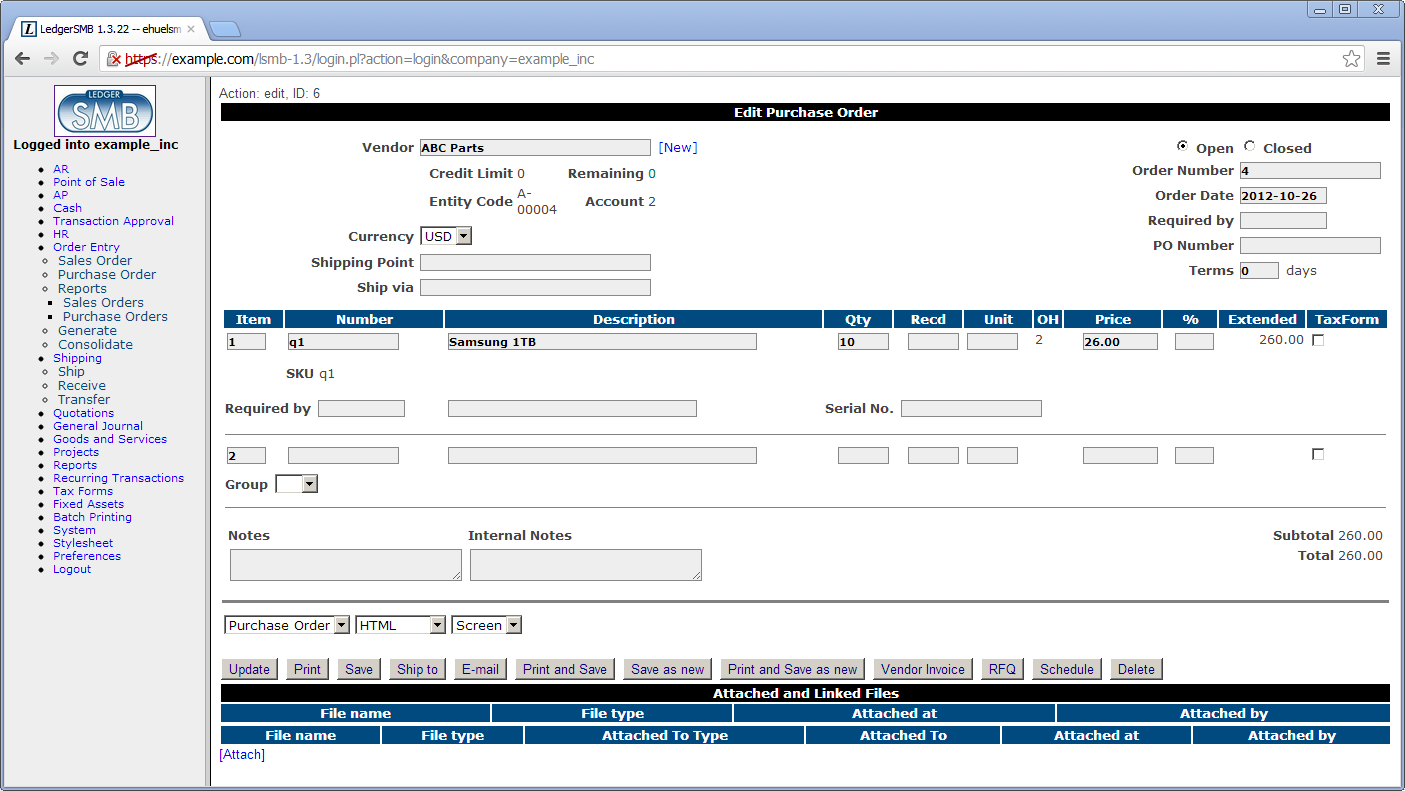

Jack clicks the “Purchase Order” button which creates a new order from the data in the RFQ. He completes it by entering the prices his vendor has quoted and by modifying it to be in accordance with the quotation. See Section 36.2 on page 36.2 for more detail on the order entry screen. When finished he saves the order and mails it to ABC Parts just like he mailed the RFQ in the previous section.

7.7 Receiving ordered items

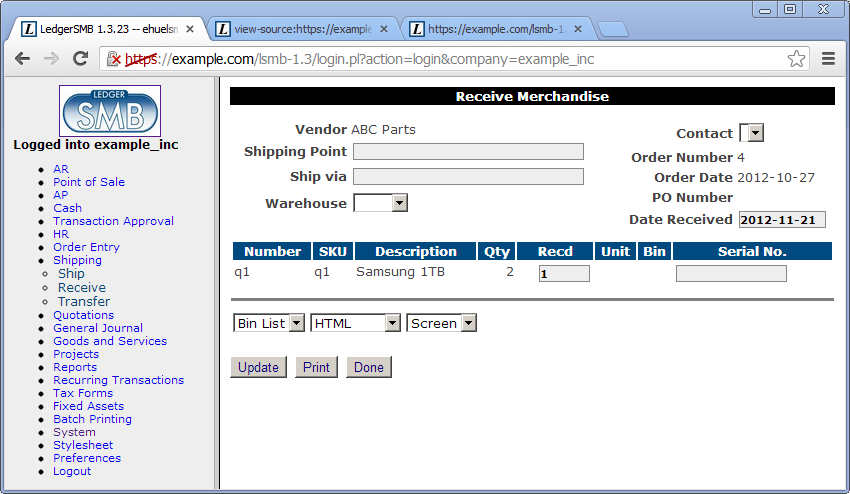

Having ordered his inventory, the vendor starts shipping. There’s too much to ship at once so the vendor ships the goods in batches: every week he ships what’s available at the end of that week - he needed to order some of the products with the manufacturer.

