Running your business with

LedgerSMB 1.3

DRAFT / WORK IN PROGRESS

Contents:

- Preface

- I Overview

-

II Getting started

- 4 Overview

- 5 Creating a company

- 6 The first login

- 7 Building up stock

- 8 Ramping up to the first sale

- 9 Shipping sales

- 10 Invoicing

- 11 Collecting sales invoice payments

- 12 Paying vendor invoices

- 13 Monitoring arrears

- 14 Branching out: services

- 15 Branching out II: service subscriptions

- III Configuration

- IV Administration

-

V Workflows

- 28 Overview

- 29 Customers and vendors

- 30 Quotations from Vendors and for Customers

- 31 Sales and vendor orders

- 32 Inventory management

- 33 Sales and vendor invoice handling

- 34 Shop sales

- 35 Manufacturing management

- 36 Managing accounts receivable and payable

- 37 Credit risk management

- 38 Receipts and payment processing

- 39 Accounting

- VI Customization

- VII Appendices

- A Differences between version 1.2 and 1.3

- B Why deleting invoices is not supported

- C Migration

- D Listing of application roles

- E Open source explained

- F Glossaries

- G Copyright and license

List of Figures:

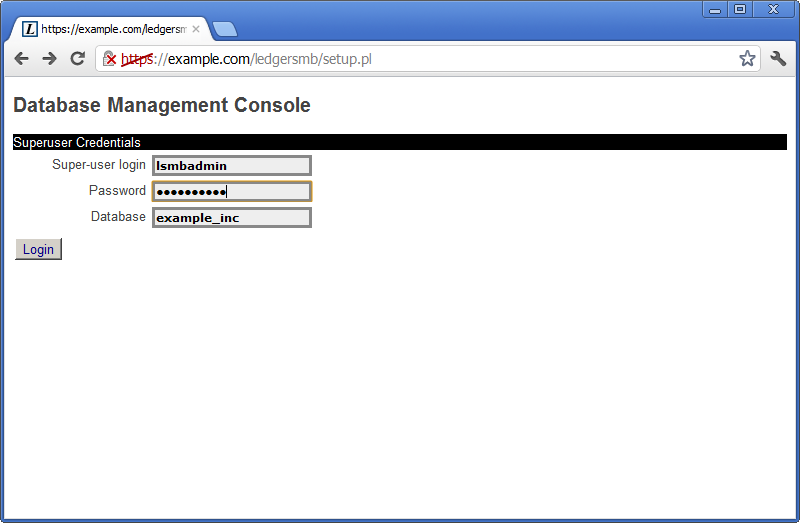

- 5.1 setup.pl login screen

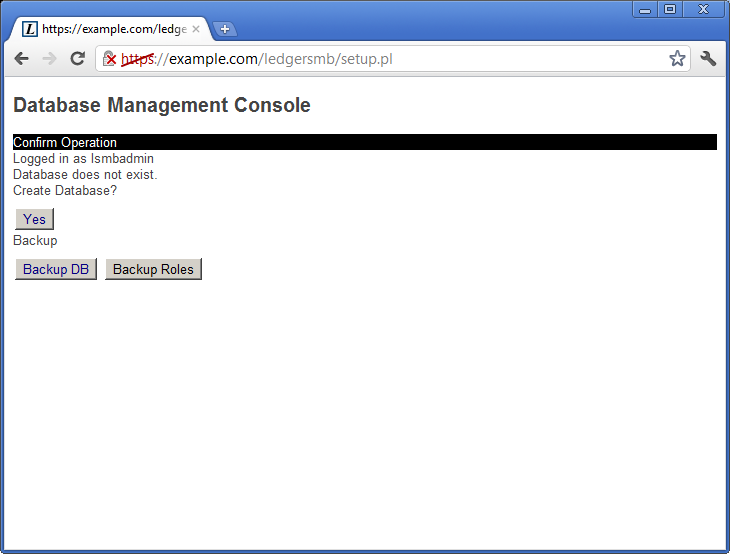

- 5.2 setup.pl company creation screen

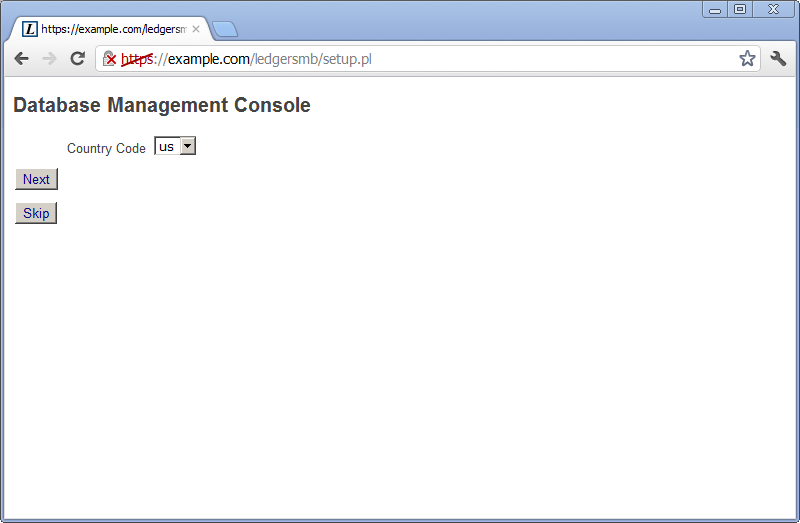

- 5.3 Chart of accounts - Country selection

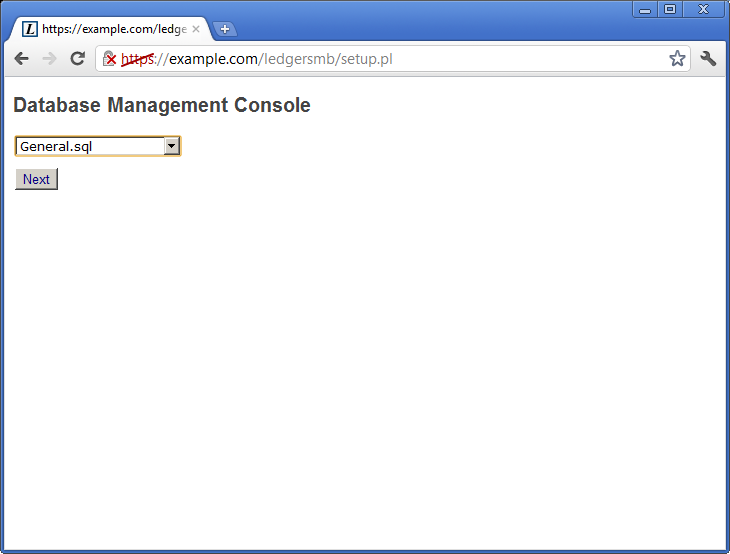

- 5.4 Chart of accounts - Chart selection

- 5.5 setup.pl initial user creation screen

- 5.6 setup.pl successful completion screen

- 6.1 login.pl opening screen

- 6.2 First login password selection

- 6.3 Bank account setup - menu items

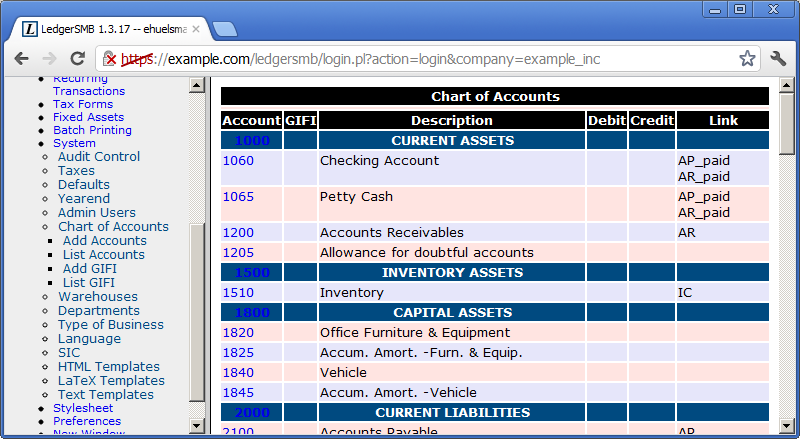

- 6.4 Bank account setup - account setup screen

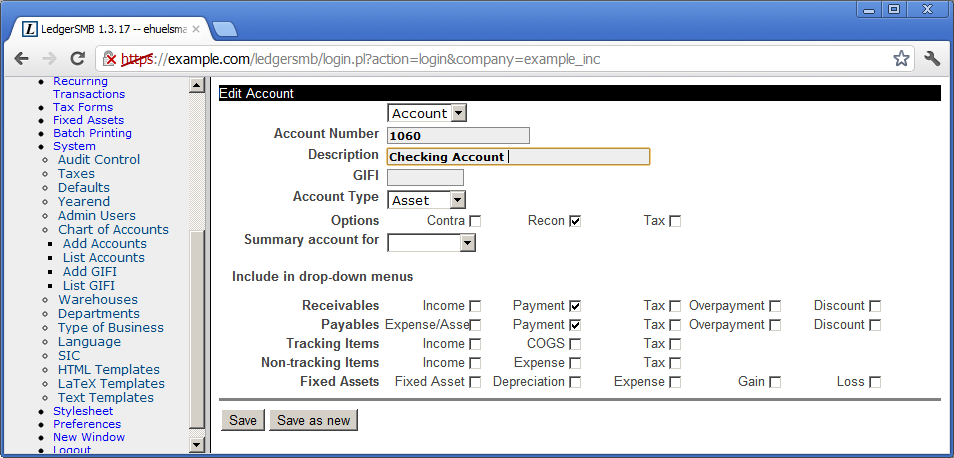

- 6.5 Tax rate adjustment screen

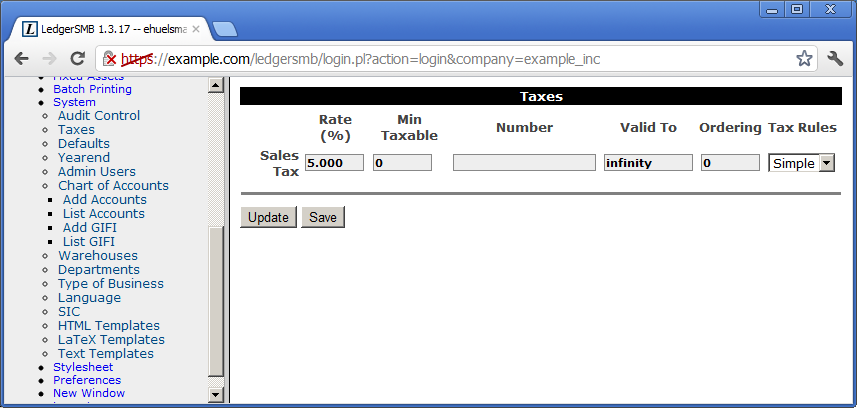

- 7.1 Company entry screen

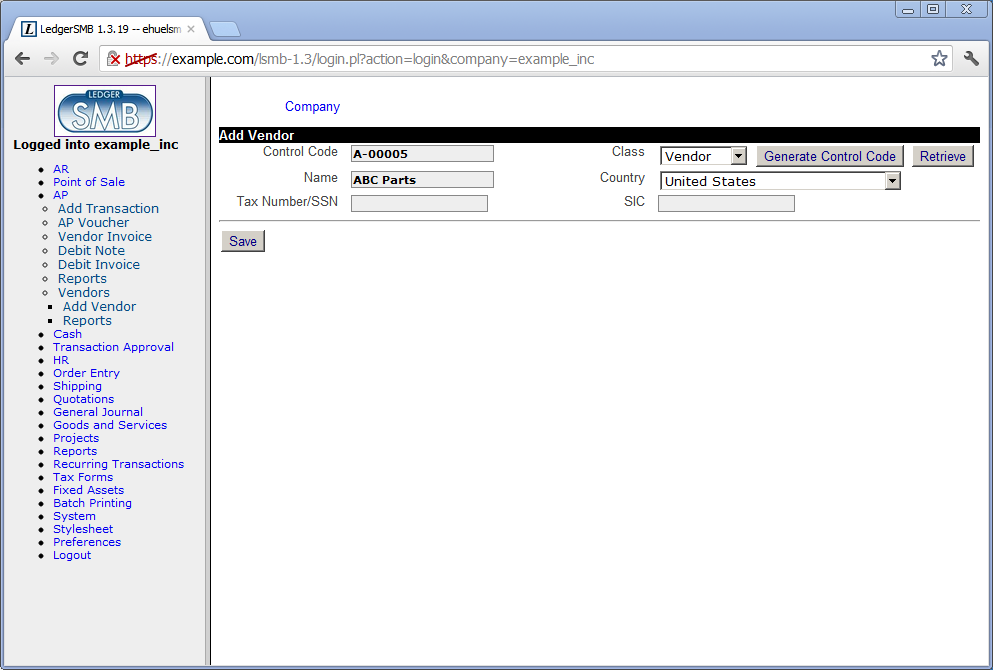

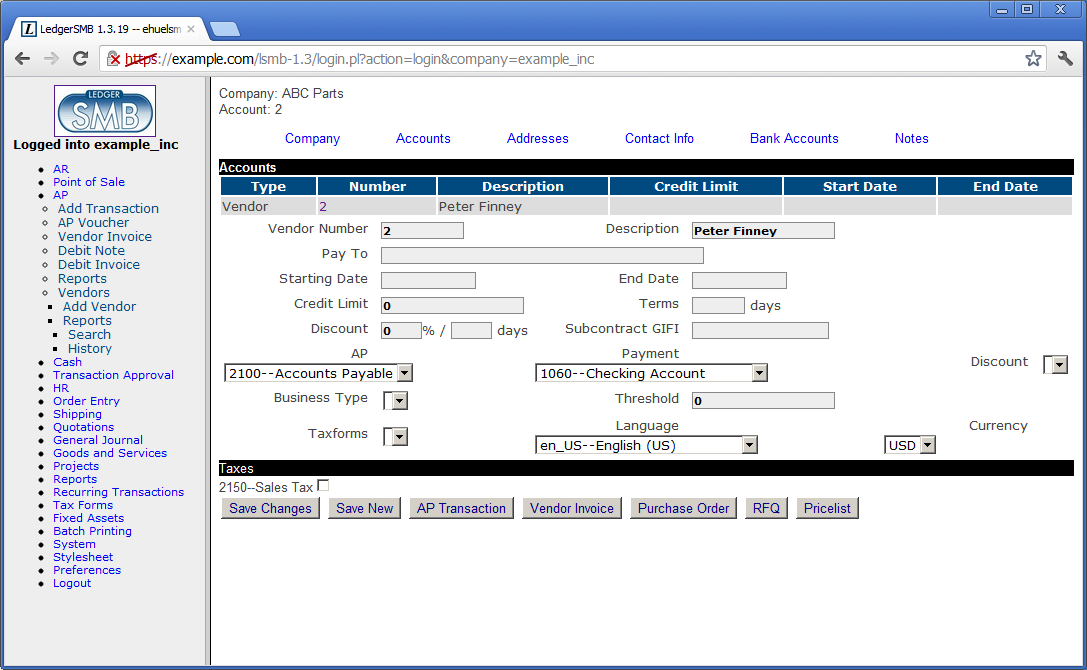

- 7.2 Vendor account screen

- 7.3 Vendor account screen - with purchase discount account

- 7.4 RFQ entry screen

- 7.5 RFQ e-mail screen

- 7.6 RFQ entry screen

- 7.7 Order receipt entry screen

- 20.1 Screen for user creation - step 1

- 20.2 Screen for user creation - step 2

- 20.3 User preferences screen

- 23.1 Tax account configuration screen

- 30.1 RFQ entry screen

- 32.1 Saved purchase order

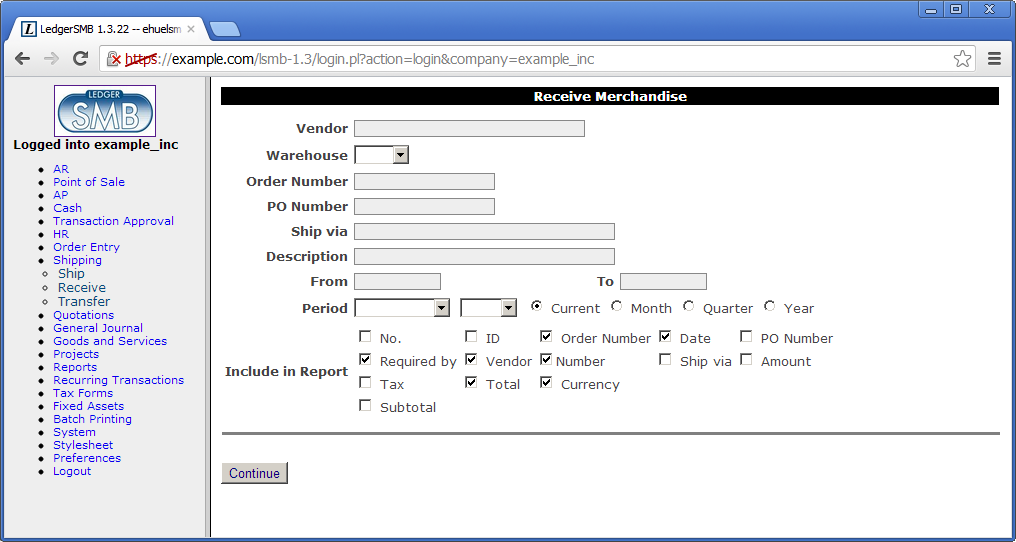

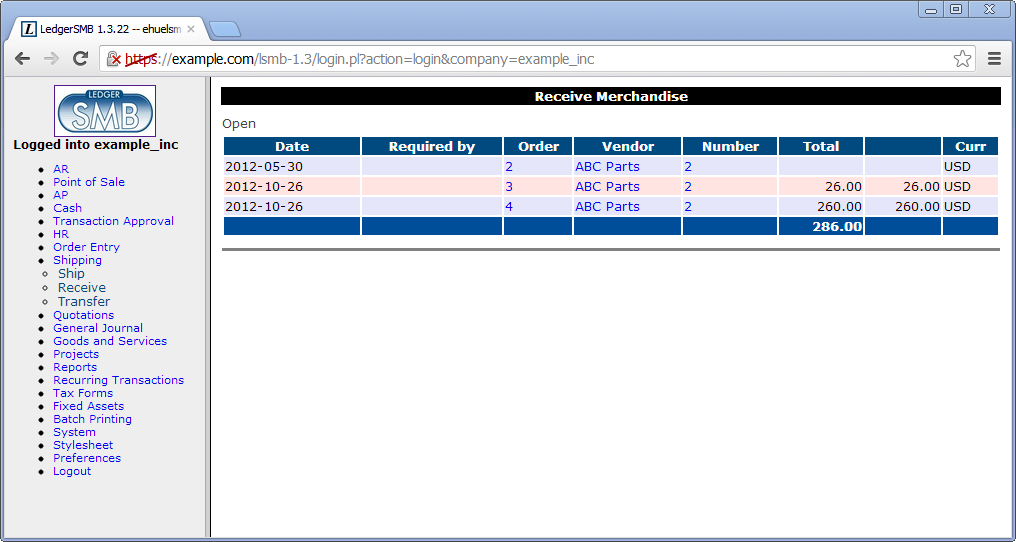

- 32.2 Search screen for purchase order item receipts

- 32.3 Search results screen for purchase order item receipts

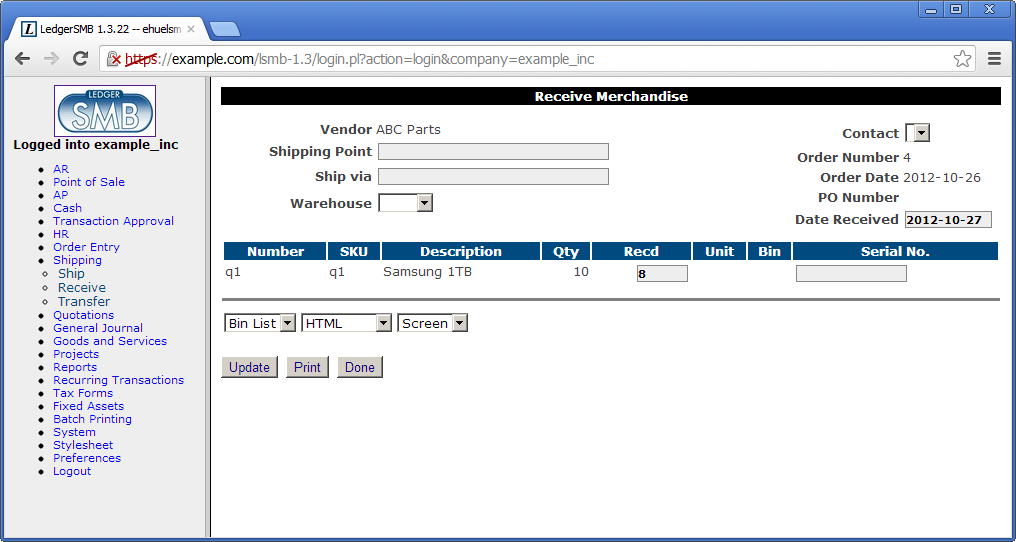

- 32.4 Purchase order receipt screen

List of Tables:

- 6.4.2 Technical accounts identified by Links

- 6.4.2 Technical accounts identified by Links

- Item numbering

Preface

Intended audience

The book has been split up in several parts intended for starting entrepreneurs, (potential) users, application integration developers and administrators, it offers something for everybody who works with or considers working with LedgerSMB.

Organization of the book

The first part (’Overview’) is intended for everybody who tries to get an impression of LedgerSMB, with chapters on technology, features, licensing and a bit of project history.

The second part (’Getting started’) leads new users and especially new entrepreneurs step by step through the application. This part also contains additional explanations on good business and accounting process.

The third part (’Configuration’) describes system wide configuration settings such as the LedgerSMB configuration file and those required for dependencies like PostgreSQL. Additionally it describes the company specific settings within the application, such as audit control settings and required special accounts. This part is required material for anybody who wants to set up a LedgerSMB instance.

The fourth part (’Administration’) discusses the different topics regarding application administration such as user management, product definition, taxes and etc. Anybody responsible for maintaining application instances in good health should read this part.

The fifth part discusses work flows; LedgerSMB best practices, so to say. This part is highly advised reading for everybody who is a LedgerSMB user and should be considered required reading for ’business architects’: those in the company who decide about process design and execution.

