27.2 Tax account configuration

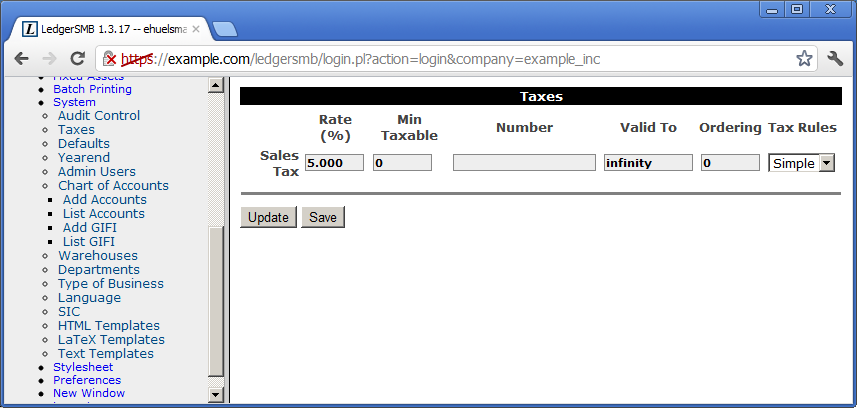

The screen (shown in Figure 27.1 on page 27.1) presents a table with the full history of the percentage rates, their dates of applicability and the tax accounts they apply to. An account can show up any number of times, with different Valid To dates.

- Account name

-

The first column; not an input field

- Rate (%)

-

The rate to be applied to the sales amount

- Min Taxable

-

The minimum amount for which the tax is applicable

- Number

-

The tax reporting number to be used for this tax

- Valid To

-

Date until which the tax rate is applicable

- Ordering

-

The meaning of this field is described below

- Tax Rules

To determine which line is applicable at any time, order the lines by their validity date and select the first one for which the validity date is later than the date being checked for. E.g. if you have two lines - one with a Valid To date of 2010-01-01 and one with a Valid To date of “infinity” - the 2010 line would be selected when checking for a date in 2009 while the “infinity” line would be selected for any date later than Jan 1st, 2010. This facilitates advance entry of a new tax rate in case of a rate change if a tax rate changes: the new rate will automatically be selected beyond the validity date of the old rate.

The order field is used to layer taxes, e.g. Canada where the province of Quebec taxes the taxes collected by the national authority, which works like this numerically: National tax with order 0 and rate 10% and Quebec tax with order 1 and rate 5% applied to a 10$ amount charges 1$ of national tax and 0.55$ of Quebec tax (5% of 11$).

Note that - as pointed out in the Overview section of this chapter - the customer related tax calculation on invoices is triggered by the settings in this chapter as well as the customer/vendor settings described in Section 34.2 on page 34.2 and part settings and service settings described in Section 25.1.1 on page 25.1.1 and Section 25.2.1 on page 25.2.1 respectively.