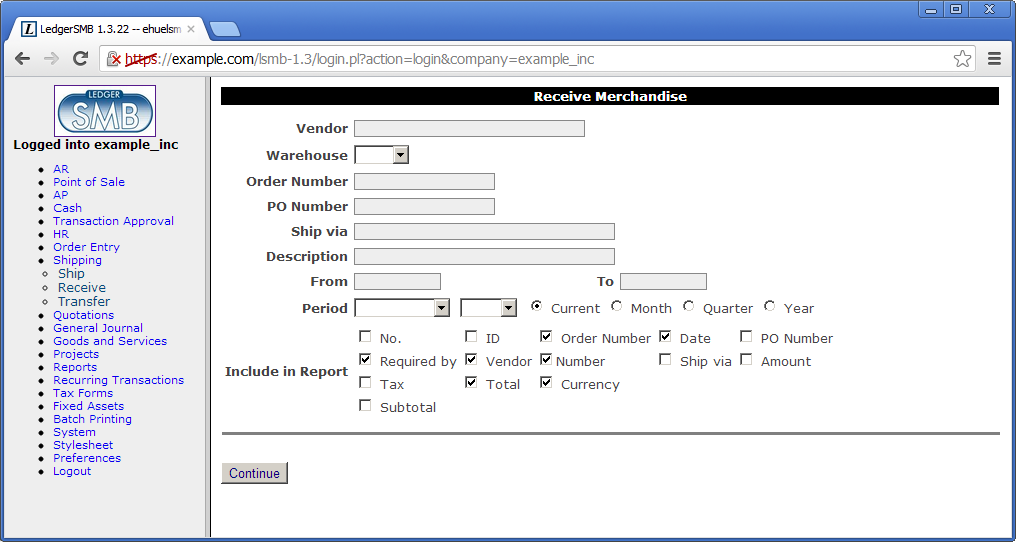

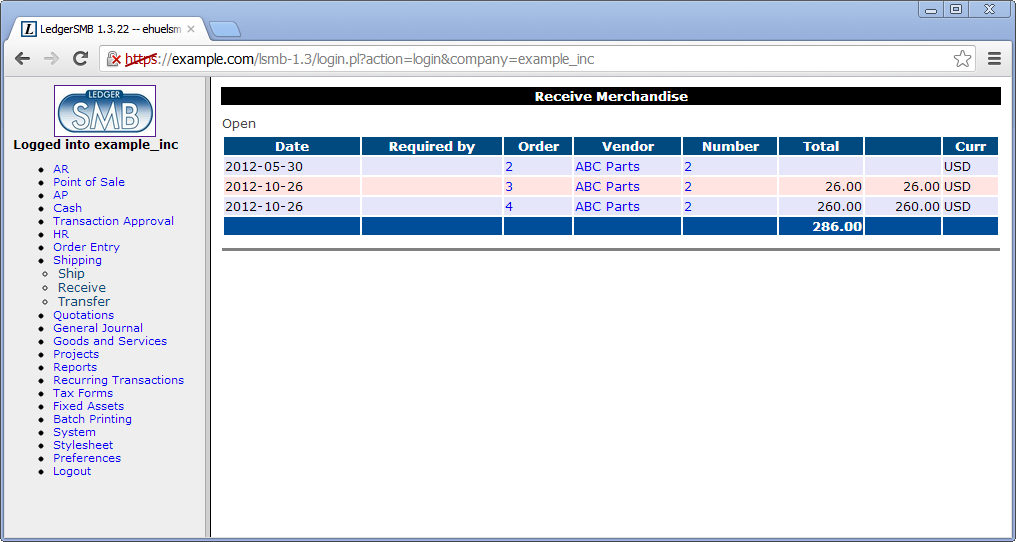

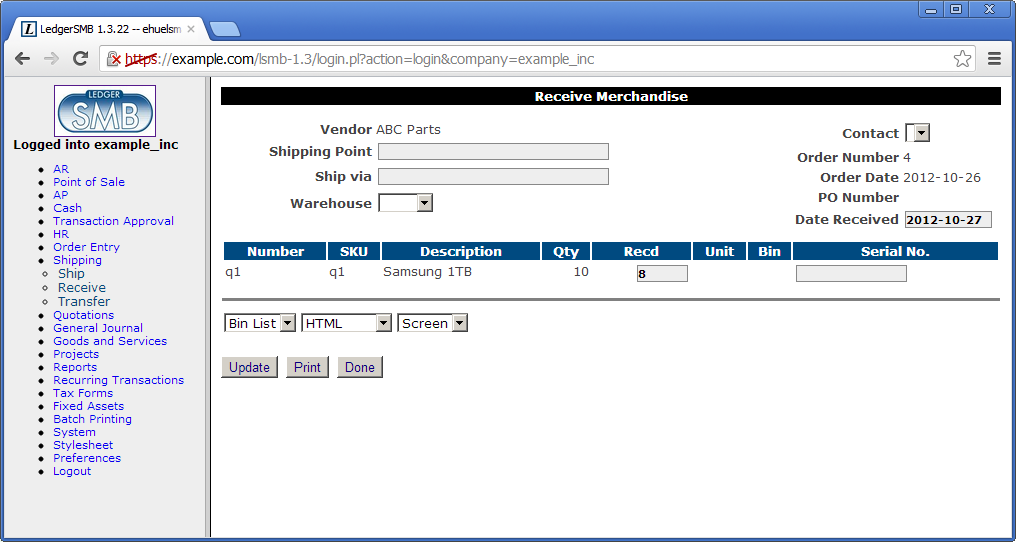

LedgerSMB helps Jack keep track to see if he has received everything he has ordered and that he’s not receiving too much. Jack goes through the menus Shipping Receive. In the search screen, he fills the vendor name (ABC Parts) and clicks “Continue” to be listed all open orders from ABC Parts. By clicking on the order number, the “Receive Merchandise” screen opens as presented in Figure 7.8 on page 7.8. This allows Jack to handle the incoming shipment. LedgerSMB will automatically update inventory based on the amounts entered as received 22 2 To resolve problems in the inventory tracking parts of LedgerSMB (inherited from before the fork), a significant change has been implemented in 1.3.31: inventory changes won’t be recorded until invoices have been posted. .

7.8 Receiving an invoice

7.9 Paying an invoice

Chapter 8 Ramping up to the first sale

8.1 Sending out a quote

8.2 Sending out a sales order

Chapter 9 Shipping sales

Chapter 10 Invoicing

10.1 Handling sales taxes

10.1.1 Invoices with taxes included

10.1.2 Invoices with explicit tax amounts

10.2 Invoice Editing

Posted invoices only have 2 fields that can be edited:

-

1.

Internal notes field

-

2.

Sales person - The Sales Person drop-down is only shown if there are sales people. Sales People are created through Employees and checking the Sales check-mark.

After editing, click the Save Info button to save the changes.

Chapter 11 Collecting sales invoice payments

11.1 Customer payments

11.2 Customer payment mismatch

11.2.1 Choosing between pardoning and registering underpayment

11.2.2 Large ones, as in partial payments or largish under/over payments

11.2.3 Pardoning small mismatches

Chapter 12 Paying vendor invoices

12.1 Handling vendors who match amounts to exact invoices

12.2 Handling vendors with running balances

12.3 Handling bounced checks

12.3.1 Voiding checks to undo payments of vendor invoices relating to bounced checks