The sixth part discusses how to customize the application. This part is intended for developers of custom extensions (such as company specific integrations), add-ons and plug-ins.

The last part, the appendices, contain information on various subjects, such as a listing and description of the authorization roles in the application as well as information on migration to or upgrading of LedgerSMB versions.

Comments and questions

The sources of this book are being developed in the ledgersmb-book Google Code project at https://code.google.com/p/ledgersmb-book/. Comments and enhancement ideas can be filed in the ticket tracker of the project. Additionally, discussion about the content of the book can be organized on the IRC freenode.net channel #ledgersmb or the ledger-smb-devel for which you can subscribe at https://lists.sourceforge.net/lists/listinfo/ledger-smb-devel.

Acknowledgements

Håvard Sørli for his efforts to help out develop the book outline.

Part I Overview

Chapter 1 What is LedgerSMB

1.1 Introduction

LedgerSMB is an open source, web based ERP system. An ERP is a system which supports business processes of all disciplines throughout the organization, automating as much of those processes as possible. To illustrate this, consider the process of selling goods to a customer in a trade company. Typically, a customer will request a quote, which Sales will provide. When satisfied he or she will convert the quote to an order. Sales will register the order, leading to order-pickers to collect one or more shipments. Upon completion, Finance sends out an invoice and records the customer’s payment. LedgerSMB supports this process by automating the conversion from quotation to order, order to shipment and shipment to invoice, as well as providing pack lists and other production related documents.

LedgerSMB includes a powerful framework which supports building your own extensions and integrations with other applications. Through this philosophy, it aspires to be the (open source) integrated administration system.

The software is being developed by the LedgerSMB project with its homepage at http://ledgersmb.org/. However, the actual project activity can be witnessed at the SourceForge project site hosted at http://sf.net/projects/ledger-smb/ and the mailing list archive hosted at http://archive.ledgersmb.org/. The project employs the Freenode.net IRC network’s #ledgersmb chat channel to help out users and to discuss development.

Its open source nature allows you to download it and use it with any infrastructure you like. So there’s no vendor lock-in: you can always take your data and set up your system with another hardware vendor or set up your own hardware.

1.2 Application architecture

Due to its heritage from SQL Ledger and the on-going process of rewriting the inherited code, the architecture differs between parts of the application: the old parts and the ones which have already been rewritten.

Overall, the application consists of five layers:

-

•

The web browser

-

•

The web server (as a network traffic handler)

-

•

The web server (as an application - CGI)

-

•

The database (as an application - PL/SQL)

-

•

The database (as storage)

Rewritten parts include the price matrix and the management of customers and vendors as well as batch payments.

The “database as an application” layer is part of the new design, but otherwise both designs share the same basic structure - as any web application.

As part of the new design, database integrity is being enforced much more strictly than before. Much of this enforcement is being done in the database at the “storage” level, by adding constraints to table definitions. Additionally, the new design moves to a model where a large part of the database API as well as business logic is implemented in PL/SQL. The ultimate goal there is to allow easier development of bindings in languages other than Perl. Part of this move is to reduce the CGI layer to become more of a “glue” layer between the web server and the application database layer.

As part of the on-going code restructuring, in 1.4 there will be a REST web service based API for the areas where functionality has been rewritten.

One of the roles that has remained so far for the CGI layer is to generate HTML screens for presentation in the web browser, handling all user interaction. Recently activities have started to change that for 1.4 and 1.5 to create a much heavier client in the web browser with back end interaction through web services.