Chapter 13 Monitoring arrears

13.1 Handling interest on arrears

Chapter 14 Branching out: services

14.1 Creation / assignment to different accounts

14.2 Recording service hours

14.3 Customer approval on service hours

14.4 Invoicing services

Chapter 15 Branching out II: service subscriptions

Part III Configuration

Chapter 16 Overview

16.1 Introduction

This section of the book describes how to set up LedgerSMB and its components. Configuration is assumed to be mostly one-off and rather technical in nature. To find out which tasks might need to be performed in order to keep the application in good health the reader is referred to the ’Administration Introduction’, Section 19.1 on page 19.1.

Chapter 17 Global configuration

17.1 Apache

Section about installing on Apache 2+

items to be discussed:

- Forwarding of authentication

-

@@@TODO

- PSGI configuration

-

@@@TODO

- performance

-

cgiD configuration: don’t (yet) [but will be supported once all legacy code is gone] @@@TODO

- security

-

suEXEC environment @@@TODO

17.1.1 Differences between Apache 1.3 and 2+

Explain how to use lsmb with 1.3 instead of 2+.

17.2 PostgreSQL

- pg_hba.conf

-

authentication @@@TODO

- security

-

local vs IP connections @@@TODO

17.3 LedgerSMB version numbers

LedgerSMB version numbers are in the form of Major.Minor.Patch-Optional Tag. So for example, the current 1.9 development release is 1.9.28-dev and the production release is 1.9.27

- Major

-

An increment in the major release number can mean significant architectural, Application Programmer Interface (API), functional, or usage changes. It is expected that an upgrade to a new Major version is going to be planned and tested by the user organization before upgrading.

- Minor

-

An increment in the minor release number may indicate changes to APIs , interfaces, user instructions, etc. But these changes are not expected to have major impact and should require minor planning and testing. Often small impact enhancements are back-patched to previous Minor versions as patches.