In the old design everything except storage was handled in the “web server as an application (CGI)” layer.

1.3 Supported functionality

As most ERP systems LedgerSMB’s functionalities are grouped into modules. Many modules are integrated parts of the base application. New features are implemented in separate modules at first to allow evaluation of the feature set. When a feature set has become sufficiently stable, the new module will be integrated in the base application. As of that time, the existing feature set of the module will be frozen, meaning that the utmost will be done to prevent changes to how the modules operate: to keep them stable.

These separate modules - which are called add-ons - have to be installed separately. After installation they become seamless parts of LedgerSMB with no visible difference from the base application. An additional benefit of having the separation between the base application and add-ons is that it allows for different release schedules and separate maturity levels.

LedgerSMB 1.3 features the following integrated modules:

-

•

General ledger

-

•

Payment and Accounts payable

-

•

Invoicing and Accounts receivable

-

•

Fixed asset accounting

-

•

Time registration and invoicing

-

•

Point of Sale

-

•

Quotation and Order management

-

•

Manufacturing

-

•

Inventory (warehousing) and shipping management

-

•

VAT reporting (cash based)

-

•

Controlling

-

–

Project accounting

-

–

Department accounting

-

–

-

•

Application administration

These add-ons can be installed:

-

•

Budgeting

-

•

Enhanced AR and AP support

-

•

VAT reporting (accrual based)

-

•

Enhanced trial-balance report

-

•

Enhanced recurring transactions

-

•

Payroll (to be created - under discussion at the time of writing)

With this list of modules and add-ons LedgerSMB has succesfully been implemented in a wide range of companies of varying types and sizes: shops, manufacturing companies and service oriented businesses up to as big as four thousand (4.000) Accounts payable transactions per week.

1.4 Feature comparison with alternatives

@@@ TODO

Packages to compare to:

-

•

GNUcash

-

•

OSfinancials

-

•

ERP5

-

•

OpenERP

-

•

xTuple

1.5 Release history

The project started out as a fork of SQL-Ledger - the open source ERP system developed by Dieter Simader - somewhere between SQL-Ledger versions 2.6 and 2.8. A fork happens when a group of developers can’t - for whatever reason - continue to work as one group on a project. At that time, the project splits into two or more projects and the fork is in effect.

LedgerSMB split off from the SQL-Ledger project (i.e. forked) because there was disagreement between developers about how to go forward both with respect to handling of security vulnerability reports as well as the general state of the code base.

After the fork, between versions 1.0 and 1.2 a lot of energy was spent on making LedgerSMB more secure (i.e. less vulnerable). In technical terms, measures were taken to fend off (amongst other things):

-

•

Cross site scripting attacks

-

•

Replay attacks

-

•

SQL injection attacks

Come version 1.3 the development directed toward improvement of the overall quality of the code base as the old SQL-Ledger code was in very poor state: looking very much like webscripts as they were written in 1998, the code had grown largely outdated in style and was no longer maintainable by 2007.

The 1.3 effort focussed on bringing relief on that front by introducing modern structure into the application. With the new application structure modern and important features were realized: separation of duties (for the accounting part of the application) and authorizations to allow distinguishing different roles in your company.

Unfortunately, by the beginning of 2011 the project looked mostly dead from an outside perspective: the team had not brought forward any releases since 2007, there were no signs of development activity and the mailing lists (a measure for community activity) were completely silent. SVN commits were continuing, but were being made by ever fewer committers and contributors.

Fortunately development activity was showing again in the first half year of 2011, leading to the release of version 1.3 by September. Between September and the year end in total 10 small bug fixes were released, showing active commitment of the developers to maintain the application.

New committers showed up, indicating revived community interest. Other signs of increased interest are the higher number of bug reports and the creation of the linux package for Debian 7, which has been included in Ubuntu 12.04 as of October 2012.

1.6 System requirements

The INSTALL file which comes with every LedgerSMB software release should be considered the authorative source of system requirements. In summary, the following technical components are required:

-

•

The Apache web server (others may or may not work)

-

•

Perl 5.10 or higher, with additional modules

-

•

PostgreSQL 8.3 or higher, with contribs

-

•

LaTeXor XeLaTeX from the TeTeX or TexLive TeXdistributions

Other system requirements such as required RAM and number of CPUs and their speed largely depend on the expected system activity. However, any modern VPS should provide enough memory and storage to satisfy a reasonable number of users.

1.7 License

LedgerSMB is being made available under the terms of the GNU Public License version 2, or shorter GPLv2 11http://www.opensource.org/licenses/GPL-2.0.

The project attaches this meaning to the license: The copyright holders grant you the right to copy and redistribute the software. In case you make any modifications to the sofware you’re obligated to make public those changes. You are however, free to use the APIs from your own software without being required to publish your own software.

The project considers the following to be APIs:

-

•

Database tables

-

•

URLs with their input and output

-

•

Webservices of any kind

-

•

Function and object calls

The effect of this interpretation is that changes directly to the code base as well as inheritance of classes defined in the software constitute ”making modifications”.

Chapter 2 Reasons to use LedgerSMB

Jack finds several tools which suit his requirements to some extent or another. After evaluation of his options he decides to use LedgerSMB for the following reasons:

-

•

Centralized data storage

-

•

Actively developed

-

•

Development team with security focus

-

•

Access to the application requires only a web browser

-

•

Integrated sales, shipping, invoicing, purchasing and accounting

-

•

Open source solution, so no vendor lock in

-

•

The roadmap appeals to him, because it has web services payrolling on it

-

•

There are multiple vendors offering commercial support, including hosted options

-

•

The developers envision building a platform out of it: creating the building blocks required to build a company on

-

•

Own your own data

-

•

Freedom to change

-

–

Support organization

-

–

Developer (organization)

-

–

Data storage provider

-

–

Application service provider

-

–

2.1 Internal control

Internal control22See also http://en.wikipedia.org/wiki/Internal_control helps organizations to prevent and detect fraud by introducing checks and balances to assess effectiveness and validity of transactions in the organization and thereby in its ERP system and accounting system(s).

2.2 Accounting principles

The accounting guidelines IAS and IFRS describe requirements to financial statements (reports) and the underlying accounting process 33See also http://en.wikipedia.org/wiki/International_Financial_Reporting_Standards. Said requirements include qualitative characteristics:

-

1.

Relevance

-

2.

Faithful representation

-

3.

Comparability

-

4.

Verifiability

-

5.

Timeliness

-

6.

Understandability

While some - if not most - of these characteristics relate to the process of accounting, the “Verifiability” item clearly has an impact on the underlaying accounting systems: In order to be verifiable, there must be a clear audit trail to show the origin of the figures. To make sure users leave behind the required audit trail, some actions can’t be performed in LedgerSMB, even though it would seem to be a logical requirement to be able to do so - from the perspective of a non-accountant.

2.3 Impact of tight integration

While both the qualitative characteristics from IFRS and the checks and balances from the internal controls are pose restrictions on the accounting process, sometimes these restrictions require support from the underlying accounting software.

One example is the support for creating reliable audit trails by protecting accounting data from deletion. It’s important to realize the scope of accounting data in this respect: because invoices are being registered in the accounts receivable administration - which is summarized in the general ledger - they are part of the data for which the audit trail needs to be recorded.

Another example is separation of duties (also known as the “four eye principle”), where one accountant enters financial transactions and another is responsible for posting them. This procedure protects the company from an accountant single-handedly faking transactions and possibly masking fraud.

The requirements for good accounting processes and internal control have impact on the work flows supported by LedgerSMB. As a consequence some of the work flows described in part V may seem unwieldy; an example being the lack of functionality to delete or correct incorrect invoices (See Section 33.5 on page 33.5 for more details).

Chapter 3 Introduction to accounting

3.1 Valuation of inventory

Part II Getting started

Chapter 4 Overview

4.1 Introduction

This part of the book will run the reader through the LedgerSMB using an example startup company run by Jack: Example Inc, which starts its life as a computer parts store for the business to business market.

Jack just completed incorporation of Example and is ready to start doing business. Before starting his operation Jack was looking for tooling to run his operation efficiently. To that extent he’ll be running LedgerSMB using the domain he acquired for his business: http://example.com/.

The other chapters in this part of the book show you what steps Jack has to go through to get LedgerSMB up and running for Example, as well as the steps he has to take to keep LedgerSMB in good health.

Due to its success Example will grow, posing new challenges to LedgerSMB and we’ll show you how Jack can change the configuration to adapt to his growing business’s needs.

Jack chooses to use a hosted LedgerSMB, so he doesn’t need to concern himself with the technical details of getting the application up and running. Instead he can start by setting up the company database immediately.

In Chapter 5 starting at page 5 and Chapter 6 starting at page 6 Jack goes through the steps of setting up a basic company. The chapters after that may not apply to every business. Chapter 7 starting at page 7, Chapter 8 starting at page 8 and Chapter 9 starting at page 9 apply to businesses dealing with physical goods: buying, selling and shipping. Chapter 33 starting at page 33 discusses how to handle invoicing from LedgerSMB. Chapter 11 starting at page 11, Chapter 12 starting at page 12 and Chapter 13 starting at page 13 discuss how to manage accounts receivable and payable including arrears monitoring.

Not all chapters may be relevant to the reader, e.g. when he or she is starting up or running a services company in which case the chapter “Building up stock” doesn’t apply. Chapters can be skipped based on relevance both to the type of business and its growth phase.

@@@ more chapters??

Chapter 5 Creating a company

5.1 Using setup.pl

LedgerSMB comes with a tool called ’setup.pl’. It’s the beginning of a web-based database administration interface to LedgerSMB. This tool can be used to create company databases as well as backups of existing ones. There’s also a command line based Unix-only setup tool - this tool is covered in the next section.

Please note that while executing the steps described in this section, it may take a while for the next screen to appear after clicking on each button: Some buttons involve a large amount of processing on the server before the next screen can be presented.

5.1.1 Step 1: setup.pl login

Jack installed LedgerSMB using the default installation instructions, which means that the url for his setup.pl is https://example.com/ledgersmb/setup.pl. Figure 5.1 on page 5.1 shows the login screen for the tool.

Please note that you can’t be logged into the administration tool (setup.pl) and the webapp through the same browser at the same time in this version of LedgerSMB - due to technicalities.

The login screen shows three fields: (a) a user, (b) a password and (c) a database name.

The user name you use to log in needs to be a PostgreSQL super user: a user you can use to log into the database using the “psql” command as well.

The password must be the same as the one used to log in from the command line using the “psql” tool or the password you used upon creation using the “createdb” tool. Both “psql” and “createdb” are PostgreSQL tools (not LedgerSMB tools).

The third field is the name of the database to be created, which is the same as the name of the company to be logged into later on through the login page shown in Figure 6.1 on page 6.1. The next paragraph discusses this field and its meaning more in-depth.

5.1.2 Step 2: Company creation

When creating a company database, there are a few things that are of importance:

-

•

The name of the database is the same as the name used at login time and hence will be used by all users - a choice of a suitable, recognizable value is important

-

•

The name of the database entered (and hence the company name) is case-sensitive

-

•

The name can’t be more than 63 characters long

After choosing “example_inc” as his company name, Jack clicks the Login button at which time the screen from Figure 5.2 on page 5.2 shows up. The screen says the database doesn’t yet exist and offers its creation. The backup buttons being offered are not useful at this stage - they have value if the database exists and setup.pl is being used to upgrade the database; one of its other functionalities.

Jack clicks “Yes” to create the database and load it with LedgerSMB’s database schema, authorization rules and stored procedures44Parts of the program inside the database.. It may take a while (30 seconds or more) for the next screen to appear55Note that during the creation of the database, logs are kept so that if there are errors these can be reviewed either by the person installing the software or by support personnel. On Linux/Unix systems these are stored, by default, in /tmp/ledgersmb/ and named dblog, dblog_stderr and dblog_stdout..

5.1.3 Step 3: Selection of a Chart of Accounts

LedgerSMB comes with numerous predefined charts of accounts. These have been grouped per country making the selection of a chart a two-step procedure. setup.pl allows for users wanting to define their own charts by offering a “Skip” button. This button skips the process of loading a chart.

Note that you need to define a chart of accounts before you can meaningfully do anything inside LedgerSMB. If you don’t load a pre-defined one you’ll need to create or import your own later.

Figure 5.3 on page 5.3 shows the first screen in the chart of accounts selection procedure. In this screen you select the country for which you want to use the chart of accounts. Note that charts of accounts are highly country dependent and you may want to consult an accountant if no default chart of accounts is included for your country.

As Jack runs his company in the US, that’s what he selects.

Figure 5.4 on page 5.4 shows the second screen in the chart of accounts selection procedure. The drop down contains a list of all charts of accounts defined for the selected country.

Jack selects the General.sql chart of accounts: that will leave him enough room to specialize the setup later if he has to, but for the time being offers a broadly useable setup.

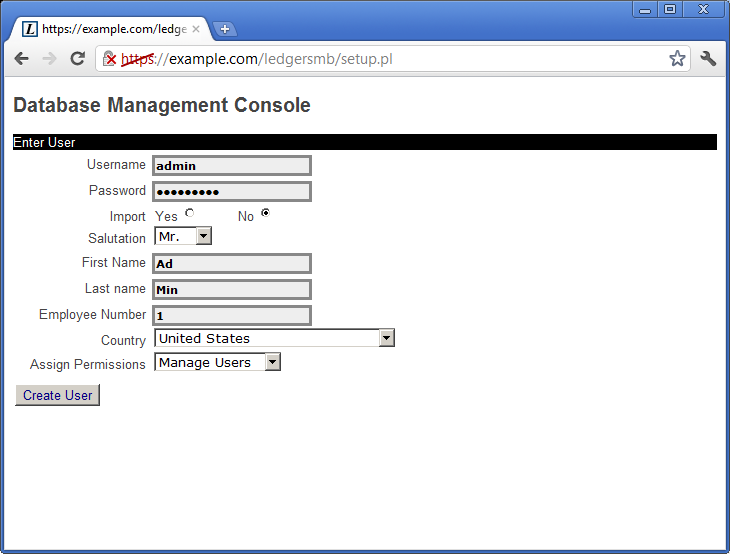

5.1.4 Step 4: Initial user

In the last paragraph the technical part of the company creation procedure was completed. However, it’s not possible to log in to the company yet. This paragraph describes how to create a first user. Figure 5.5 on page 5.5 shows the user creation screen. The fields in this screen have the same meaning as those discussed as part of user management in Section 20.2 on page 20.2.

Jack chooses to create an administrative user called admin who will be authorized to do everything in the application. Later on he will also create a user jack who will be authorized to do everything but changing the configuration and doing application administration. He’ll use the latter user to log in for day to day operations. This will help him prevent changing things by accident.

Note that none of the fields in this screen are optional. If the name of the user being created isn’t already used with other companies, leave the Import option set to No, otherwise please read the chapter on user creation mentioned above.

Note: The password you enter here is a temporary one which will remain in effect for 24 hours only. Be sure to execute the steps in Section 6.2 on page 6.2 before these 24 hours elapse, because the user will be disabled after that.

The setup.pl program offers the user to be created to be one of two types:

-

•

Manage Users

-

•

All Permissions

Jack’s choice for a fully authorized admin user leads him to select the All permissions option.

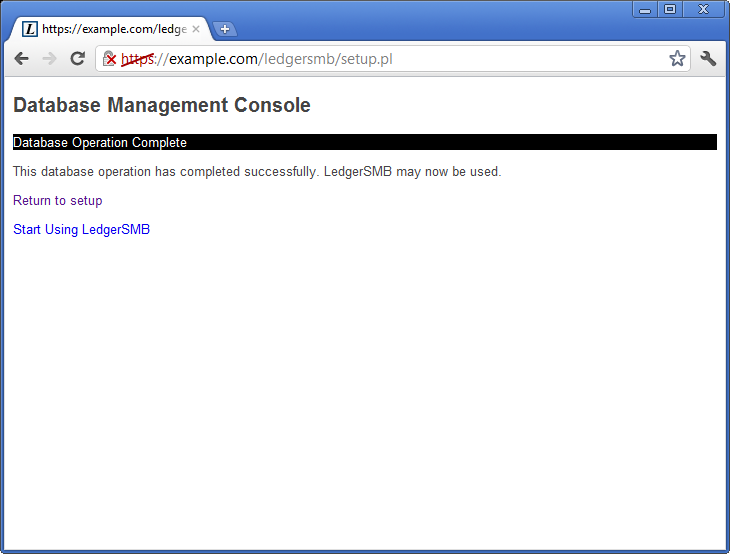

Jack succeeded to correctly create his company database. His story continues in the next chapter “The first login”.

5.2 Using prepare-company-database.sh

To be done.

Chapter 6 The first login

6.1 Introduction

After the company has been created by executing the procedure described in the last chapter it is still an empty shell which needs to be populated. The correct data needs to be entered for things like bank accounts and company contact data to be used on invoices.

These steps have to be completed before LedgerSMB can be used meaningfully: these settings have to be present for many workflows. A major reason is that with LedgerSMB - as most ERP systems - financial consequences of events in many workflows are directly reflected in the company’s books. Some accounting related settings have to be completed before LedgerSMB can do so.

6.2 Steps to the first login

After Jack finishes the last chapter, he clicks the Start using LedgerSMB link shown in Figure 5.6 on page 5.6.

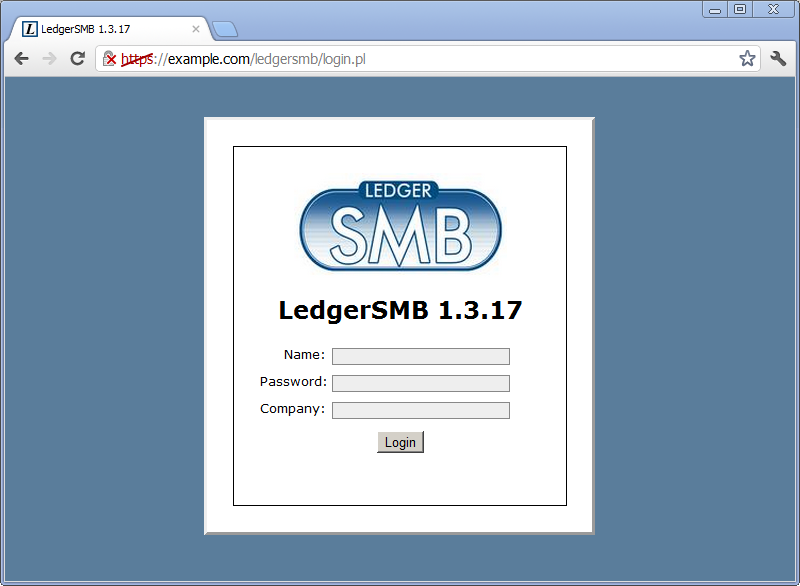

6.2.1 Login screen

The login screen shows three fields which need to be filled out as follows:

- Name

-

The user name created during database setup; Jack uses admin

- Password

-

The password - in this case for Jack’s admin user

- Company

-

The name of the database created; Jack uses example_inc

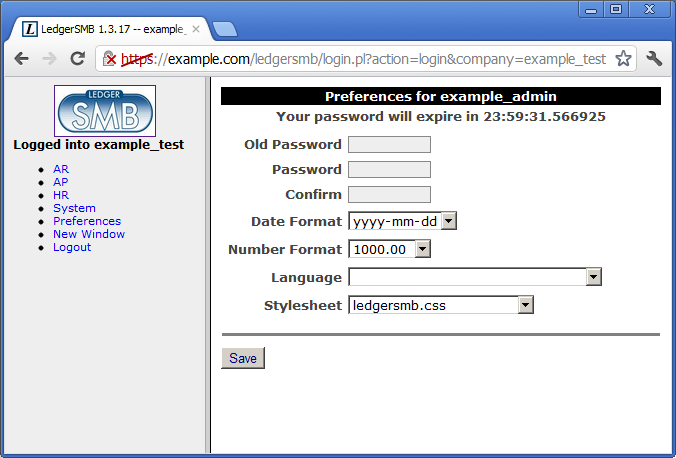

6.2.2 Selecting a password

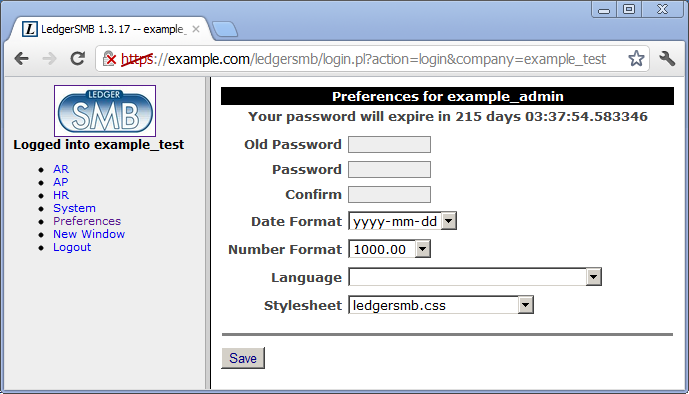

After successful login, the system shows the user preferences screen as depicted in Figure 6.2 on page 6.2 to facilitate the required password change. The initial password has a 24-hour validity limit to prevent unused user accounts from posing a security risk.

The password Jack chooses may be either the same as the one he used before. Not clicking the Save button means the password remains unchanged and the 24-hour limit remains in effect.

The new password has a validity of determined by the Password Duration setting

from the System ![]() Defaults screen. User management is discussed is detail in Chapter 20 starting at page 20.

Defaults screen. User management is discussed is detail in Chapter 20 starting at page 20.

The password reset dialog won’t show on subsequent logins until one week before expiry. Login will be denied to users with expired passwords; they can request password resets through user admins.

6.3 Setting up a bank account or credit card

As part of the start up activities of his company, Jack comes to an agreement with the bank for three products:

-

•

A current account with number “C54769”

-

•

Deposit account with number “D54990”

-

•

Credit card with a number ending with “.7734”

Most accounting systems - LedgerSMB included - use separate GL accounts to represent each bank account. This allows easy reconciliation of the ending balance on the bank account with the balance in the books.

Knowing this, Jack looks up the example bank account from his preconfigured US chart of

accounts using the System ![]() Chart of Accounts

Chart of Accounts ![]() List Accounts menu as

shown in Figure 6.3 on page 6.3.

List Accounts menu as

shown in Figure 6.3 on page 6.3.

-

1.

Renames the original account 1060 “Checking account” into “Checking account C54769”

-

2.

Click “Save”

-

3.

Open the 1060 account again

-

4.

Change the number to 1061

-

5.

Change the description to “Cash deposit account D54990”

-

6.

Click “Save as”

Then Jack repeats the steps 3 to 6 for the credit card with the account number 1062 and description “Credit card xxxx.xxxx.7734” to set up the credit card. Figure 6.4 on page 6.4 shows the screen in which to enter the account details. Section 22.2.1 on page 22.2.1 discusses the options in detail - for now using the settings as configured for the sample checking account will do.

6.4 Checking and adjusting the chart of accounts

First and foremost the chart of accounts serves to register income, expenses, assets and liabilities in categories which support financial decision making or regulatory requirements. When checking his chart of accounts, this is the first thing Jack checks for.

Many business events in LedgerSMB trigger the creation of financial transactions. If the configuration required for these transactions to be created isn’t in place, users won’t be able to complete their workflows.

6.4.1 Accounts list

Jack wants to make sure his chart of accounts fits his purposes. To perform these

checks Jack goes into the System ![]() Chart of Accounts

Chart of Accounts ![]() List Accounts page. For now, he finds

the ledger to be in order. Although the single Sales account stands out a bit against

the numerous expense accounts, it turns out that there is also a single Purchases

account on which all the expenses for parts purchases are going to be booked.

List Accounts page. For now, he finds

the ledger to be in order. Although the single Sales account stands out a bit against

the numerous expense accounts, it turns out that there is also a single Purchases

account on which all the expenses for parts purchases are going to be booked.

6.4.2 Technical accounts identified by Links

For LedgerSMB to operate correctly, a number of accounts have to be configured for their specific purpose. He continues on the same screen as the previous section. His checks concern the values in the Link column of the screen. These values have to be present:

| AR | The summary account for accounts receivables; most example charts of accounts have one. |

| AR_overpayment | Receivables overpayments; if a customer pays too much or gets a credit invoice for an invoice already paid, this is where his credit gets recorded if it’s not refunded immediately |

| AR_discount | Sales discounts; if a customer pays within the specified terms, a discount is applied. In order to monitor effectiveness of the discount offered, one probably wants it posted on its own account. |

| AP | Same as AR, except for payables. |

| AP_overpayment | Same as AR_overpayment, except that this registers credits others owe you |

| AP_discount | Same as AR_discount, except that it applies to payables |

| IC | Summary account for inventory; this account doesn’t apply to companies which sell services only. |

Jack’s chart (the US General.sql standard chart) misses the AR and AP_overpayment links as well as the overpayment accounts. He’ll need to create them by going to the Add Accounts under the same submenu as the List Accounts option. The table below shows the settings required for the account types listed in Table LABEL:tbl:special-purpose-account-types-links.

| AR | Asset | |

| AR_overpayment | Liability | Receivables |

| AR_discount | Income (Contra) | |

| AP | Liability | |

| AP_overpayment | Asset | Payables |

| AP_discount | Expense (Contra) | |

| IC | Asset |

Jack creates two accounts, one for each line marked in italics in Table LABEL:tbl:special-purpose-account-config-summary:

-

1202

Advance payments

-

2105

Advance receipts

6.4.3 Technical accounts from System Defaults

Two special purpose accounts are currently not assigned their special purpose through the Links column in the Chart of Accounts menu. Instead, their special purpose is indicated in the defaults screen as discussed in Section 6.6 on page 6.6.