- Patch

-

Increments in the Patch number represent bug fixes, security improvements, or enhancements that do not break existing functionality, usage, or APIs. These changes are expected to be applied to an installation as soon as possible.

- Optional Tag

-

Common values include dev, beta, or alpha. Typically, these are only used internally by the LedgerSMB developers.

17.4 LedgerSMB Configuration

LedgerSMB configuration using ledgersmb.conf is deprecated as of 1 Jan 2023. New functionality may only available when using ledgersmb.yaml configuration file.

For the time being there is a conversion step that converts the old ’ledgersmb.conf’ to ‘ledgersmb.yaml‘, but the old conf file does not support new functionality.

17.4.1 ledgersmb.yaml

For an example of the default, non debug ledgersmb.yaml see https://github.com/ledgersmb/LedgerSMB/blob/master/doc/conf/ledgersmb.yaml

cookie

@@@TODO

db

@@@TODO

default_locale

@@@TODO

environment_variables

@@@TODO

extra_middleware

@@@TODO

logging

@@@TODO

login_settings

@@@TODO

Email can be configured by selecting which of the three available transports to use. The default ledgersmb.yaml file contains examples for the first two.

-

Email::Sender::Transport::Sendmail – Emails are sent using the local server’s sendmail binary. The configuration parameters are:

-

transport:$class – Email::Sender::Transport::Sendmail

-

transport:path – optionally provide a path to the directory that contains the ’sendmail’ binary.

-

-

LedgerSMB::Mailer::TransportSMTP - Emails are sent using a remote SMTP server. The configuration parameters are:

-

transport:$class – LedgerSMB::Mailer::TransportSMTP

-

transport:host – The required host name of the smtp server.

-

transport:port – The required port number of the smtp server. Note this might vary depending on whether TLS or SSL is used.

-

sasl_username:$class – The required smtp server authentication method. The values can be ‘Authen::SASL‘ or ‘Authen::SASL::SCRAM‘.

-

sasl_username:mechanism – The available mechanism are defined at https://metacpan.org/dist/Authen-SASL or https://metacpan.org/dist/Authen-SASL-SCRAM depending on the selected ‘$class‘.

-

sasl_username:callback:user – The required SMTP user name. ’the-user’ in the default file is a place holder and must be replaced.

-

sasl_username:callback:pass – The required SMTP password. ’SECURITY-FIRST’ in the default file is a place holder and must be replaced.

-

-

Email::Sender::Transport::DevNull - Emails are sent to /dev/null, in other words emails are not sent anyplace. This prevents errors in the user interface, but throws away any mail. There is only one configuration parameter. This is not a recommended production configuration. It is usually used for testing.

-

transport:$class – Email::Sender::Transport::DevNull

-

miscellaneous

@@@TODO

output_formatter

@@@TODO I really don’t have a good way to format lists explanations. See below at paths:config:workflows for an example. Guidance welcome.

paths

This section configures the various paths used by LedgerSMB. The configuration parameters are:

-

config:locale – Path to locale files. Defaults to locale/po.

-

config:sql – Path to the SQL schema definition files.

-

config:sql_data – Path to the reference and initial SQL database load files. For example, the names of the countries.

-

config:templates – Path to the templates base directory. Typically set to templates.

-

config:UI – Path to the UI HTML files. Defaults to ./UI/

-

config:UI_cache – Path to the location of the UI template cache . These are cached after they have been parsed and translated. This improves performance.

-

config:workflows – A list of the Directories where workflow files are stored. Contains the default and custom workflows. Custom workflows are used to override behavior of the default workflows by providing actions, conditions, etc. with the same name and type or by providing workflows of the same type with additional states and actions. Default workflows defaults to workflows. Custom workflows defaults to custom_workflows. Default workflow path must precede all the custom workflow paths. @@@TODO is the last statement correct? Can there be more than 2 paths?

printers

This section contains a list of printers and their definition.

The default ledgersmb.yaml file shows two printers named ’Laser’ and ’Epson’ with the printers defined using the linux lpr command and its arguments.

This default definition will provide for the selection of the printers named ’Laser’ and ’Epson’ in the LedgerSMB user interface.

For more information search the internet for ’linux lpr command’ or use man lpr at the linux command line.

reconciliation_importer

@@@TODO

setup_settings

@@@TODO

ui

@@@TODO

workflows

@@@TODO

Chapter 18 Per company configuration

18.1 Matching your business processes

By default, LedgerSMB operates such that all optional functionality is available and the user decides to use it or not based on which menu items they select, what fields they enter data into, and what buttons they click.

Removing application roles (see Appendix D starting at page D) can limit the visibility of menu items, data fields, and buttons. This will simplify the users view of the system, reduce training, and better configure LedgerSMB to your business requirements.

Outside of application roles, the only other enforced business process configuration is whether the same person can both create and post transactions. It is called ’separation of duties’ and is defined in Section 18.4.3 on page 18.4.3.