Each chart of accounts should have

-

•

a foreign exchange gain account in the Income part

-

•

a foreign exchange loss account in the Expense part

This restriction applies even for companies which don’t expect to be using foreign currencies since the accounts have to be selected in the defaults screen: there’s no option to leave them blank.

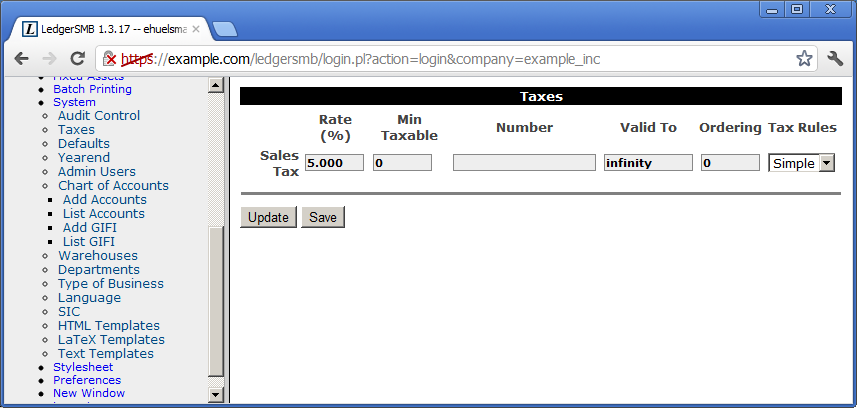

6.5 Checking sales tax (VAT) rates

First off, Jack asserts that a sales tax account has been provisioned. He finds it in the Current Liabilities section of his chart of accounts. In his jurisdiction there is only one sales tax rate applicable at any one time, which means this single account will suit his needs just fine. If he had been in a jurisdiction with multiple tax rates applicable, e.g. different rates for different types of goods, he would have been required to create more accounts.

The procedure to create more sales tax accounts is the same as the one used in Section 6.3 on page 6.3, with the notable difference that this time the base account to be used is the sales tax account.

With the accounts in place, the tax rates have to be checked and possibly adjusted.

To do so, go to the System ![]() Taxes page as shown in Figure 6.5 on page 6.5.

Taxes page as shown in Figure 6.5 on page 6.5.

6.6 Setting up the system defaults

With the password renewal out of the way, Jack can start to set up the company for first

use. To do so, Jack selects the System ![]() Defaults menu item.

Defaults menu item.

A more elaborate description of the parameters in this screen is provided in subsection 18.3.3. However, when setting up a new company, it’s probably good enough to fill out these parameters (and thus skip the rest):

-

•

Business number (e.g. Chamber of commerce number) [12345]

-

•

Default language [English]

-

•

Default accounts (Inventory, Expense, Income) [1510 Inventory / 4010 Sales / 5010 Purchases]

-

•

Foreign exchange result accounts (Foreign exchange gain/ loss) [4450 Gain / 5810 Loss]

-

•

Default country [US]

-

•

Templates directory [demo]

-

•

Currencies [USD:CAD]

-

•

Password Duration [180]

-

•

Default Email From [info@example.com]

-

•

Company Name [Example Inc.]

-

•

Company Address [215 Example street - Whereitsat]

-

•

Company Phone [555 836 22 55]

-

•

Company Fax (optional) [N/A]

Jack enters the values mentioned between the square brackets in the list above.

Chapter 7 Building up stock

7.1 Overview

In this chapter Jack goes through the process of setting up LedgerSMB for his trade activities in computer parts, which includes deciding which parts he wants to resell. From there on he goes to contact a vendor to request a quotation, convert that to an order and receive goods into inventory and invoices into accounts payable.

To prepare LedgerSMB for his parts sales and purchases, Jack needs to configure Parts. The system records inventory for parts and assemblies. Jack won’t use them for his business. There’s more on assemblies in @@@.

Once set up, Jack is ready to execute the ordering process. Even though the process is described here from a purchasing perspective sales work the same way with the roles reversed (Jack will act as a vendor in the sales process).

To start his purchase, Jack creates a RFQ document which he sends one or multiple vendors to let them know he’s interested in their products.

The vendor responds to Jack’s request by issuing a Quotation. From a legal perspective a quotation is a document which promises to deliver the requested goods or services at a certain rate - subject to conditions specifically mentioned. If Jack accepts the quotation and meets the conditions, the vendor is obligated to deliver.

In response to the quotation, Jack will place an order with the vendor to indicate acceptance quotation (or he can let the it expire). When he places the order, that legally means he agrees to the terms and conditions in the quotation. If the vendor delivers the goods or services as per the order, Jack has accepted the legal obligation to pay.

The vendor responds to the order by shipping the goods and services as well as sending an invoice. The invoice legally means the vendor considers to have a claim on the assets of Jack’s company. Jack creates a vendor invoice in his system to record the claim on his company by the vendor and the vendor creates a sales invoice in their system to do the same.

As a result of the above it’s considered bad practice to delete or change invoices once created. The accepted process to adjust invoices is to generate a debit invoice (for purchases) or a credit invoice (for sales) to “undo” the effects of the invoice and letting the other party know about it. Then a new invoice can be generated with the appropriate content. However, when the order process is correctly followed from order to invoice chances of sending the wrong invoice are greatly reduced.

7.2 Defining parts

Jack needs to enter a large number of items he’ll be offering in his new shop. He starts out with the easy ones: the ones which will be sold as single items.

7.2.1 Single items

Jack chooses a 5TB hard drive by Samsung to be entered into the system as the first item.

To do so, he goes to the Goods and Services ![]() Add part page from the menu

as shown in @@@ (figure to be inserted).

Add part page from the menu

as shown in @@@ (figure to be inserted).

Based on his reading from Section 21.1.1 on page 21.1.1, Jack decides to enter the hard drive with the following data:

| Number | SAM5TB |

| Description | Samsung Hard drive 5TB / 7200rpm |

| Inventory account | 1510 - Inventory |

| Income account | 4010 - Sales |

| COGS account | 5010 - Purchases |

| Sell price | 75.00 |

He decides not to include make/model information, drawings or images yet and since he hasn’t entered vendors or customers in his system yet, he decides to leave those sections blank as well.

7.2.2 Combining single-item and “multi-item pre-packaged” sales

After having finished setting up the easy parts, Jack now wants to enter the memory modules he’s going to sell. The problem is that they usually go in pairs, since that’s what the systems consuming them need. However, he expects them to be sold as single items as well and he wants to be able to set a separate price for those occasions.

From his reading of Section 21.1.5 on page 21.1.5, it should be possible to support this scenario with a small work around77It’s planned to directly support this use-case in some version higher than 1.3. From the two solutions available, he chooses option (b): to create a part and an assembly and regularly restock the assembly to 0 (zero) in order to remove the stock from the single item.

7.3 Defining part groups

As Jack continues to enter more parts into the system, he wonders how he’s going to look up the parts efficiently later on. Returning his reading to Section 21.1.1 on page 21.1.1, he understands that ’part groups’ are the solution to that problem. He decides to create the following list of part groups:

-

•

Storage

-

•

Monitors

-

•

Input devices

-

•

Printers and MFPs

After creating these part groups, the “Group” drop down appears on the parts entry screen, allowing him to assign each of his parts to one of these groups.

Since he doesn’t expect to be running more than one or two types of CPUs, he decides not to create a separate group for those and leaves these two parts unassigned.

7.4 Defining vendors

Jack selects “ABC Parts” to purchase the inventory he needs to run his company. In order to start buying inventory, ABC Parts needs to be entered as a Vendor to LedgerSMB.

Using the work flow detailed in Section 29.2 on page 29.2 Jack starts to do so by going through the menu AP ![]() Vendors

Vendors ![]() Add Vendor.

He fills out the Company creation form by clicking the Generate control code

button and adding the data as shown in Figure 7.1 on page 7.1.

Add Vendor.

He fills out the Company creation form by clicking the Generate control code

button and adding the data as shown in Figure 7.1 on page 7.1.

After saving the company data, Jack is presented the account data screen which he fills out as shown in Figure 7.2 on page 7.2.

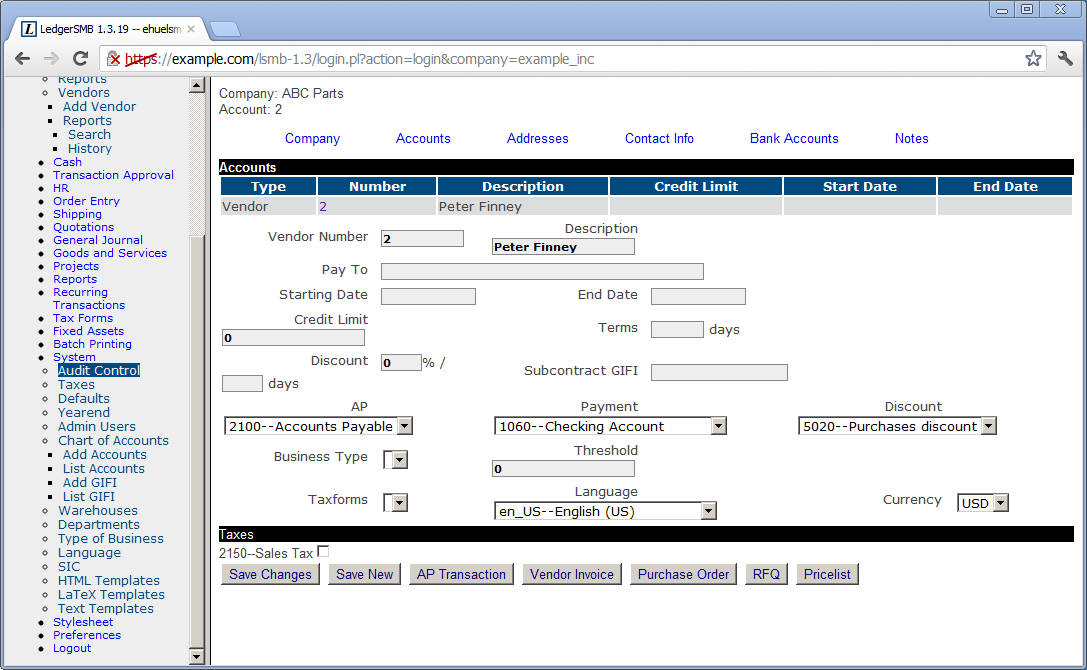

When he’s done filling out and saving the form, he notices the empty “Discount” drop down. Reading more about account configuration check marks in Section 22.2.3 on page 22.2.3 and going back to the checks on his chart of accounts (Section 6.4 on page 6.4), he finds he’s missing the purchase and sales discount accounts. He adds two accounts as listed in Table LABEL:tbl:special-purpose-account-config-summary on page LABEL:tbl:special-purpose-account-config-summary:

-

4020

Sales discount

-

5020

Purchase discount

Note the top-left corner stating “Company: ABC Parts” and “Account: 2”. The information entered on the “Addresses”, “Contact Info” and “Bank Accounts” tabs will be attached to the account listed, i.e. account number 2 in this case.

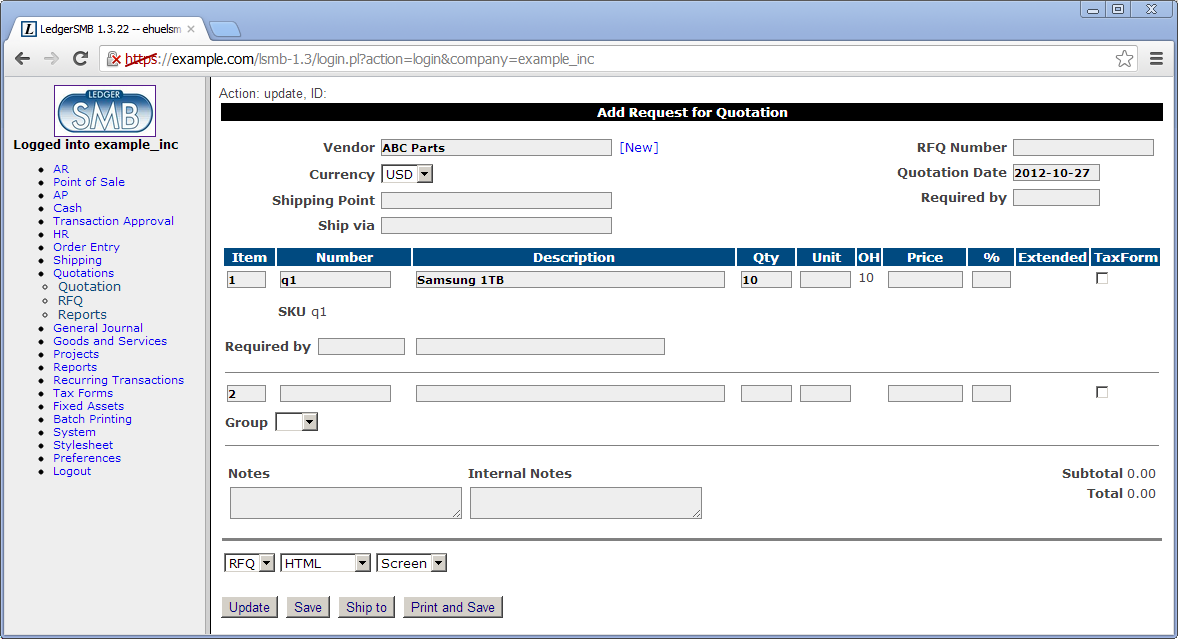

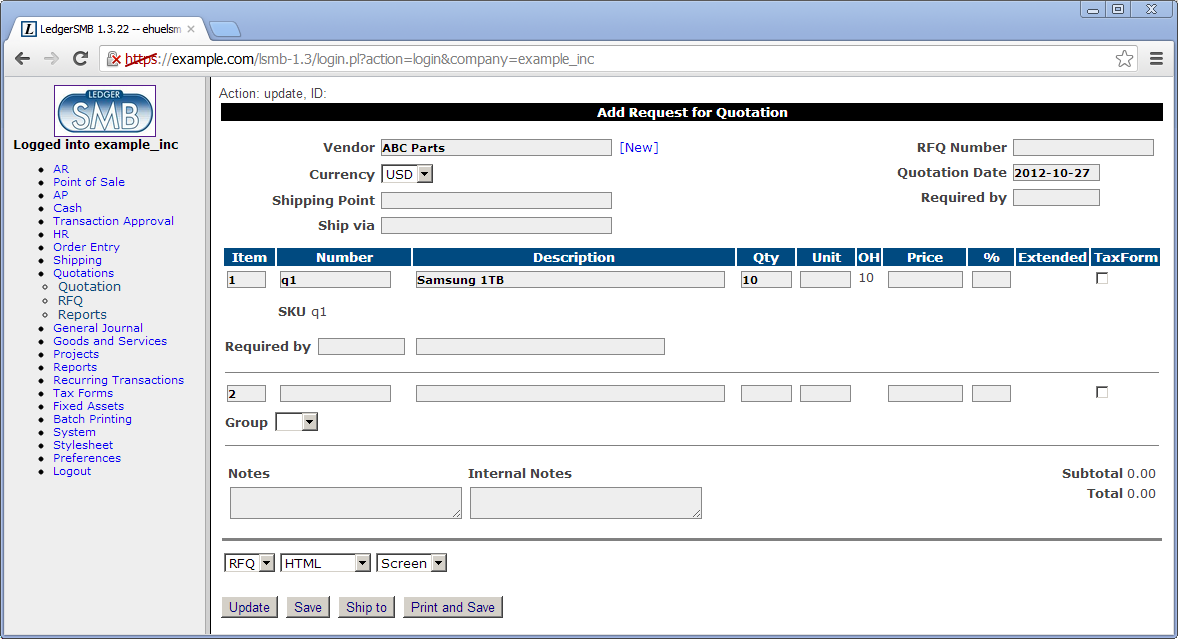

7.5 Requesting quotations

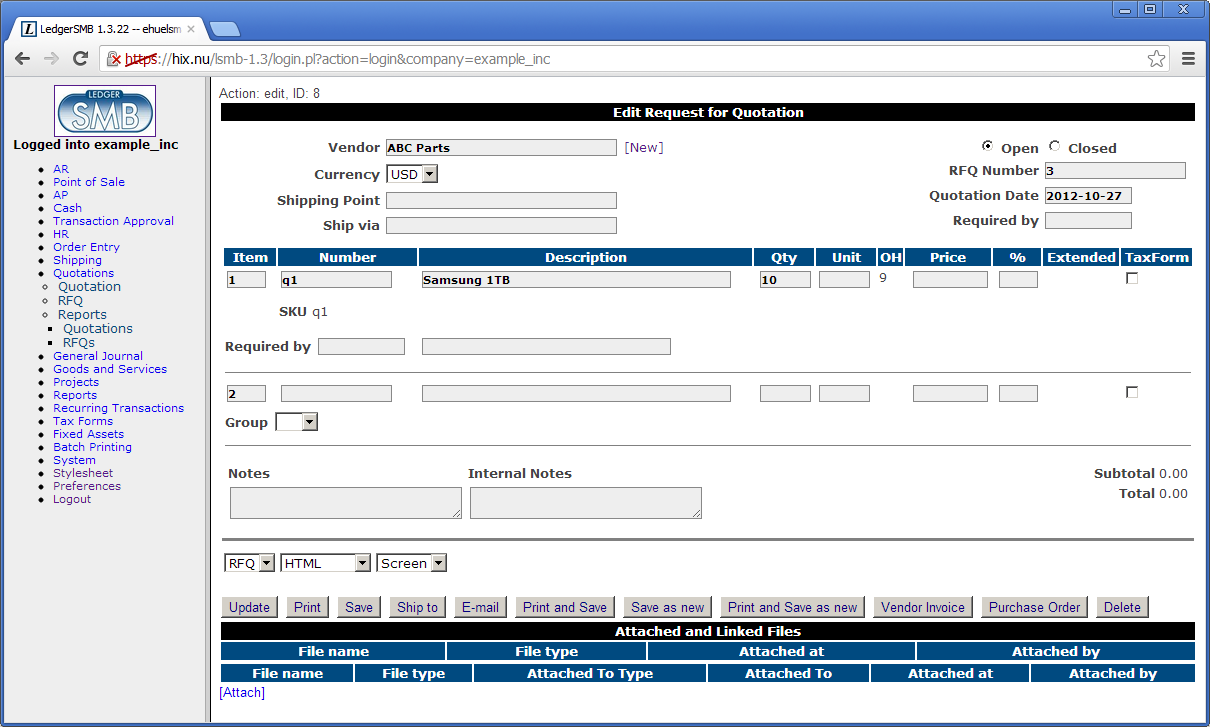

After Jack finishes setting up the parts and vendor information, he decides to use LedgerSMB to draw

up a list of items he wants to order from this company. To do so he follows the menu path

Quotations ![]() RFQ which opens up a screen (shown

in Figure 30.1 on page 30.1) for entering a new RFQ .

RFQ which opens up a screen (shown

in Figure 30.1 on page 30.1) for entering a new RFQ .

Remark Note that the RFQ entry screen contains prices; this is misleading at least: the printed output to be sent to the vendor does not. The fact that this screen allows entry of prices could be considered a bug.

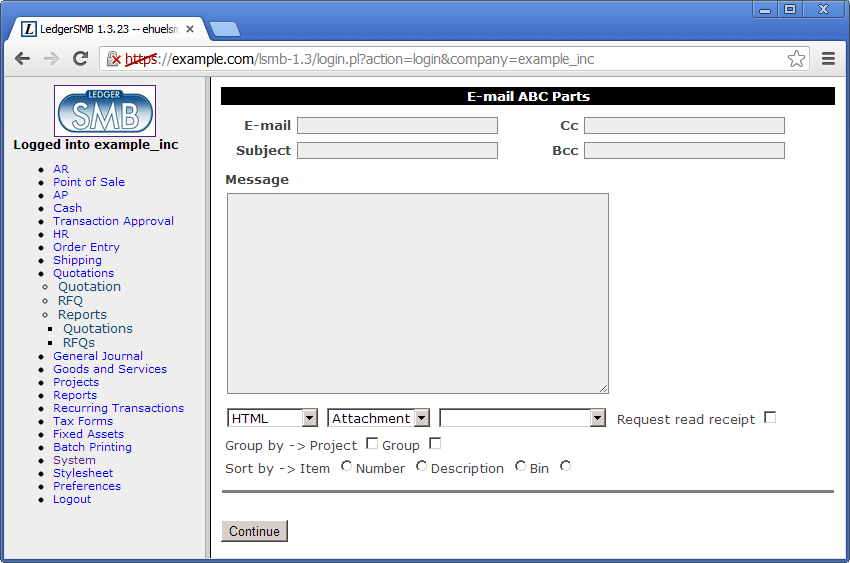

After filling out the form in accordance with the description in Section 30.1 on page 30.1, Jack expedites his RFQ to his vendor through e-mail by clicking the “E-mail” button. He finds himself in the screen shown in Figure 7.5 on page 7.5.

The From field of the e-mail to be sent out will be filled using the “Default From” setting documented in Section 18.3.3 on page 18.3.3. The other address fields can be entered by the user and may be readily populated if the customer account has the right contact info items attached: if there are Email, Cc and/or Bcc contact items set up, those will be used to fill these fields.

At the bottom there are three selection lists. The first allows selection of the format used to send the RFQ. Available options are HTML, CSV, Postscript (PS) and PDF. The last two require Postscript and PDF support to be correctly set up. The last selection list selects the language to be used for the RFQ. If no value is selected the system default language is used.

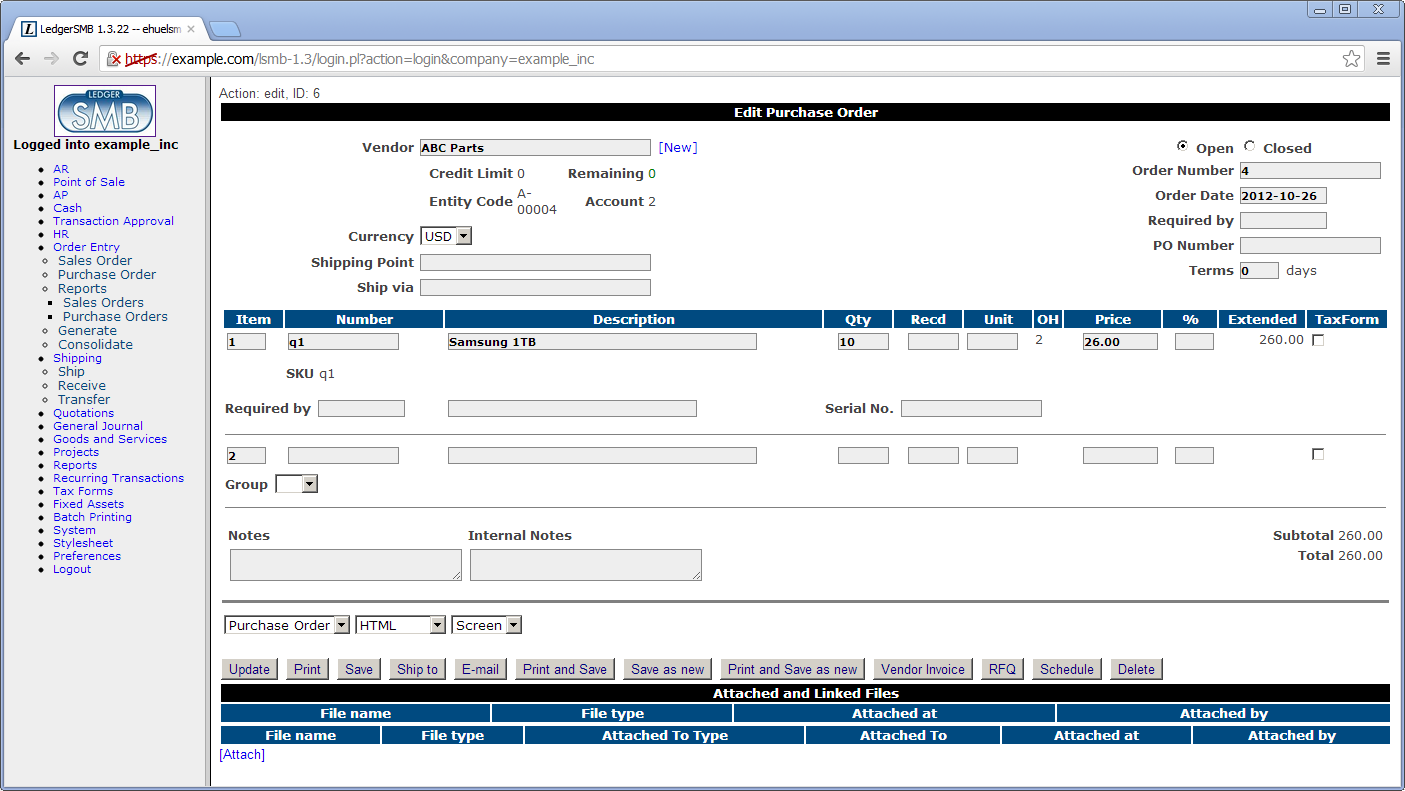

7.6 Following up on a quotation

Jack’s vendor (ABC Parts) sends him a quotation in response to his RFQ. Jack and his vendor can go back and forth a few times until Jack likes the offer he’s getting, but for the sake of argument let’s assume this is the final quotation.

Since Jack likes the offer, he wants to place an order with his vendor. To do so he looks up the

RFQ he sent to the vendor using the menu path Quotations ![]() Reports

Reports ![]() Search.

The screen shows additional buttons now that it shows a saved RFQ.

Search.

The screen shows additional buttons now that it shows a saved RFQ.