LedgerSMB is configured to adjust inventory when a Sales or Purchase Invoice is posted. This closely matches retail business processes where the customer walks out of the establishment with the product and an invoice (or receipt). This functionality can also be used for wholesale shipping applications because LedgerSMB can also produce picking and shipping documents, just remember that the inventory transaction happens when an invoice is posted.

LedgerSMB uses FIFO for COGS and inventory calculations. There are provisions for alternatives, but the code is not yet complete. See Section 3.3 on page 3.3 for a detailed explanation of FIFO calculations.

In addition to the above, LedgerSMB has configurable Workflows . These are not user configurable but your technical support staff should be able to create and edit them. See Chapter VIII starting at page VIII.

Contact the development team for other business process customizations. In most cases the need for more flexible matching of LedgerSMB to your business processes is understood, but the project has not not yet had any customer requests or development volunteers.

18.2 Administrative user

18.3 Chart of accounts

@@@ Should refer to the ’administration’ section???

18.3.1 Special accounts

-

•

AR/AP summary accounts

-

•

5 other special purpose accounts, see “Defaults” screen discussion

-

•

sales tax accounts

18.4 System menu settings

This section enumerates the “System” menu’s immediate children. In some cases the functionality is too complex and is referred to a chapter of its own.

18.4.1 Audit control

Enforce transaction reversal for all dates

This is a Yes/No value which affects the actions which can be performed on posted financial transactions.

-

•

No means transactions can be altered or deleted, even after posting them. Note that if a transaction has been posted before the latest closing date, it can never be altered, not even when this value is in effect.

-

•

Yes means transactions can’t be altered after posting. This setting is highly preferred and considered the only correct approach to accounting as it assures visible audit trails and thereby supports fraud detection.

Close books up to

@@@ This item isn’t a system setting; shouldn’t it move to “Transaction approval”?? That way system settings (config) and processes are separated.

@@@ My preference is to remove the setting entirely and rely on year-end workflow. We might add an account checkpoint interface as well at some point –Chris T

It’s advisable to regularly close the books after review. This prevents user error changing reviewed numbers: after closing the books, it’s no longer possible to post in the closed period.

There are also performance benefits to closing the books, because LedgerSMB uses the fact that the figures are known-stable as a performance optimization when calculating account balances.

Activate audit trail

This is a Yes/No value which - when Yes - causes the system to install triggers to register user actions (creation/adjustments/reversals/etc…) executed on financial transactions.

@@@ Once activated, where can we see it the audit trail??

@@@ This setting should go. In 1.3 the audit trails are always enforced via triggers so this setting does nothing. –CT

18.4.2 Taxes

This page lists all accounts which have the “Tax” account option enabled as discussed in Section 26.2.1 on page 26.2.1.

Each account is listed at least once, but can be listed many times, if it has had different settings applied over different time periods. E.g. if one of the current VAT rates is 19%, today but it used to be 17.5% until last month, there will be 2 rows for the applicable VAT account. See Chapter 27 starting at page 27 for further discussion of how taxes work in LedgerSMB and the choices involved when being required to handle changes in tax rates.

Each row lists the following fields:

- Rate (%)

-

The tax rate to be applied when calculating VAT to be posted on this account.

- Number

-

Account number

- Valid To

-

The ending date of the settings in this row. This can apply to the rate as well as the ordering or the tax rules (but usually applies to the rate).

- Ordering

-

This has to do with cumulative taxes. For example if two taxes exist and one has an ordering of 0 and one of 1, then the second tax will be calculated on a basis that includes the first. One place where this used to be used was in Quebec, where GST was taxable under PST.

- Tax rules

18.4.3 Defaults

Business number

This is used to store an arbitrary identification number for the business. It could be used to store a business license number or anything similar.

Weight unit

The unit of measurement for weights. @@@ why don’t we have a unit of measurement for distance as well??? And maybe a unit of measurement for content?

Separation of duties

Separation of duties is a method to help reduce fraud where one employee can’t modify the accounting ledger without another employee’s approval.

Select ”Yes” if you want to activate separation of duties or ”No” if you don’t want to activate it.

In order for separation of duties to be enforced, user roles have to be set differently for each user. This is done by removing the draft_post role from the users that cannot post and making sure that the users that can post have the role enabled. See Section 24.3 on page 24.3 for more details about changing and setting User Roles.

Default accounts

This setting will be used to preselect an account in the listings of the three categories listed below:

-

•

Inventory

-

•

Income

-

•

Expense

Foreign exchange gain and loss accounts

When working with foreign currencies, the system needs two special purpose accounts. One to post the gains onto which are caused by foreign currencies increasing in value; the other to post the losses onto which are caused by foreign currencies decreasing in value.

Default country

This setting indicates which country needs to be pre-selected in country selection lists.

Default language

The language to be used when no other language has been selected. Several parts of the application require language selection, such as customer, vendor and employee entry screens.

Templates directory

This setting indicates which set of templates - stored in the templates/ directory - should be used. In a standard installation, the drop down lists two items:

- demo

-

which contains templates based on LATEX, which is more commonly installed but has issues dealing with accented characters

List of currencies & default currency

Enter a list of all currencies you want to use in your company, identified by their 3-letter codes separated by a colon; i.e. “USD:EUR:CHF”. To ensure correct operation of the application, at least one currency (the company default currency) must be listed. In case of multiple currencies the first is used as the company default currency.