Jack clicks the “Purchase Order” button which creates a new order from the data in the RFQ. He completes it by entering the prices his vendor has quoted and by modifying it to be in accordance with the quotation. See Section 31.2 on page 31.2 for more detail on the order entry screen. When finished he saves the order and mails it to ABC Parts just like he mailed the RFQ in the previous section.

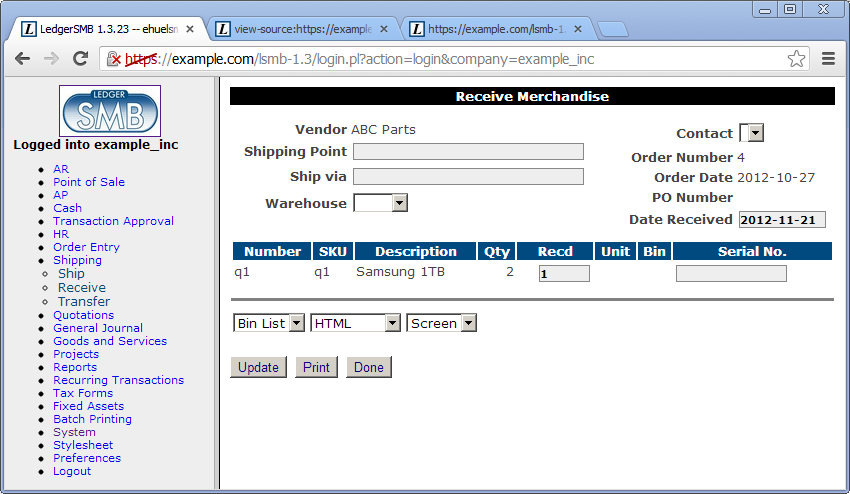

7.7 Receiving ordered items

Having ordered his inventory, the vendor starts shipping. There’s too much to ship at once so the vendor ships the goods in batches: every week he ships what’s available at the end of that week - he needed to order some of the products with the manufacturer.

LedgerSMB helps Jack keep track to see if he has received everything he has ordered and

that he’s not receiving too much. Jack goes through the menus Shipping ![]() Receive.

In the search screen, he fills the vendor name (ABC Parts) and clicks “Continue” to be listed

all open orders from ABC Parts. By clicking on the order number, the “Receive Merchandise” screen

opens as presented in Figure 7.7 on page 7.7. This allows Jack to handle the incoming

shipment. LedgerSMB will automatically update inventory based on the amounts entered as received

88To resolve problems in the inventory tracking parts of LedgerSMB (inherited from

before the fork), a significant change has been implemented in 1.3.31: inventory changes won’t

be recorded until invoices have been posted.

.

Receive.

In the search screen, he fills the vendor name (ABC Parts) and clicks “Continue” to be listed

all open orders from ABC Parts. By clicking on the order number, the “Receive Merchandise” screen

opens as presented in Figure 7.7 on page 7.7. This allows Jack to handle the incoming

shipment. LedgerSMB will automatically update inventory based on the amounts entered as received

88To resolve problems in the inventory tracking parts of LedgerSMB (inherited from

before the fork), a significant change has been implemented in 1.3.31: inventory changes won’t

be recorded until invoices have been posted.

.

7.8 Receiving an invoice

7.9 Paying an invoice

Chapter 8 Ramping up to the first sale

Chapter 9 Shipping sales

Chapter 10 Invoicing

10.1 Handling sales taxes

Chapter 11 Collecting sales invoice payments

11.1 Customer payments

11.2 Customer payment mismatch

Chapter 12 Paying vendor invoices

Chapter 13 Monitoring arrears

Chapter 14 Branching out: services

14.1 Recording service hours

14.2 Customer approval on service hours

14.3 Invoicing services

Chapter 15 Branching out II: service subscriptions

Part III Configuration

Chapter 16 Overview

16.1 Introduction

This section of the book describes how to set up LedgerSMB and its components. Configuration is assumed to be mostly one-off and rather technical in nature. To find out which tasks might need to be performed in order to keep the application in good health the reader is referred to the section “Administration”.

Chapter 17 Global configuration

17.1 Apache

Section about installing on Apache 2+

items to be discussed:

Forwarding of authentication

cgi configuration

performance: cgiD configuration: don’t (yet) [but will be supported once all legacy code is gone]

security: suEXEC environment

17.1.1 Differences between Apache 1.3 and 2+

Explain how to use lsmb with 1.3 instead of 2+.

17.2 PostgreSQL

pg_hba.conf: authentication

security: local vs IP connections

17.3 LedgerSMB

17.3.1 ledgersmb.conf

to be discussed:

Individual configuration keys; full discussion of possible values in reference appendix?

General section

- auth

- logging

- tempdir

-

Directory to store temporary artifacts. E.g. PDF files are stored here before being sent to the browser. The default on unix variants is /tmp/ledgersmb.

- cache_templates

-

Determines if HTML templates used for the LedgerSMB UI will be stored in precompiled form for improved performance. The value 0 (zero) means no caching; the value 1 means caching in the directory $(tempdir)/lsmb_templates; systems running multiple LedgerSMB instances with customized UIs should use separate values for tempdir for that reason

- language

- log_level

- DBI_TRACE

- pathsep

- latex

-

Identifies if the system has LaTeXavailable: 0 means no LaTeX, 1 means LaTeXsupported

- check_max_invoices

- max_post_size

- decimal_places

- cookie_name

- no_db_str

’environment’ section

- PATH

’paths’ section

- spool

- userspath

- templates

- images

- memberfile

- localepath

’programs’ section

- gzip

’mail’ section

- sendmail

- smtphost

- smtptimeout

- backup_email_from

’printers’ section

This section contains a list of printers and the commands to be executed in order for the output to be sent to the given printer with the document to be printed fed to the program through standard input. The example below shows how to send standard input data to a printer called “laser” when selecting the item “Laser” in the LedgerSMB printer selection drop down.

Laser = lpr -Plaser

’database’ section

- host

-

Name of the host to connect to. See the documentation of the -h command line option at http://www.postgresql.org/docs/9.2/static/app-psql.html for more information (documentation unchanged since before 8.3, so applies to older versions as well)

- port

-

Port number to be used to connect to. See the documentation of the -p option at the same URL as the previous item

- default_db

-

Database to connect to when the “Company” entry field in the login screen is left blank

- db_namespace

-

The name space the company resides in; expert setting – should not be used (default is “public”)

- contrib_dir

-

Path of the directory in which the PostgreSQL contrib modules (extensions) are located; this setting is used by setup.pl when creating new companies or rebuilding (upgrading) existing ones

- sslmode

-

Selects whether to use SSL over TCP connections or not; can be “require”, “allow”, “prefer” or “disable”

log4perl_config_modules_loglevel

@@@ This is a list of <module.name >= <level >

This is an advanced setting not typically touched.

17.3.2 pos.conf.pl

@@@ no idea what should go in here. to be investigated.

17.3.3 templates

LedgerSMB uses templates mainly for two things:

-

•

Output documents such as pick lists and invoices

-

•

The HTML User Interface

This setting relates to the former, which are meant to be copied and customized by users. The system supports having multiple sets in a global setup, where companies can be configured to use different sets.

17.3.4 ledgersmb.css

Chapter 18 Per company configuration

18.1 Administrative user

18.2 Chart of accounts

@@@ Should refer to the ’administration’ section???

18.2.1 Special accounts

-

•

AR/AP summary accounts

-

•

5 other special purpose accounts, see “Defaults” screen discussion

-

•

sales tax accounts

18.3 System menu settings

This section enumerates the “System” menu’s immediate children. In some cases the functionality is too complex and is referred to a chapter of its own.

18.3.1 Audit control

Enforce transaction reversal for all dates

This is a Yes/No value which affects the actions which can be performed on posted financial transactions.

-

•

No means transactions can be altered or deleted, even after posting them. Note that if a transaction has been posted before the latest closing date, it can never be altered, not even when this value is in effect.

-

•

Yes means transactions can’t be altered after posting. This setting is highly preferred and considered the only correct approach to accounting as it assures visible audit trails and thereby supports fraud detection.

Close books up to

@@@ This item isn’t a system setting; shouldn’t it move to “Transaction approval”?? That way system settings (config) and processes are separated.

@@@ My preference is to remove the setting entirely and rely on year-end workflow. We might add an account checkpoint interface as well at some point –Chris T

It’s advisable to regularly close the books after review. This prevents user error changing reviewed numbers: after closing the books, it’s no longer possible to post in the closed period.

There are also performance benefits to closing the books, because LedgerSMB uses the fact that the figures are known-stable as a performance optimization when calculating account balances.

Activate audit trail

This is a Yes/No value which - when Yes - causes the system to install triggers to register user actions (creation/adjustments/reversals/etc…) executed on financial transactions.

@@@ Once activated, where can we see it the audit trail??

@@@ This setting should go. In 1.3 the audit trails are always enforced via triggers so this setting does nothing. –CT

18.3.2 Taxes

This page lists all accounts which have the “Tax” account option enabled as discussed in Section 22.2.1 on page 22.2.1.

Each account is listed at least once, but can be listed many times, if it has had different settings applied over different time periods. E.g. if one of the current VAT rates is 19%, today but it used to be 17.5% until last month, there will be 2 rows for the applicable VAT account. See Chapter 23 starting at page 23 for further discussion of how taxes work in LedgerSMB and the choices involved when being required to handle changes in tax rates.

Each row lists the following fields:

- Rate (%)

-

The tax rate to be applied when calculating VAT to be posted on this account.

- Number

-

Account number

- Valid To

-

The ending date of the settings in this row. This can apply to the rate as well as the ordering or the tax rules (but usually applies to the rate).

- Ordering

-

This has to do with cumulative taxes. For example if two taxes exist and one has an ordering of 0 and one of 1, then the second tax will be calculated on a basis that includes the first. One place where this used to be used was in Quebec, where GST was taxable under PST.

- Tax rules

18.3.3 Defaults

Business number

This is used to store an arbitrary identification number for the business. It could be used to store a business license number or anything similar.

Weight unit

The unit of measurement for weights. @@@ why don’t we have a unit of measurement for distance as well??? And maybe a unit of measurement for content?

Separation of duties

Default accounts

This setting will be used to preselect an account in the listings of the three categories listed below:

-

•

Inventory

-

•

Income

-

•

Expense

Foreign exchange gain and loss accounts

When working with foreign currencies, the system needs two special purpose accounts. One to post the gains onto which are caused by foreign currencies increasing in value; the other to post the losses onto which are caused by foreign currencies decreasing in value.

Default country

This setting indicates which country needs to be pre-selected in country selection lists.

Default language

The language to be used when no other language has been selected. Several parts of the application require language selection, such as customer, vendor and employee entry screens.

Templates directory

This setting indicates which set of templates - stored in the templates/ directory - should be used. In a standard installation, the drop down lists two items:

-

demo

which contains templates based on LaTeX, which is more commonly installed but has issues dealing with accented characters

-

xedemo

which contains the same templates based on TeTeX, which handles UTF-8 input (and thus accented characters) much better than LaTeXand is broadly available, but not usually pre-installed.

List of currencies & default currency

Enter a list of all currencies you want to use in your company, identified by their 3-letter codes separated by a colon; i.e. “USD:EUR:CHF”. To ensure correct operation of the application, at least one currency (the company default currency) must be listed. In case of multiple currencies the first is used as the company default currency.

Company data (name /address)

The fields “Company Name”, “Company Address”, “Company Phone” and “Company Fax” will be used on printed/e-mailed invoices.

Password duration

This is an integer value field measuring the validity period in days for passwords set through the user’s Preferences screen. If this field is empty, passwords set through that method won’t expire.

A user will receive password expiration reminders upon logging starting a week before password expiry. When not acted upon, starting two days before expiry an hourly popup will appear requesting the user to change the password.

The application behaves this way because users with expired passwords won’t be able to log in: their password will need to be reset by a user admin.

Note that passwords set by admins for other users expire within 24 hours after setting them. This value is hard coded and can’t be overruled. This is a security measure taken to make sure as few unused accounts as possible exist: Existence of such accounts could open up security holes.

Default E-mail addresses

These addresses will be used to send e-mails from the system.

Note that the “Default Email From” address should be configured in order to make sure

e-mail doesn’t look like it’s coming from your webserver. The format to be used is ``Name'' <e-mail address> where the e-mail address should be inserted between the

“![]() ” and “

” and “![]() ”.

”.

Max per dropdown

Some elements in the screens may present a drop down. However, drop downs are relatively unwieldy to work with when used to present a large number of values to choose from.

This configuration option sets an upper limit on the number of records to be presented as drop down. When the number is exceeded, no drop down is used. Instead, a multi-step selection procedure will be used.