Company data (name /address)

The fields “Company Name”, “Company Address”, “Company Phone” and “Company Fax” will be used on printed/e-mailed invoices.

Password duration

This is an integer value field measuring the validity period in days for passwords set through the user’s Preferences screen. If this field is empty, passwords set through that method won’t expire.

A user will receive password expiration reminders upon logging starting a week before password expiry. When not acted upon, starting two days before expiry an hourly popup will appear requesting the user to change the password.

The application behaves this way because users with expired passwords won’t be able to log in: their password will need to be reset by a user admin.

Note that passwords set by admins for other users expire within 24 hours after setting them. This value is hard coded and can’t be overruled. This is a security measure taken to make sure as few unused accounts as possible exist: Existence of such accounts could open up security holes.

Default E-mail addresses

These addresses will be used to send e-mails from the system. Note that the “Default Email From” address should be configured in order to make sure e-mail doesn’t look like it’s coming from your webserver. The format to be used is ‘‘Name’’ <e-mail address> where the e-mail address should be inserted between the “” and “”.

Max per dropdown

Some elements in the screens may present a drop down. However, drop downs are relatively unwieldy to work with when used to present a large number of values to choose from.

This configuration option sets an upper limit on the number of records to be presented as drop down. When the number is exceeded, no drop down is used. Instead, a multi-step selection procedure will be used.

Item numbering

Many items in the system have sequence numbers: invoices, parts, etc. These can be just a number (i.e. 1 or 37) or they can also be both prefixed and suffixed. For example, INV0001 for invoices and EMP001 for employees or YOU-0001TOO, in which case the next item will be YOU-0002TOO.

You can only issue every number in the sequence once, but you can issue Y21-001 and Y22-001 by changing the sequence number format at the beginning of the year.

The numbers shown in the input boxes will be used to generate the next number in the numbering sequence.

- GL Reference number

-

The default reference number for the next GL transaction.

- Sales invoice/ AR Transaction number

-

This number is used to generate an invoice number when none is being filled out by the user.

- Sales order number

-

Same as Sales invoice number, except that it’s used for sales orders @@@ layout issue: the label is too big to fit on the page

- Vendor invoice/ AP Transaction number

-

Same as Sales invoice, except that the number is used for accounts payable transactions. @@@ layout issue: the label is too big to fit on the page

- Sales quotation number

-

Same as sales order number, except that it’s used for quotations.

- RFQ number

-

Request for quotation number is like the sales quotation number, except that it is used to track which vendors have been asked for quotes.

- Part number

-

All parts, services and assemblies are identified by a unique number. When an item is created and no number is entered by the user, a number is generated from this sequence.

- Job/project number

-

Used when creating new projects.

- Employee number

-

Same as the sales invoice number, used by new employee entry.

- Customer number

-

@@@ is this the control code number? or is this meta_number?? – Meta-number (CT)

- Vendor number

-

@@@ same question as customer number

Check prefix

The prefix to use when printing checks. There’s no check sequence number. That sequence number is requested from the check printing interface, because checks can be created outside the application as well, meaning the numbers can get out of sync.

18.4.4 Year end

@@@ Rename “Yearend” in menu interface to “Year end”.

@@@ IMO this section doesn’t belong here, because it’s a process, not config, but does it belong in this menu then? IMO it doesn’t…

18.4.5 Admin users

@@@ Same as Year end; doesn’t belong here…

18.4.6 Chart of accounts

@@@ Chart of accounts isn’t exactly a “process”, but it doesn’t feel like being pure config either. At any rate it’s a fact that the CoA discussion is a full chapter in and of itself - so discussion here isn’t necessary anymore.

18.4.7 Warehouses

Warehouses are stocking locations. They don’t have any properties (in the system) other than that they have a name. Warehouses can be added, modified and deleted from the System Warehouses menu item.

18.4.8 Departments

Departments can be used to divide a company in smaller pieces. LedgerSMB distinguishes two types of departments:

- Profit centers

-

which can be associated with any type of transaction, including AR transactions.

- Cost centers

-

which can be associated with all types of transactions, except AR transactions.

Departments can be created (added), modified or deleted through the System Departments menu item.

18.4.9 Type of business

Types of business are used in sales operations where customers can be assigned a type of business. Based on the type of business assignment, quotations, sales orders and invoices will automatically apply discount rates. For each type of business you enter a description and a discount rate to be applied.

18.4.10 Languages

The language table is the table users can select languages from, both to present the UI of the application as well as the setting for customers to be used to generate documents.

This listing should correspond to the actual translations of the application being available in the program installation directory.

Languages can be added, modified or deleted through the System Language menu item.

18.4.11 Standard Industry Code (SIC)

SI codes feature these three fields:

- Code

- Heading

- Description

When creating a company you can assign that it an SIC code, irrespective of its role (i.e. customer, vendor, lead or anything else). An example of an SI code system is the US’s NAICS11 1 https://www.census.gov/naics/ code. Other countries have their own coding systems such as ANZSIC22 2 https://www.abs.gov.au/statistics/classifications/australian-and-new-zealand-standard-industrial-classification-anzsic/latest-release for Australia and New Zealand and NACE33 3 https://ec.europa.eu/competition/mergers/cases/index/nace_all.html for Europe

The SIC field currently doesn’t support a specific function in the application and is there merely for informational purposes. However in the future its role could be extended to include impact on reports, taxes or other functionalities where type of industry could matter.

18.4.12 Templates

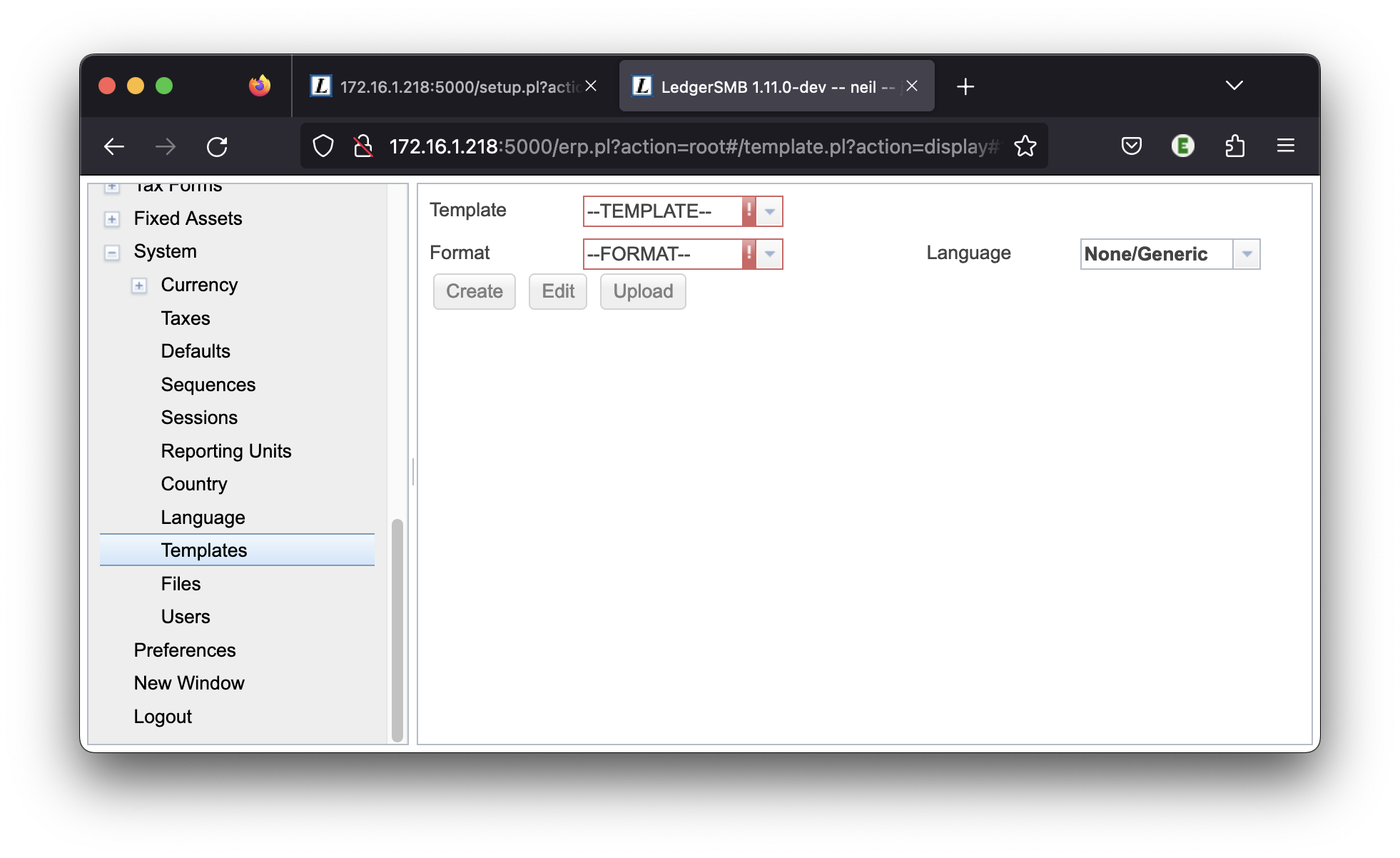

Templates are available to control the output format of many LedgerSMB outputs including Balance Sheet, Sales Orders, etc.

There are 3 types of templates: LATEX, HTML, and CSV. Templates are accessed by navigating to System Templates. You should see the view shown in Figure 18.1 on page 18.1.

The template you want to change is selected in the ”Template” drop-down. The template format you want to change is selected in the ”Format” drop-down.