Item numbering

Many items in the system have sequence numbers: invoices, parts, etc. These sequence numbers can be just a number (i.e. 1 or 37), but they can also be prefixed numbers, e.g. INV0001 for invoices and EMP001 for employees. The numbers shown in the input boxes will be used to generate the next number in the numbering sequence.

| GL Reference number | The default reference number for the next GL transaction. |

| Sales invoice/ AR Transaction number | This number is used to generate an invoice number when none is being filled out by the user. |

| Sales order number | Same as Sales invoice number, except that it’s used for sales orders @@@ layout issue: the label is too big to fit on the page |

| Vendor invoice/ AP Transaction number | Same as Sales invoice, except that the number is used for accounts payable transactions. @@@ layout issue: the label is too big to fit on the page |

| Sales quotation number | Same as sales order number, except that it’s used for quotations. |

| RFQ number | Request for quotation number is like the sales quotation number, except that it is used to track which vendors have been asked for quotes. |

| Part number | All parts, services and assemblies are identified by a unique number. When an item is created and no number is entered by the user, a number is generated from this sequence. |

| Job/project number | Used when creating new projects. |

| Employee number | Same as the sales invoice number, used by new employee entry. |

| Customer number | @@@ is this the control code number? or is this meta_number?? – Meta-number (CT) |

| Vendor number | @@@ same question as customer number |

Check prefix

The prefix to use when printing checks. There’s no check sequence number. That sequence number is requested from the check printing interface, because checks can be created outside the application as well, meaning the numbers can get out of sync.

18.3.4 Year end

@@@ Rename “Yearend” in menu interface to “Year end”.

@@@ IMO this section doesn’t belong here, because it’s a process, not config, but does it belong in this menu then? IMO it doesn’t…

18.3.5 Admin users

@@@ Same as Year end; doesn’t belong here…

18.3.6 Chart of accounts

@@@ Chart of accounts isn’t exactly a “process”, but it doesn’t feel like being pure config either. At any rate it’s a fact that the CoA discussion is a full chapter in and of itself - so discussion here isn’t necessary anymore.

18.3.7 Warehouses

Warehouses are stocking locations. They don’t have any properties (in the system)

other than that they have a name. Warehouses can be added, modified and deleted from

the System ![]() Warehouses menu item.

Warehouses menu item.

18.3.8 Departments

Departments can be used to divide a company in smaller pieces. LedgerSMB distinguishes two types of departments:

-

Profit centers

which can be associated with any type of transaction, including AR transactions.

-

Cost centers

which can be associated with all types of transactions, except AR transactions.

Departments can be created (added), modified or deleted through the System ![]() Departments menu item.

Departments menu item.

18.3.9 Type of business

Types of business are used in sales operations where customers can be assigned a type of business. Based on the type of business assignment, quotations, sales orders and invoices will automatically apply discount rates. For each type of business you enter a description and a discount rate to be applied.

18.3.10 Languages

The language table is the table users can select languages from, both to present the UI of the application as well as the setting for customers to be used to generate documents.

This listing should correspond to the actual translations of the application being available in the program installation directory.

Languages can be added, modified or deleted through the System ![]() Language menu item.

Language menu item.

18.3.11 Standard Industry Code (SIC)

SI codes feature these three fields:

- Code

- Heading

- Description

When creating a company you can assign that it an SI code, irrespective of its role (i.e. customer, vendor, lead or anything else). An example of an SI code system is the US’s NAICS code99http://www.census.gov/eos/www/naics/. Other countries have their own coding systems such as ANZSIC1010http://www.abs.gov.au/ausstats/abs@.nsf/mf/1292.0 for Australia and New Zealand and NACE1111http://ec.europa.eu/competition/mergers/cases/index/nace\_all.html for Europe

The SIC field currently doesn’t support a specific function in the application and is there merely for informational purposes. However in the future its role could be extended to include impact on reports, taxes or other functionalities where type of industry could matter.

18.3.12 HTML templates

18.3.13 LaTeX templates

Same as the last subsection.

18.3.14 Text templates

Same as the previous subsection.

Part IV Administration

Chapter 19 Overview

19.1 Introduction

This part of the book describes the tasks and processes that may need to be carried out on a regular basis in order to keep the application in good health and in line with requirements from end users.

Maintenance may require different types of system access for different types of tasks:

-

1.

Within application tasks, such as user management, require an appropriately authorized application login

-

2.

Database administration tasks, such as creation of backups and application upgrades, require a database level login to be used with (amongst others) ’setup.pl’

-

3.

Other system-level maintenance tasks, such as updating PostgreSQL or Apache, which require user accounts on the server hosting LedgerSMB

Each of the above tasks requires its own type of user account. Creating and managing accounts for the first type of task is the subject of the next chapter.

Chapter 20 User management

20.1 Introduction

This chapter deals with management of application level user accounts. This is the first of the three types of system access required to do LedgerSMB administration described in the previous chapter.

20.2 User creation

Users experienced with LedgerSMB 1.2 or before or SQL Ledger (any version) are referred to appendix A.1 to read about the differences with version 1.3.

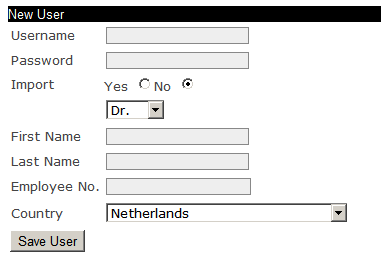

In order to create users, the current user must be sufficiently authorized. The user created at application set up time is such a user.

Go to the System ![]() Admin Users

Admin Users ![]() Add User. You’ll be presented the page as shown in figure Figure 20.2 on page 20.2.

Add User. You’ll be presented the page as shown in figure Figure 20.2 on page 20.2.

The value entered in the ’Username’ field will cause a database user by that name to be created. Database users are a global resource, meaning that a collision will occur if multiple people try to define the same user in multiple companies. Section 20.5 on page 20.5 describes how to use the same user across multiple companies.

Enter the password to be used for this user into the “Password” field. If you’re importing a user, please leave the field empty – that will prevent the password from being changed. Note that initial passwords (and password resets) are only valid for one day unless the user logs in and changes his/her password.

The “Import” field is discussed in Section 20.5 on page 20.5. To create a new user, leave the setting at “No”.

All of the “First Name”, “Last Name” and “Employee No.” fields are required. However, when no employee number is specified, the system will generate one using the sequence specified in the Defaults screen as documented in Section 18.3.3 on page 18.3.3.

The “Country” field speaks for itself and is required as well.

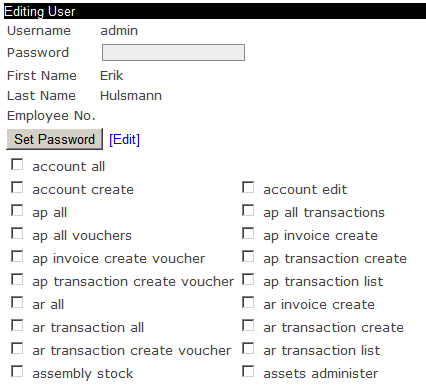

20.3 User authorization

After filling out all the fields as described in the previous section and clicking “Save user”, you’ll be presented a second screen in the user creation process: the user authorization screen. See Figure 20.2 on page 20.2 for a screenshot of the top of that screen.

The process of assigning user authorizations is the process by which the granted access to specific parts of the application. One can imagine that - in a moderately sized company - sales should not be editing accounting data and accountants should not be editing sales data. Yet, in order to cooperate, both parties need to be given access to the same application. This is where authorizations come in.

In aforementioned screen, which equals the “Edit user” screen, you have to assign the newly created user his application rights. By default, the user doesn’t have any rights. Checking all check marks makes the user an application “super user”, i.e. gives the user all available application rights.

20.4 Maintaining users

20.4.1 Editing user information and authorizations

When the role of a user in the company changes, it may be necessary to assign

that user new roles and possibly revoke some other roles. This can be done through

user search: System ![]() Admin Users

Admin Users ![]() Search Users

Search Users ![]() Search

Search ![]() [edit] which brings you to the same screen as presented in

Figure 20.2 on page 20.2.

[edit] which brings you to the same screen as presented in

Figure 20.2 on page 20.2.

Similarly, there may be reasons to change the user information, such as a last name (e.g. upon marriage).

Note that if you reset a password, the new password is valid for one day unless changed. The preferred workflow is for the individual with permissions to reset the password, give the new password to the user, they then log in and immediately change it.

20.4.2 Changing user preferences

Each user can change his preferences and password through the Preferences top level menu. See Figure 20.3 on page 20.3.

20.4.3 Deleting users

From the “User search” result screen, users can be “deleted” from the company: they have their access to the current company revoked.

Note that the user is only revoked access to the current company; the login remains a valid login for the database cluster. Administrators wanting to remove user accounts at the database level need to take additional action.

20.5 User imports

If a database user already exists, e.g. because this user was created to be used with another LedgerSMB company, it can’t be created a second time. In order to be able to use that user with the current company, it needs to be “imported” instead.

The difference between creating a new user and importing one is that the “Import” radio button should be set to “Yes” and that you should not fill out a password. If you do, the password of that user will be overwritten for all companies.

All other fields are still applicable: the data entered for other companies isn’t copied to the current company.

20.6 setup.pl users

As mentioned in the introduction, users created through the process documented above don’t have rights to execute work with the setup.pl database administration tool. Note that this is on purpose. You will need access to the server to create such users, or request one from your application service provider (ASP) if you use a hosted solution.

During the set up process such a user is normally being created. This user can later be used to manage the database from the database administration tool setup.pl.

Chapter 21 Definition of goods and services

21.1 Definition of goods

Structure of products in the system.

21.1.1 Definition of parts

The part entry screen consists of four parts:

-

1.

Part information

-

2.

Vendor information

-

3.

Customer information

-

4.

File attachments

The paragraphs below discuss each of the four sections. The part definition section contains both required and optional fields. The information in the remaining three sections is entirely optional.

Part information

Every part requires the following fields to be entered:

-

Number

The (alphanumeric) code the company uses to identify the item

-

Description

The (native language) description of the item, used as the default description on sales invoices

-

Inventory account

The asset account used to maintain the monetary equivalent of the inventory amount

-

Income account

The P&L (income) account to post the sales revenues on

-

COGS account

The P&L (expense) Cost of Goods Sold (COGS) account to use to post cost of sold items on

-

Sell price

The default selling price used on sales invoices

The other fields in this section of the screen are optional:

-

List price

Informational; can be used for any (monetary) purpose

-

Last cost

Last buying price, updated when a vendor invoice listing the current part is posted

-

Markup percentage

Markup on Last cost to calculate the Sell price

- Image

- Drawing

- Microfiche

-

Unit

A five-character field shown on the invoice

-

Weight

Informational; can be used by add-ons or customizations

-

ROP

Reorder point - when the inventory drops below this number, the part will show up in “Short parts” reports

-

Bin

The storage location in the warehouse

Apart from these fields, there are also the Make and Model paired fields. Every part can have as many Make/Model lines as required. They are informational, but can be used in customizations of the software.

The Average Cost and On Hand fields are output-only calculated fields. Average Cost is calculated from the historic buying prices. On Hand is the current inventory, which is updated when posting a vendor invoice (increased) or sales invoice (decreased).

Taxation of parts

Right below the accounts selection section, there is the Tax section, which lists all tax accounts with a check mark. Each account corresponds with a certain tax type and rate. E.g. in the Netherlands, there’s one VAT tax type (BTW) which has two rates, one of which applies to every product. This setup requires two accounts. There’s more on the subject of sales taxes in Chapter 23 starting at page 23.

By checking the checkmark on an account, the system is signalled to calculate that kind of tax for the part if the customer (or vendor) has the appropriate setup as described in section

Vendor information

This section of the screen lists one or more vendors from which the part can be purchased, with purchasing information for the given vendor:

-

Vendor code

Code used by the vendor to identify the good, to be used by customizations and future enhancements (currently informational only)

-

Lead time

Lead time of the part from the vendor in days

-

Last cost

Last price at which the good was purchased from the vendor

-

Currency

The currency belonging to the Last cost field

Customer information

The customer information section specifies sell prices per customer or price group where those are required to deviate from the default sell price. This mechanism exists to support the marketing principle of categorizing customers.

-

Sell price

Price for this part to be used for this customer

-

From

Start of the applicability window of the price (inclusive)

-

To

End of the applicability window of the price (inclusive)

21.1.2 Definition of part groups

All goods and services can be categorized in ’part groups’. Upon lookup, these can help to limit the number of matches when searching for a partial part number.

As long as no part groups have been defined, the part group assignment field doesn’t show up on the goods entry screens.

There’s no requirement that a good be assigned to any specific part group if part groups have been configured, however, a good can be assigned to more than one part group.

21.1.3 Definition of assemblies

21.1.4 Definition of overhead or labour

21.1.5 The use of parts versus assemblies for multi-item-package sales

Often times, one may want to sell pre-packaged multiples of a single item, such as Jack in Chapter 7 starting at page 7 who wants to sell memory modules in pairs as well as single items, with the price for the pair set separately from the single-item price.

There are basically two use-cases

-

1.

Pre-packaged sales which are separately stocked

-

2.