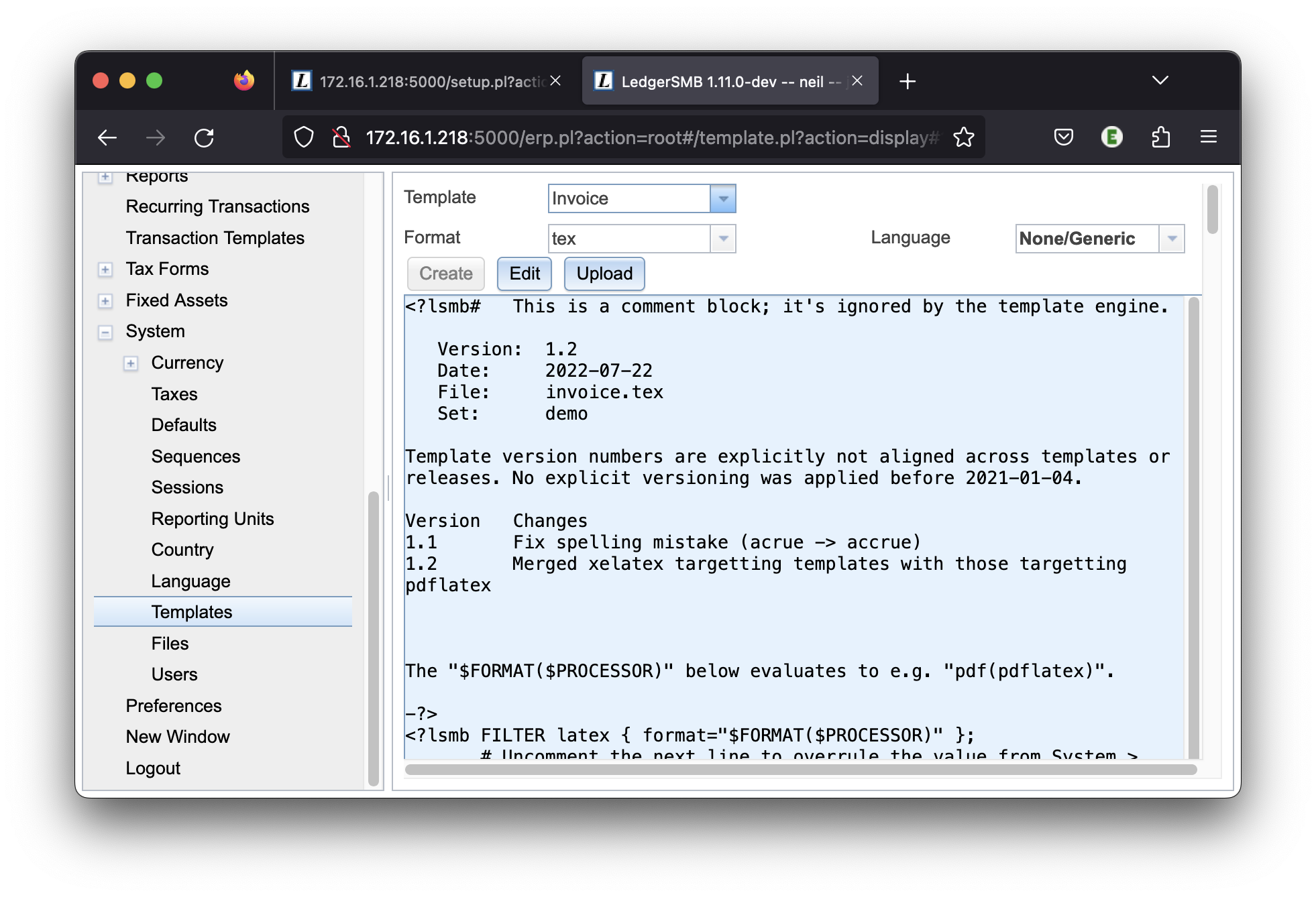

LATEX templates

To change a LATEX template navigate to System Templates. Select, for example, Template ”Invoice” and Format ”tex”, you should see the view shown in Figure 18.2 on page 18.2

To add a file to the latex template, first upload the image file to the database. This can be accomplished by navigating to System Files.

To include this graphic file in your LATEX document, it needs to be retrieved from the database and temporarily stored in a location accessible to the PDF generator. Once the file is in the database, then the function dbfile_path handles that.

For example, If the graphic file is named ”FL_Logo_icon_250x250.png”, then add something like the following to the LATEX template using the Edit button.

\parbox[b]{.1\textwidth}{%

\includegraphics[scale=0.7]{%

<?lsmb dbfile_path("FL_Logo_icon_250x250.png")?>}

}

After editing the template must be uploaded to the database using the Upload button.

HTML templates

@@@TODO Add HTML specific template info.

CSV templates

@@@TODO Add CSV specific template information here.

Part IV Administration

Chapter 19 Overview

19.1 Introduction

This part of the book describes the tasks and processes that may need to be carried out on a regular basis in order to keep the application in good health and in line with requirements from end users.

Maintenance may require different types of system access for different types of tasks:

-

1.